Stocks usually rebound sharply after sever declines. The recent dramatic days of plunge was fast and furious. Volatility has indeed returned to the market. What was until a China issue, has become a global problem. The most important factor that changed the calculus on the impact is the spreading of the virus in the US. Below is an excerpt from a Feb 27th article at Citywire:

Ollie Beckett, manager of TR European Growth (TRG) investment trust, has warned of ‘widespread panic’ across stock markets if coronavirus spreads in the US as outbreaks gather pace in Europe and the Middle East.

Global markets suffered heavy falls this week as clusters of coronavirus exploded in Italy, Iran and South Korea, with further cases reported in Tenerife, Austria, and Croatia adding to equity woes.

The majority of the more than 80,000 cases of infection and over 2,700 deaths have so far been contained in China but the Covid-19 virus is making rapid inroads in other countries, particularly in Europe.

The US has had a relatively narrow escape from the virus, and despite registering 53 cases it has not reported any deaths from the illness. US president Donald Trump has played down fears, no doubt cautious about upsetting stock markets which are sensitive to the economic impact the virus is posing, stating the situation is ‘very well under control’.

However, Beckett, who also runs the £226m Janus Henderson European Smaller Companies fund alongside the £451m trust, warned that any escalation of Covid-19 would hurt markets. Beckett’s portfolio shed 4.6% to trade at 906p per share in the global sell-off and continued to fall – the shares are trading at 898p today.

‘If it gets to the US then we are going to have widespread panic,’ he said. ‘There is no getting away from it.’

Source: Beckett: prepare for ‘widespread panic’ if virus spreads in US, Citywire

Unlike other developed the US is also the most vulnerable to outbreaks due to the morass of a patchwork of thousands of private health care systems. The excellent article below at FT discusses some of the flaws of the US health care system when there is an outbreak.

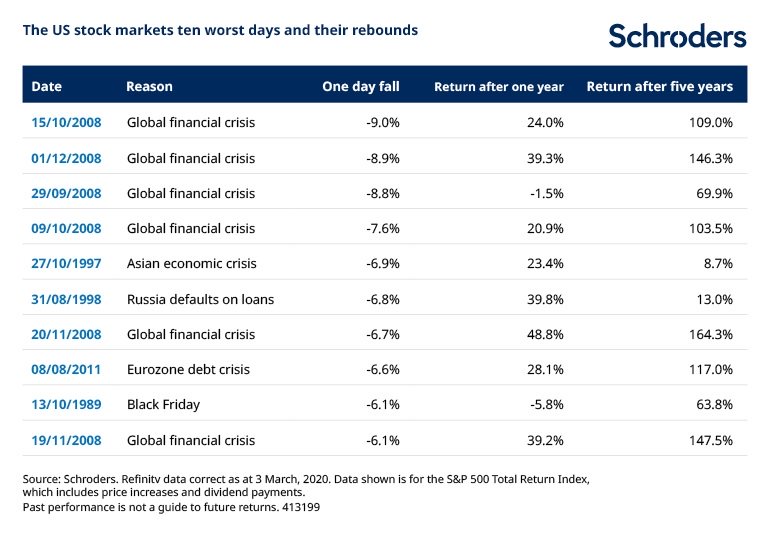

That said, the below table shows the ten worst days of declines in the US equity market and their rebounds:

Source: How stock markets perform after heavy falls by David Brett, Schroders

From the article:

How the stock market bounces back

Using the US stock market as an example, the past three decades show the strongest five-year rebound in the US brought a return of 164%. That is an annualised return of 21% in the five years after a 6.7% fall for the S&P on 20 November 2008.

That date was during a particularly gloomy phase of the 2008-09 financial crisis.

Given the abject mood at the time, investors may have struggled to believe that an investment of $10,000 made in the market at the start of that turbulent day would have grown to $26,400 within five years, before charges.

Of course, past performance is not guaranteed to be repeated in the future. The returns are illustrative and do not include any costs or fees. But the data underlines the historic resilience of shares over longer timeframes, even following shocks.

Some US equity ETFs:

- SPDR S&P 500 ETF (SPY)

- S&P MidCap 400 SPDR ETF (MDY)

- SPDR Consumer Discretionary Select Sector SPDR Fund (XLY)

- SPDR Consumer Staples Select Sector SPDR Fund (XLP)

- SPDR Energy Select Sector SPDR Fund (XLE)

- SPDR Financials Select Sector SPDR Fund (XLF)

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions