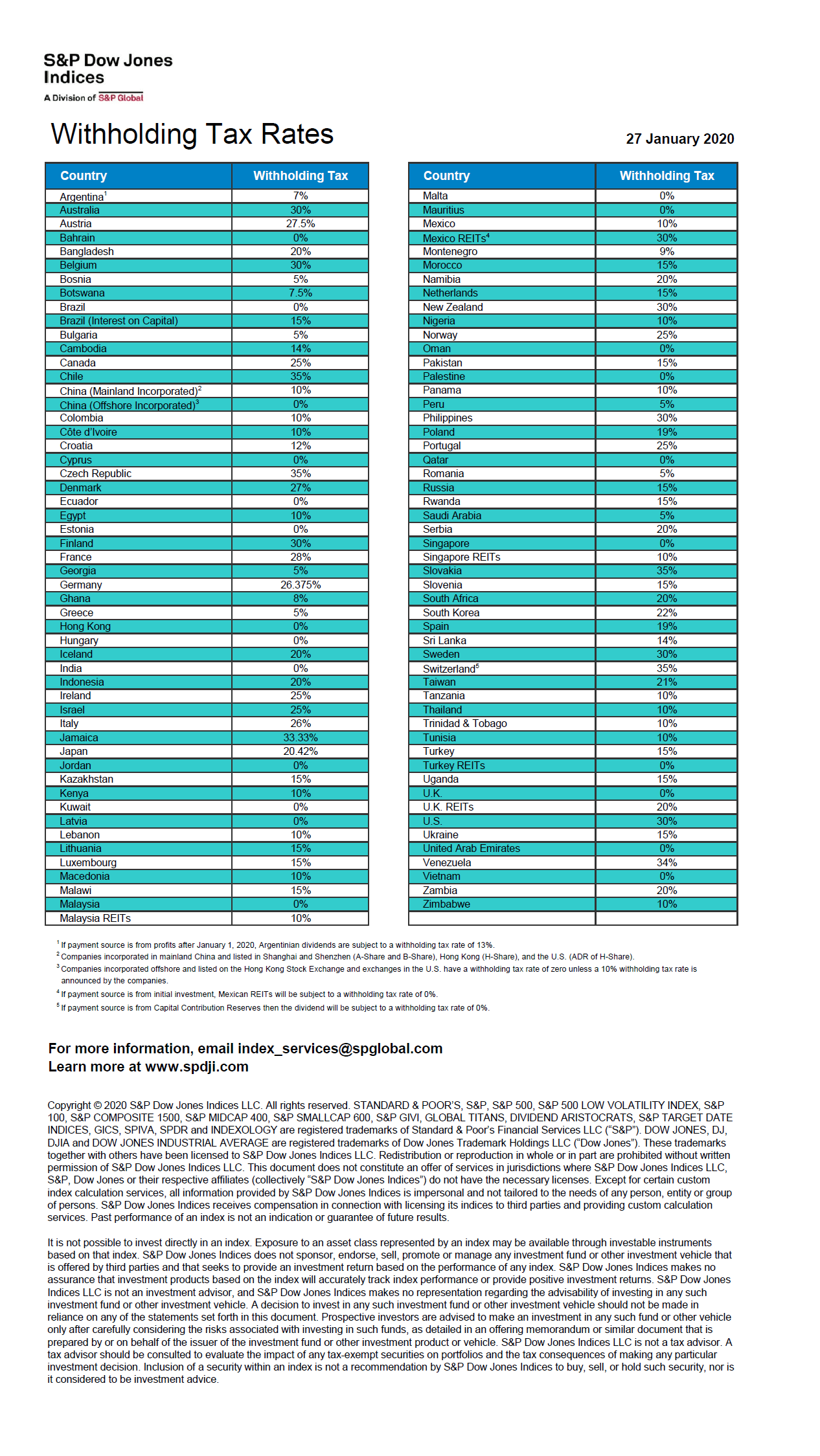

The Dividend Withholding Tax Rates by Country for 2020 has recently been published by S&P Global. This simple one-page is useful to any investor holding foreign stocks and receiving dividend income. This table shows withholding tax rates for stocks held in regular brokerage accounts only. It does not show the rates for assets held in qualified retirement accounts. For example, the rate for Canada is shown as 25%. This rate does not apply to Canadian stocks owned by Americans in retirement accounts like IRAs. Canada does not charge any taxes on dividends received in those accounts. So investors looking to avoid the withholding taxes can own Canadian stocks in retirement accounts.

Update – Click this link for 2022 rates: Dividend Withholding Tax Rates by Country for 2022

In addition, the 25% rate can be reduced to 15% by filing NR301 form with the Canada Revenue Agency (CRA). For more details on this form go here.

Investors should also pay attention to the difference in rates between REITs and non-REITs. For instance, UK charges no withholding taxes to US residents. However this rate does not apply to UK REITs Dividends paid out REITs would be charged at 20%.

Click to enlarge

Source: S&P Dow Jones Indices

Download:

Earlier: