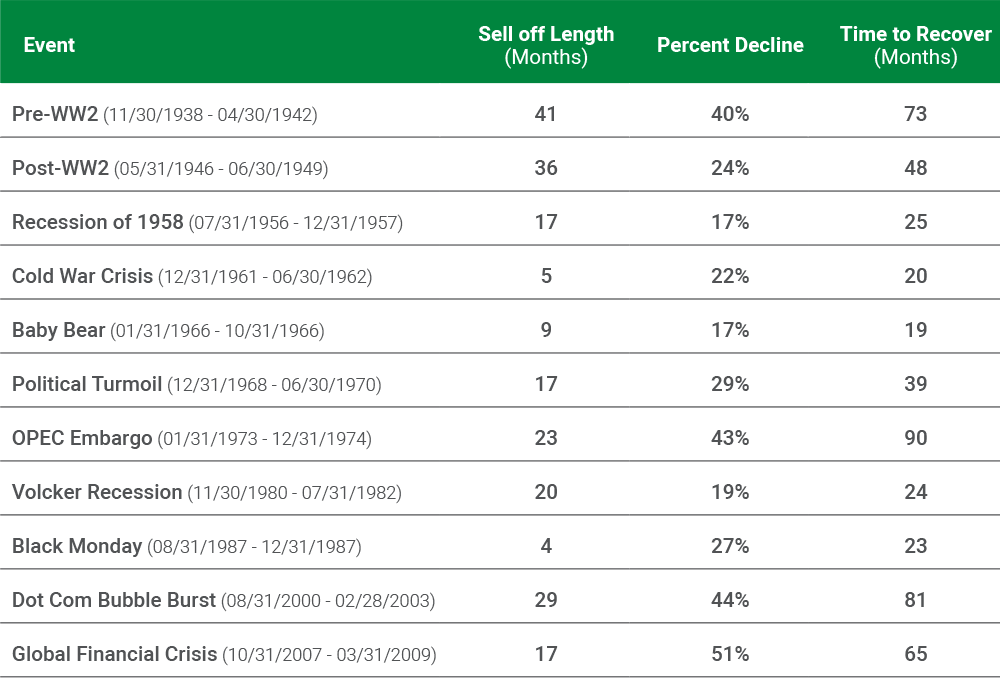

US equity markets have turned extremely volatile since June is year. Fears of recession up until a few ago has been overtaken by positive developments or hints of progress in the trade dispute with China. In addition, Brexit and other chaos adds more uncertainties to the global equity markets. Even if the market stabilizes and continues to move higher it is always wise to be vigilant of the downside risks. Severe declines of 40% or more have become more common in recent crashes according to a report by Manning & Napier.

The following table shows the major drawdowns in the past 80 years:

Click to enlarge

Source: HOW INVESTORS SHOULD HANDLE MARKET SELLOFFS by Dana Vosburgh, Manning & Napier