Global investors are turning their attention to emerging markets this year. Though these markets had a lackluster to poor performance last year, this year they are heading in the right track. Some of the major markets are already up by double digit percentage points year-to-date. The returns for few of the emerging market indices are listed below:

China’s Shanghai Composite: 5.0%

India’s Bombay Sensex: 1.5%

Brazil’s Sao Paulo Bovespa: 11.9%

Russia’s RTS Index: 14.5%

Chile’s Santiago IPSA: 6.8%

Mexico’s IPC All-Share: 6.5%

Turkey’s BIST 100: 12.2%

Source: WSJ

Despite the strong rises, many of the emerging countries are attractive their developed world peers. According to an article by Frank Holmes, emerging markets could soar should the US dollar fall. From the article:

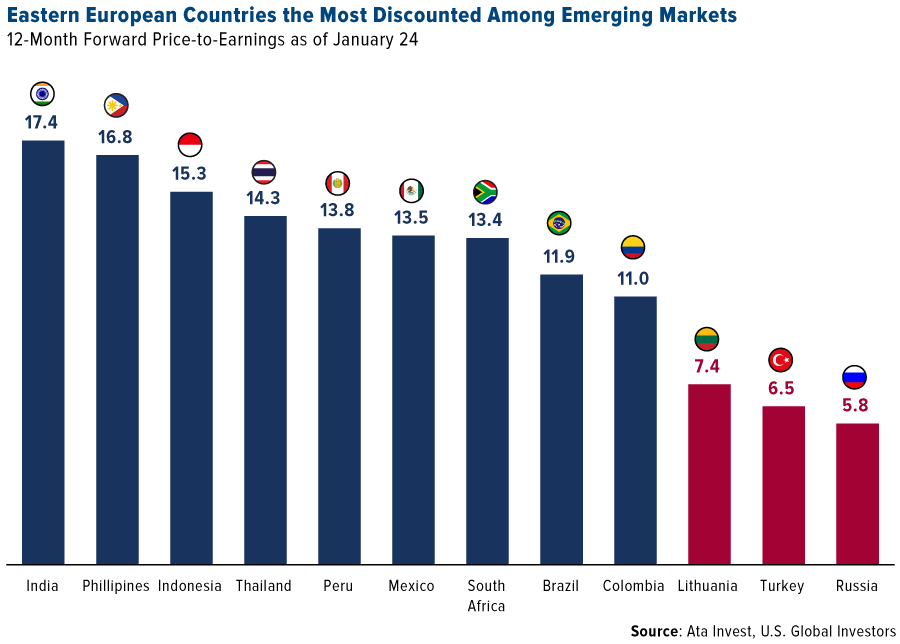

Eastern Europe Trading at Attractive Valuations

The best performing emerging economy in 2018 was Russia, which slipped only 1.5 percent. The country not only proved to be the most resilient to higher U.S. rates and trade war fears, but it also has both attractive dividend rates and strong valuation support. As you can see below, Russian stocks were trading at a very low 5.8 times earnings, a discount of nearly 50 percent against MSCI’s index of 24 emerging economies. Fellow Eastern European countries Turkey and Lithuania also had very attractive valuations, trading at 6.5 times earnings and 7.4 times earnings.

On an annualized basis, Russia has been a good bet for the 10-year period as well, delivering 9.21 percent on average through December 31, 2018.

What’s more, Central and Eastern European (CEE) economies are projected to grow 3.4 percent this year. That’s slower than in 2018, but stronger than Western Europe and the U.S.

Besides a weaker U.S. dollar, CEE countries should benefit this year from more favorable monetary policy. A number of central banks are expected to cut rates in 2019, including Turkey’s, which could lower them from 24 percent to 18 percent, according to Credit Suisse. Russia is also expected to ease, though likely by only 50 basis points.

Source: These Emerging Markets Could Soar If the Dollar Falls, U.S. Funds

Ten stocks from the countries shown in the above chart are listed below with their current dividend yield for further research:

1.Company: Bancolombia SA . (CIB)

Current Dividend Yield: 2.89%

Sector: Banking

Country: Colombia

2.Company: Ultrapar Participacoes SA (UGP)

Current Dividend Yield: 2.70%

Sector: Oil, Gas & Consumable Fuels

Country: Brazil

3.Company: Nedbank Group Limited (NDBKY)

Current Dividend Yield: 4.80%

Sector: Banking

Country: South Africa

4.Company:Fomento Economico Mexicano SAB de CV (FMX)

Current Dividend Yield: 1.55$=%

Sector:Beverages

Country:Mexico

5.Company: Braskem SA (BAK)

Current Dividend Yield: 6.33%

Sector: Chemicals

Country: Brazil

6.Company: Credicorp Ltd (BAP)

Current Dividend Yield: 1.75%

Sector: Banking

Country: Peru

7.Company: Gazprom OAO (OGZPY)

Current Dividend Yield:4.88%

Sector: Oil

Country: Russia

8.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield:5.00%

Sector: Banking

Country: South Africa

9.Company: Petrobras SA (PBR)

Current Dividend Yield: 0.78%

Sector: Oil

Country: Brazil

10.Company: Itau Unibanco Holding SA (ITUB)

Current Dividend Yield: 0.66%

Sector: Banking

Country: Brazil

Note: Dividend yields noted are as of Feb 5, 2019. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions

Disclosure: Long PBR,CIB, ITUB