Australia is known as the lucky country. It is rich in natural resources, has a small population and has a stable democratic government. The country hasn’t had a recent in recent years. In addition, Australia have never had bank collapses like in other developed countries such as the US in recent memory. The lucky country also came off the Global Financial Crisis of 2008-09 relatively unscathed. However Australia’s may run out with a possible recession looming in the horizon.

Below is a short note on Australia’s economy at the MoneyWeek:

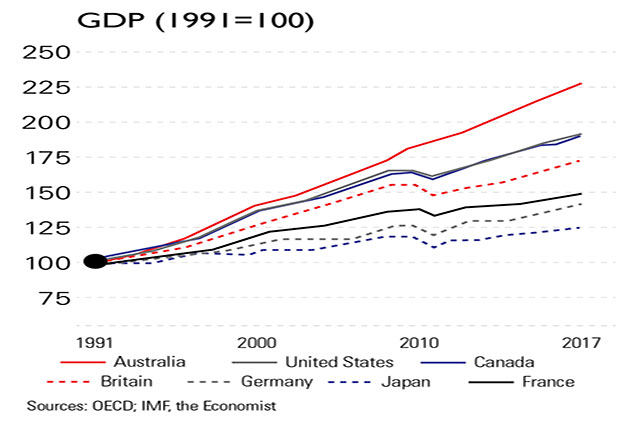

“The last time Australia suffered a recession, the Soviet Union still existed and the internet did not,” The Economist points out. Around 27 years of uninterrupted growth is a record for a developed country. But how much longer can the “wonder down under” last? One of the key drivers of growth was a housing bubble that allowed people to borrow against the rising value of their houses and thus spend more than their income. Throw in mortgages and household debt increased from 45% of GDP in 1996 to an eye-watering 120% at the end of last year. The housing bubble is now hissing air, which, along with overstretched household balance sheets will reduce the impetus from consumption.

Source: Chart of the week: Australia, the wonder down under, MoneyWeek

The Australian equity market is under-performing the US market so far this year. Compared to the S&P 500’s 7.40% rise in terms of price year-to-date, the Australian All Ordinaries index is down 2.5%.

It should be noted that unlike US mortgages, Australian mortgages are recourse loans meaning the lender go after the assets of a borrower. So in some ways the housing collapse may not happen like in the U.S. However heavy dependence on resource exports to China is one of the key Achilles heel of the economy. Volatile commodity markets have also adversely impacted the financial services sector. Hence investors need to be cautious of Australia in the near future.After years of avoiding recessions the country may fall into a recession.

Related ETFs:

- iShares MSCI Australia Index Fund (EWA)

Disclosure: No Positiosn