Emerging market stocks have had a severe correction so far this year. With many of these markets down substantially some contrarian investors may be considering adding emerging equities at current levels. A few articles I have come across recently have suggested that these stocks are attractive from a fundamental standpoint.

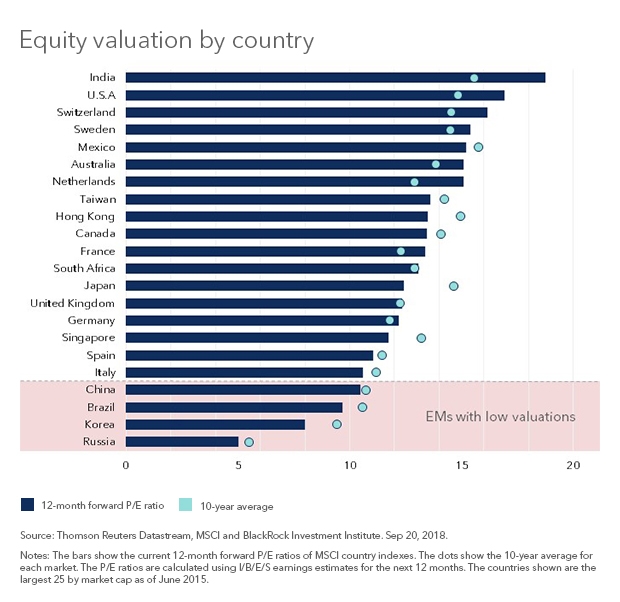

In a post Russ Koesterich at Blackrock states that emerging markets may be a good bet for a potential rebound. He notes a few countries China, South Korea, Russia and Brazil are cheap based on valuation.

From the post:

Following the recent correction, EM stocks are trading at levels that preceded previous rebounds. EM equities are trading at roughly 1.55 times price-to-book (P/B), the lowest since late 2016 and a 35% discount to developed markets. Price-to-earnings (P/E) measures paint a similar picture. Current valuations represent a 33% discount to developed markets. Today, countries from Russia to South Korea are trading at less than 10x earnings (see Chart 1)

Click to enlarge

Source: Emerging markets’ lost (near) decade, Blackrock blog

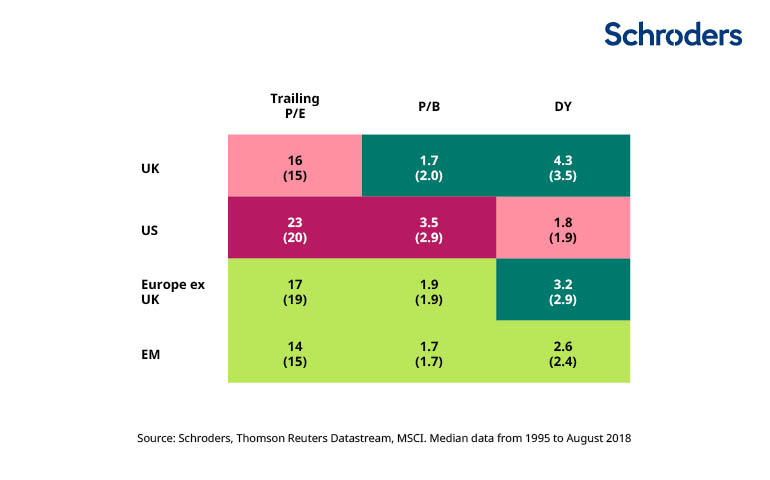

At Schroders Andrew Rymer makes the argument in favor of emerging stocks based on a few variables. From the article:

Attractive valuations

On the face of it, the valuation of emerging markets equities appears to be cheap when compared to their long-run history and relative to developed markets, as the table above highlights. The deepest shade of green indicates the best value while at the other end of the scale, the heavy red highlights expensive valuations.

The trailing price-to-earnings ratio looks at the current emerging markets index price relative to the past 12 months earnings for all of the index companies. The lower the ratio, the cheaper the market.

Emerging markets score relatively well, sitting just below their long-run average.

Price-to-book also uses the value of the emerging markets index but in this case divides by the accounting book value, or net asset value. Again, a low number implies better value. On this measure, emerging markets stocks are trading broadly in line with their long-run historical average at 1.7x.

Dividend yield, meanwhile, is the income paid to investors as a percentage of the current price. In this case, a lower dividend yield has been associated with poor future returns. Emerging markets stocks currently offer a dividend yield of 2.6%, above their long-run average of 2.4%.

Notes:

DY – Dividend Yield

P/E – Price to Earnings ratio

P/B – Price to Book ratio

Source: Five charts that explain the case for emerging markets, Schroders

Investors hunting for bargains in the emerging market space can find plenty of bargains at today’s prices.