The U.S. financial sector is similar to the Canadian financial sector in some ways but different in others. For example, the banking industry in Canada is dominated by just 5 or 6 major banks forming a nice oligopoly. However it is not the case south of the Canadian border.

From the standpoint of equity returns, is the US financial sector better than the Canadian one or the other way around?

The answer to the above question is US financials are better in the short term but Canadian financials beat their US peers in the long run.

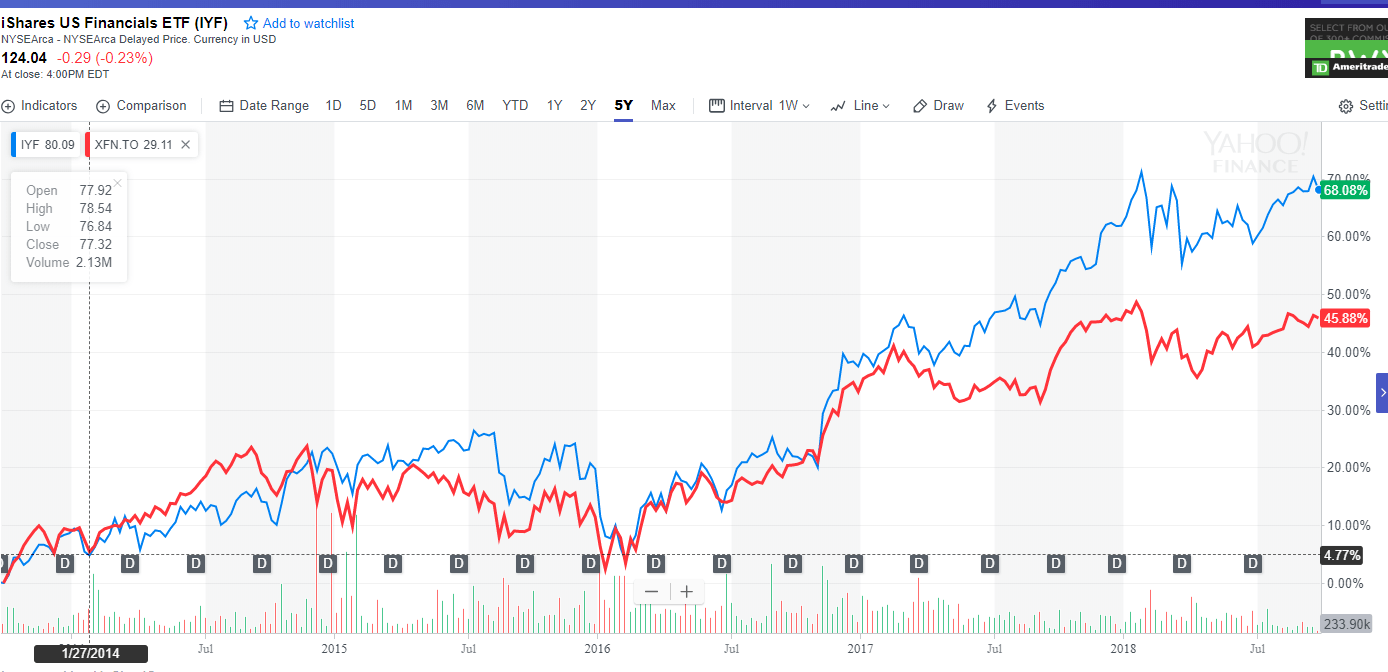

For instance, while US financials have performed very well in the recent past – say 5 years compared to their Canadian counterparts. Let us use the iShares S&P/TSX Capped Financials Index ETF(XFN.TO) trading on the TSX as a proxy for Canadian financials and the iShares U.S. Financials ETF (IYF) for the US. The big five Canadian banks account for about 65% of the ETF while five major banks constitute only about 23% of the US ETF.

Click to enlarge

Source: Yahoo Finance

Clearly the US financial sector has strongly outperformed the Canadian peer in the past 5 years.

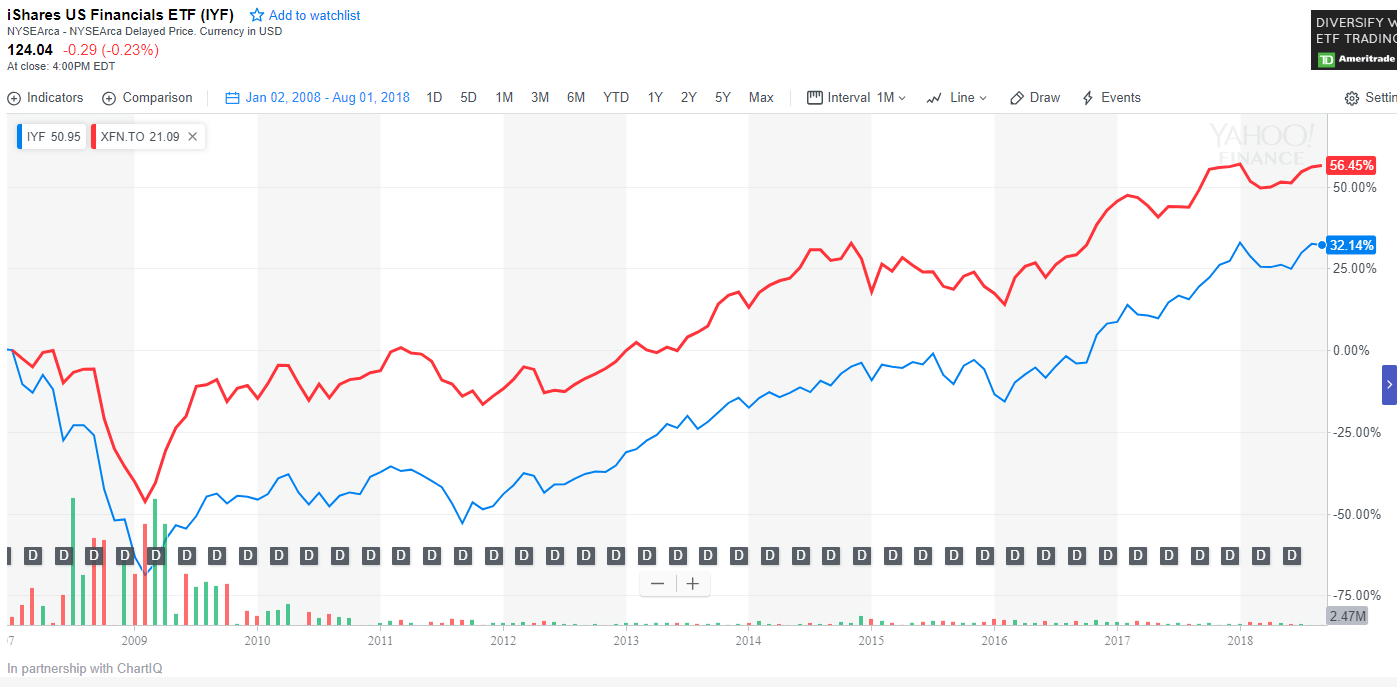

However comparing returns from Jan 1, 2008 thru Sept 25, 2018 shows that Canadian financials yielded 24% more in return than their American counterparts.

Click to enlarge

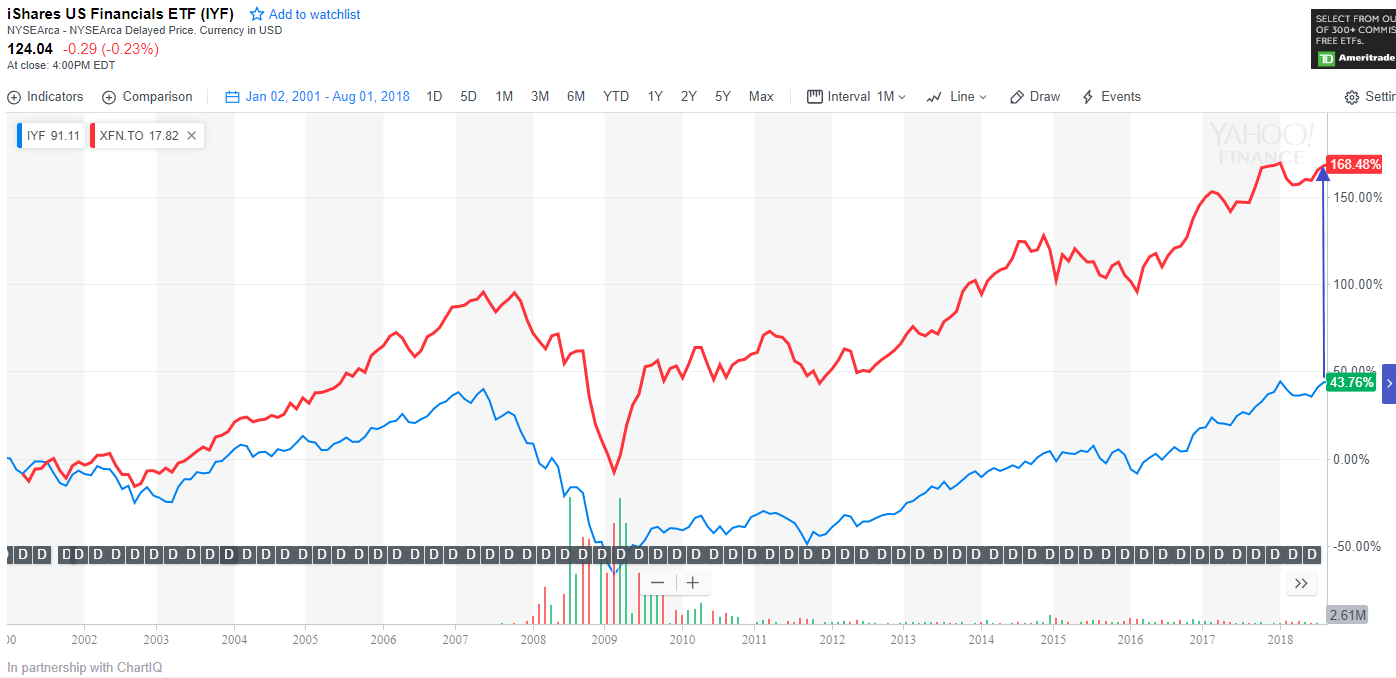

In terms of long-term returns from 2001, Canadian financials have vastly outperformed US financials as shown in the chart below. In fact, the gap between the two returns is huge.

Click to enlarge

Source: Yahoo Finance

In the recent past, the commodity-driven economy of Canada has been adversely affected by falling commodity prices particularly oil. Hence financials under-performed. But over long periods Canadian financials have earned much higher returns over their American peers.

Note: The above comparison does not include the impact of taxes and foreign exchange rate fluctuations.

Disclosure: No Positions

Related: