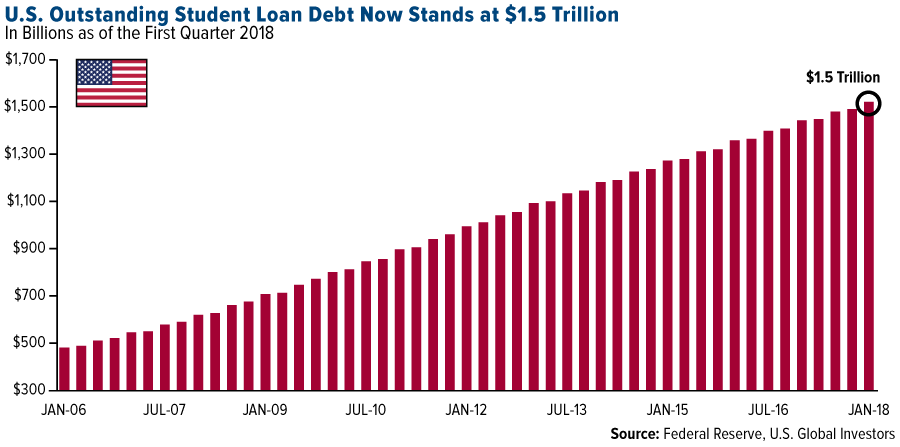

Student loan debt is the largest debt in the US after mortgages. According to the Federal Reserve, the outstanding US student loan debt reached an astonishing $1.5 Trillion at the end of first quarter, 2018. This debt mountain is so huge that it is bigger than even outstanding credit card loans and auto loans.

From an investment impact perspective, investors need not fear a student loan debt crisis. This is because unlike mortgages most of the student loans is held by Uncle Sam and there are always ways the state can help students if they fail to replay. Outright cancellations of debt, debt forgiveness for students working in the civil service, postponement of debt repayments, etc. are some of the options. So though $1.5 Trillions for most investors it simply means nothing.

Click to enlarge

Source: Texas Gold Investors Just Got Their Own Fort Knox by Frank Holmes, U.S. Global Investors

Earlier:

- Why is College Tuition Increasing Consistently in the U.S.?, TFS

- On the Continuous Rise of College Tuition in the U.S., TFS