The S&P/ASX 200 is the benchmark index of the Australian equity market. However a better benchmark for the overall Australian market is the S&P/ASX 300 index. It contains the S&P/ASX 200 components and 100 smaller companies. This index accounts for 89% of the Australian equity market as of March, 2018.

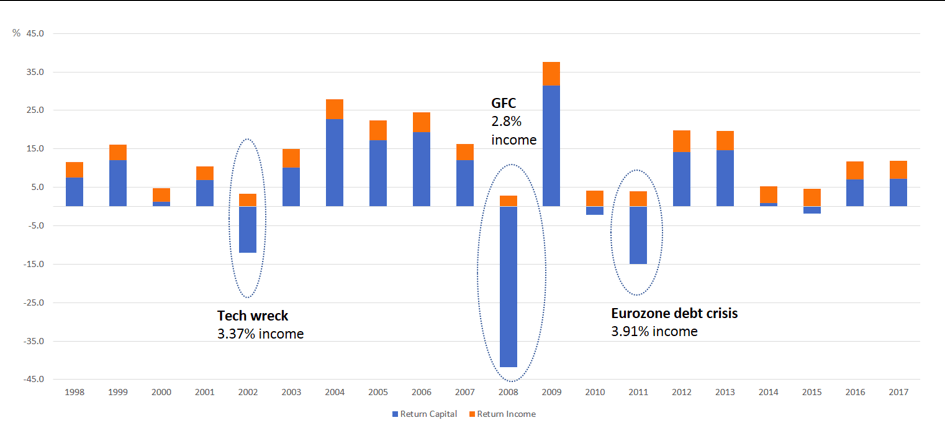

Capital returns of a stock changes over time and are volatile. However the dividend returns component of total returns of a stock remains stable and provide dependable returns year over year. Capital returns vary based on investor sentiment, overall market conditions, P/E expansions, etc. However dividend payouts are set by a company at a certain level and dividends paid out change based on earnings.

Over the long-term dividends account for a decent portion of overall returns and are stable. Unlike capital return, dividen returns are always positive. The Australian example shows below that dividend returns were positive even during the Global Financial Crisis(GFC) of 2008-09.

The composition of Australian Total Returns fro 1998 to 2017:

Click to enlarge

Source: Lower your volatility with dividends, Australian Dividend Investor

The key takeaway for investors is that total return is important and investors should not just consider stock price appreciation alone when making an equity investment.

Related ETF:

- iShares MSCI Australia Index Fund (EWA)

You can also check out The Complete List of Australian Stocks Trading on the US markets for potential investment opportunities.

Disclosure: No Positions

Related post: