The number of public companies in the US has continued to decline for many years now. One of the implications of this scenario is that investors have fewer options to invest in. To put it another way, billions of dollars flowing into the equity markets have fewer places to find a home. As a result, one theory goes that some stocks continue to soar and remain elevated despite the lack of fundamentals. High-flying tech stocks for example have shot up higher in recent years as investors are attracted to their growth potential and there are only a limited of these companies that are publicly traded.

The following is an excerpt from a journal story late last year on the decline in US public companies:

The media and the public pay a lot of attention to broad stock market indexes, but many of the most well-known measures aren’t what they seem. The Wilshire 5000, for example, contains roughly 3,500 companies. There haven’t been 5,000 domestic stocks to include in the index since 2005.

The number of public companies in the U.S. has been on a steady decline since peaking in the late 1990s. In 1996 there were 7,322 domestic companies listed on U.S. stock exchanges. Today there are only 3,671. Easy access to venture, growth and private-equity capital means that companies no longer need to pursue an initial public offering to fund growth or access liquidity. Increases in regulations, shareholder lawsuits and activist demands have also diminished the appeal of a public listing. Over the past two decades, the number of annual IPOs has fallen sharply, to 128 in 2016 from 845 in 1996. (emphasis mine)

Source: Where Have All the Public Companies Gone?, WSJ, Nov 16, 2017

However according to an article by Jim Rowley at Vanguard, the decline in the number of public companies is mostly in the micro-cap stocks and investors need not worry about the negative implications of reduced options.From the article at Vanguard Blog:

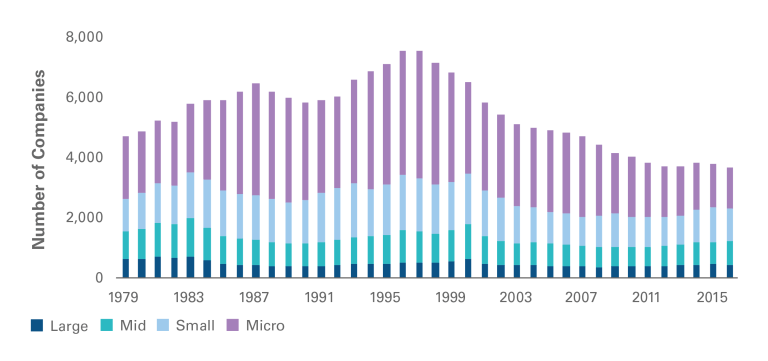

Picture 1 shows that the falling number of public companies is largely attributable to a drop-off in the number of micro-cap companies.

Picture 1

Notes: Large, mid, low, and micro are defined by CRSP. The first and second deciles are defined as large-cap; the third, fourth, and fifth are defined as mid-cap; the sixth, seventh, and eighth are defined as low-cap (i.e., small-cap); and the ninth and tenth are defined as micro-cap. Only securities that had portfolio assignments at year-end were used.

Source: Vanguard calculations, based on data from CRSP.

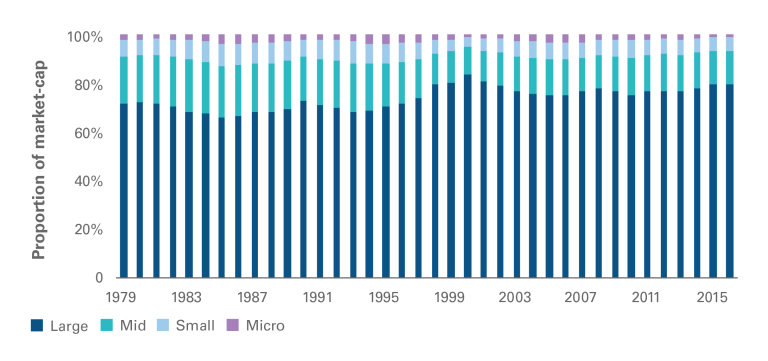

Picture 2, however, shows that micro-caps’ proportion of overall market capitalization has stayed relatively stable, at around 1.5%.

Picture 2

Notes: Large, mid, low, and micro are defined by CRSP. The first and second deciles are defined as large-cap; the third, fourth, and fifth are defined as mid-cap; the sixth, seventh, and eighth are defined as low-cap (i.e., small-cap); and the ninth and tenth are defined as micro-cap. Only securities that had portfolio assignments at year-end were used.

Source: Vanguard calculations, based on data from CRSP.

It is critical to highlight this because these smallest firms are not considered investable for most mutual funds and are not included in many indexes because of their illiquidity.

Therefore, the shrinking number of publicly listed companies consists almost entirely of those securities that would not have been invested in by active and passive funds anyway. Despite the drop in the number of publicly listed companies, the implications for investors appear to be few, if any.

Source: Two pictures are worth 2,000 words by Jim Rowley , The Vanguard Blog for Advisors

Jim’s argument supported by the above data is indeed convincing. But in general the number of companies going public has decreased and many of the large successful startup firms continue to remain private and out of the reach of the general investing public. Moreover a handful of highly popular stocks such as the FAANG stocks have become large enough to dominate entire sectors and drive the overall market. So though the number of large caps that are public remain fairly stable over the years just a few firms dominating the market is not the ideal situation for a free market economy.