The virtual current Bitcoin jumped $400 in one day and reached a new all-time high of $7,454.04 this past Friday. The cryptocurrency has soared a staggering 640% so far this year alone. It should be noted that bitcoin is mostly banned in countries like China. Any time an asset rises so much in a short period of time there is a fear of bubble among investors. Fears of collapse are especially high for investors in virtual currencies.

According to an article ublished last month by Andrew Williams at Schroders, bitcoin seems to be following the pattern of a classic asset bubble. From the article:

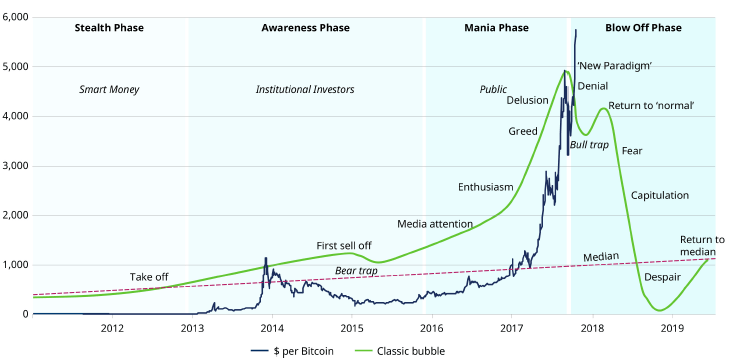

Take a look at the following chart, which plots its price movements over the last six years against the classic trajectory of any asset bubble.

It is a pretty good fit, with the journey over the last few months putting bitcoin above the ‘New Paradigm’ point of the ‘Blow-off’ phase.

Source: Thomson Reuters Datastream, 19 October 2017. Past performance is not a guide to future performance and may not be repeated.

To be clear, none of this is to attack bitcoin, the other cryptocurrencies or the extraordinary ‘distribution ledger technology’ that underpins them.

What we do find extremely concerning, however, here on The Value Perspective, is the behaviour of the wider market towards something whose intrinsic value cannot be assessed – for the simple reason it does not have any.

Source: If bitcoin isn’t a bubble, it’s a spookily good impression, Schroders

Earlier:

- Bitcoin vs. S&P 500 Returns: Chart, TFS

- All You Need to Know About Bitcoin’s Rise, From $0.01 to $15,000, Bloomberg BusinessWeek

“towards something whose intrinsic value cannot be assessed”.. how do we assess the value of currencies then, what’s their intrinsic value?

Yep. I agree with you. The intrinsic value of currencies cannot be measured as well.