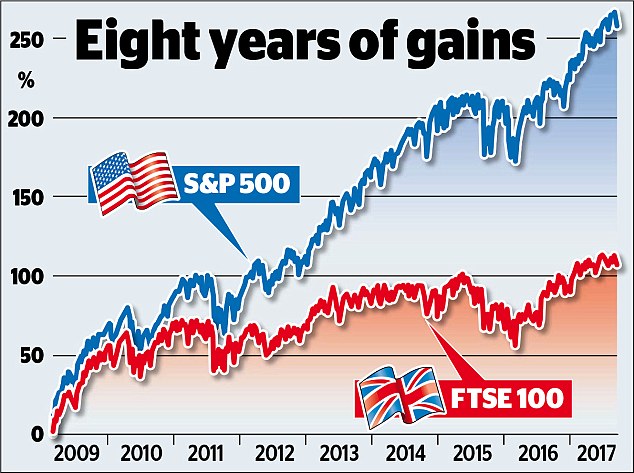

U.S. stocks have soared since the Global Financial Crisis (GFC) of 2008-09. The benchmark S&P 500 has more than doubled from the lows reached during the dark days of 2009 when it seemed like world was coming to end. However none of the markets in developed Europe have had a strong recovery since the GFC like the US markets. One of the reasons for their dismal performance is dithering by policy makers and politicians. While the US took swift action to shore up banks with programs like TARP Europeans were slow to take action as a result of political fights and analysis paralysis. Multiple hits of sovereign debt crises in countries such as Greece did not help European markets also.

The chart below shows the wide gap in returns between S&P 500 and FTSE 100 returns since the GFC:

Click to enlarge

Source: Are global stock markets heading for a crash? With US shares expensive and rates set to rise, fund managers fear we could be due a correction, This is Money, UK

On a year-to-date basis the FTSE 100 is up only 3.6% while the S&P has increased a decent 9.12% based on price appreciation only.