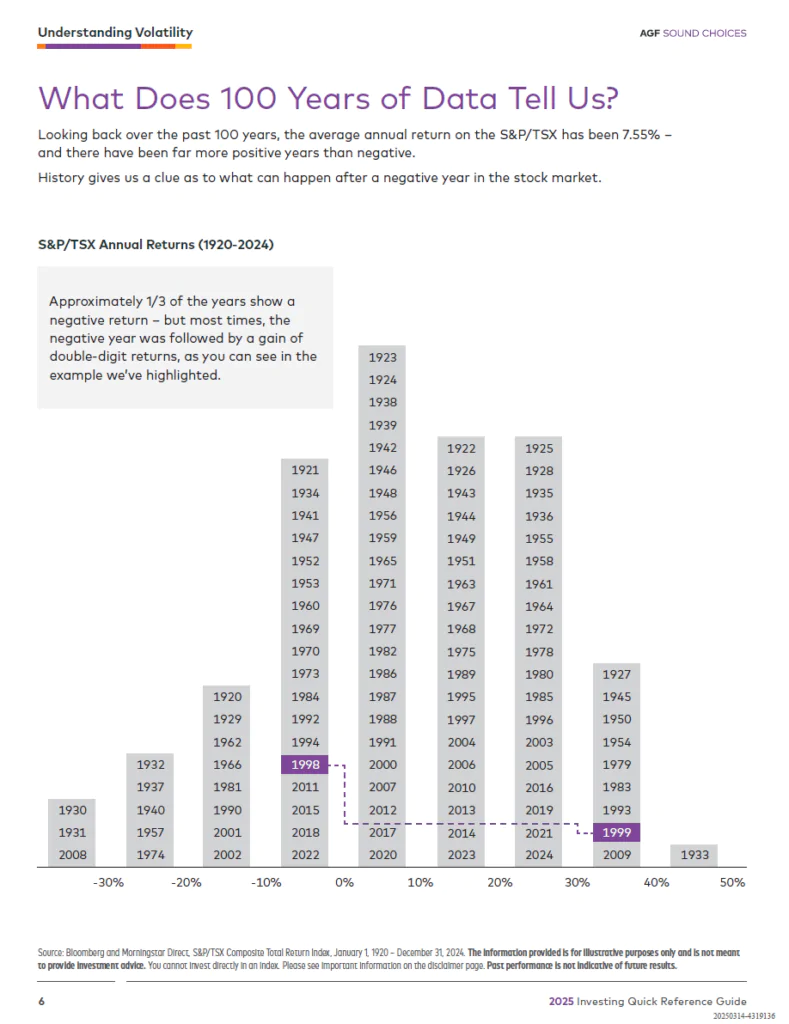

Many of the equity markets have double-digit percentage growth so far this year. For example, developed European markets like Austria and Denmark are up by 21.4% and 12.9% respectively. Among emerging markets, Chile and India are up by 20.6% and 18.4% respectively YTD based on their benchmark indices. The S&P 500 has increased by a decent 8.34% year-to-date on a price only basis. On the other hand, the Canadian stocks are in the doldrums this year with the S&P/TSX Composite down by 2.2% YTD.

According an article in Bloomberg this week, on a valuation basis Canadian equities are cheaper relative to their American peers. From the article:

An upbeat earnings season hasn’t had much impact on valuations yet. The gap in forward price-to-earnings between the S&P/TSX and the S&P 500 Index is the biggest it’s been since 2008. Several strategists and investors say a gap this big can’t last and will either be narrowed by declines in the U.S. or gains in Canada.

“There’s a good case to be made for the bout of serious underperformance in Canada to subside,” Robert Kavcic, senior economist at BMO Capital Markets, wrote in a recent note.

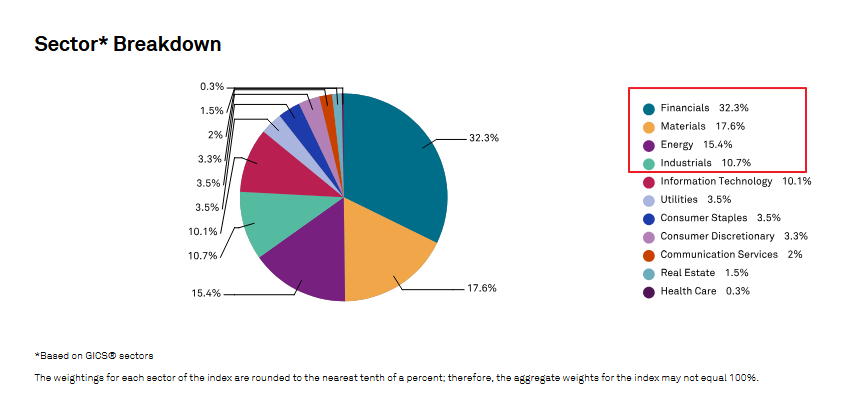

Any recovery in the S&P/TSX will need energy stocks behind it, given their importance to the benchmark. Although there are plenty of unknowns for oil prices — including OPEC’s commitment to production cuts and U.S. shale producers’ ability to fill the gap — there are also signals that investors are getting more bullish on energy.

Source: Five charts that show Canadian stocks could rise from the dead, Bloomberg via Financial Post

Investors looking to add Canadian stocks can consider some of the companies trading on the US markets. You can checkout the complete list of Canada Stocks Trading on the US Markets.