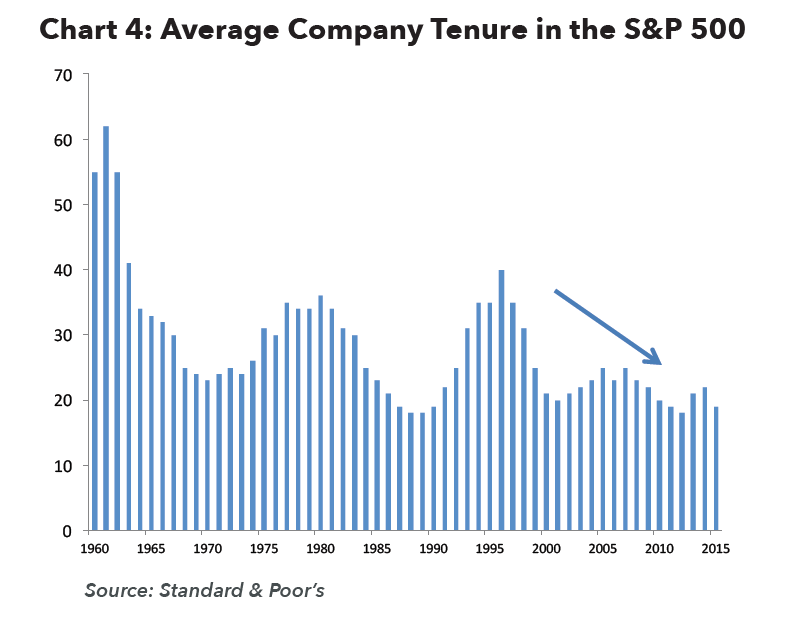

The average tenure of a company in the S&P 500 index has been on a decline for many years now. According to one research report, the average tenure is under 20 years now. So a S&P 500 company today may not exist in the index or even disappear completely within the next 20 years.

Click to enlarge

Source: Navigating Macro Choppiness, The Fiduciary Group

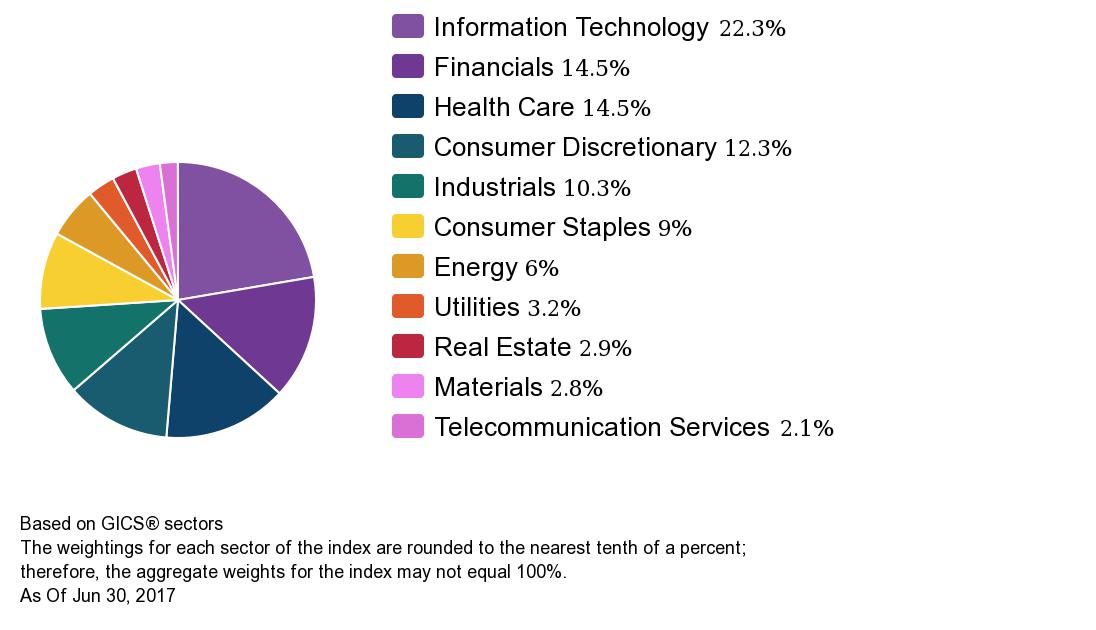

Currently the sector composition of the S&P 500 looks like below:

Click to enlarge

Source: S&P 500

At over 22% the tech sector accounts for about one-fourth of the index and is the largest sector in the index followed by financials and health care. Among the top 10 constituents by index are weight are tech companies like Apple Inc (AAPL), Microsoft Corp(MSFT), Amazon.com Inc (AMZN) , Facebook Inc A(FB) and Alphabet Inc C (GOOG). These and other tech companies in the index will endure higher competition and technological disruption in the next 20 years. As a results a few of them may disappear. While this may not be the case with larger companies like Apple or Amazon, they will still have to fight off competition and the nature of the industry is such that some other new technology can appear and uproot their dominance.

A recent article at CityWire quoted Anton Eser, chief investment officer at Legal & General Investment Management (LGIM) as saying that companies currently in the S&P 500 will change in the next 10 years and predicts 50% of the companies in the index will disappear by 2027.From the article:

Half of the companies in the S&P 500 could become obsolete by 2027, according to Legal & General Investment Management (LGIM) chief investment officer Anton Eser.Eser expects the blue chip index, made up of the 500 largest stocks listed on the New York stock exchange and Nasdaq, will see a radical shake-upover the next decade.

‘Companies that we own over the next 10 years will change and the average lifespan of a company on the S&P 500 is declining,’ he said.

‘Fifty per cent of the companies will no longer be there by 2027.’

He expects many companies will face major disruption as a result of technological change, not least retailers as they adapt to the growth of online shopping.

The automotive sector also faces new competition from driverless and electric cars. James Carrick, LGIM global economist, points out that this poses a challenge for traditional car manufacturers.

While the UK and US are major players in the world of internal combustion engines, there is no guarantee that their car manufacturers will stay ahead of the game forever.

‘China is looking at electric cars. It may not compete when it comes to internal combustion engines, but we do not know who will make autonomous cars in the future. What happens to Ford, Toyota and the others?’ Carrick asked.

Elsewhere, technology has led to advances in energy production, with significant repercussions for economic growth.

‘The cost of solar is down to the equivalent of fossil fuel and that will have an impact on economic growth in 10 to 20 years,’ Eser said.

‘Energy costs are declining dramatically in the US…the money people have to spend on energy is declining and it is leaving [that money] available for consumption elsewhere,’ he added.

Source: LGIM: tech could wipe out half of the S&P 500, CityWire

The key takeaway for investors is that they should be prepared for big changes in the composition of the S&P 500 over the next decade or so. This is especially important for investors in the tech sector as the industry is the most vulnerable to major changes quickly.

Disclosure: No Positions