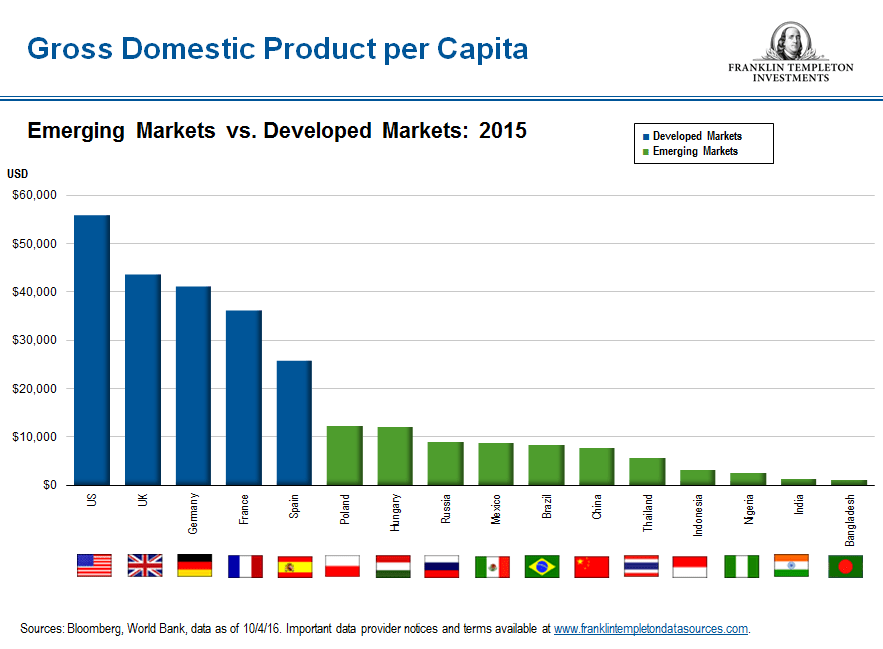

Emerging markets such Brazil, China, India, Russia,etc. have had overall strong economic growth in the past few decades.However despite the tremendous increase in the standard of living in these and other emerging countries, the GDP per Capita is still far lower than those of developed countries.

Click to enlarge

Source: Emerging-Market Equity 2017 Outlook, Franklin Templeton Investments

The GDP per capita of the BRICs are less than $10,000 which is far lower than that of the US or Germany for instance. Hence emerging countries have still a long way to go to catch-up with the developed world. When they reach that point, they would no longer be emerging markets. Mark Mobius of Franklin Templeton predicts strong economic growth over the long-term for emerging markets.

Related article:

- Emerging Markets and a Trump Presidency: No Need to Panic (Franklin Templeton)

- China tipped to be best-performing stock market in 2017 (Money Observer)

- The Emerging Markets Hat Trick: Time to Throw Your Hat In? (Research Affiliates)

Related ETFs:

Disclosure: No Positions