Interest rates are projected to rise sometime later this year or next year. This has many income investors worried as rising interest rates is not good for income stocks such as utilities. However Richard Turnill, BlackRock Global Chief Investment Strategist at Blackrock noted in a blog post that dividend-paying stocks are still preferred to own in a rising interest rate environment since they could earn a positive return over the next five years.

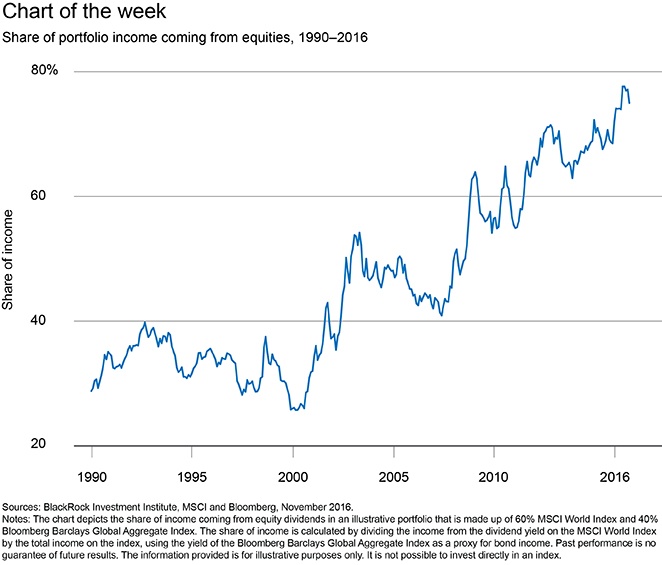

The chart below shows impact of low interest rates on the income generated by a typical portfolio. Equities’ portion of portfolio income produced by a portfolio of 60% stocks and 40$ bonds has steadily increased over the years:

Click to enlarge

Source: Taking stock of income stocks, Richard Turnill, Blackrock

From the above post:

Dividend income is poised to become a larger component of lower overall portfolio returns over the next five years, BlackRock analysis suggests. Bond yields have likely bottomed out, and we don’t see scope for big rises in already elevated stock market valuations amid tepid earnings growth.

High-yielding dividend stocks typically suffer more when rates rise than dividend growers — quality companies with enough free cash flow to sustain dividend increases over time. Yet even many of these stocks could generate positive returns in a gradually rising yield environment. Thanks to the power of compounding dividends and earnings growth, valuations of global developed stocks would need to fall by roughly 30% over the next five years to generate negative returns for investors, our return assumptions suggest. We view this as unlikely.

So investors willing to hold income stocks for the long-term can take advantage of the current lower prices and add them in phases. Here are some stocks for potential investment:

Utilities: Consolidated Edison Inc. (ED), Southern Co. (SO), NextEra Energy, Inc. (NEE) and Duke Energy Corp. (DUK)

Consumer Staples: Kimberly-Clark Corp (KMB), General Mills Inc (GIS), Colgate-Palmolive Co (CL), Nestle SA (NSRGY), Johnson & Johnson (JNJ) and Kellogg Co (K)

Consumer Discretionary: Diageo PLC (DEO), Heineken NV (HEINY), British American Tobacco PLC (BTI), and Anheuser-Busch InBev SA/NV (BUD)

Disclosure: Long NEE, GIS