The US equity market as measured by S&P 500 is up by just over 2% year-to-date. Compared to this return, most developed European markets in the negative territory with the exception of UK’s FTSE 100 which is up by about 10% since many companies in the index derive most of their revenue from emerging markets which are doing well this year. Among the emerging markets, all the major markets in Latin America are up so far this year.

A post by Russ Koesterich of Blackrock published yesterday noted that US stocks are expensive while international stocks are not. From the article:

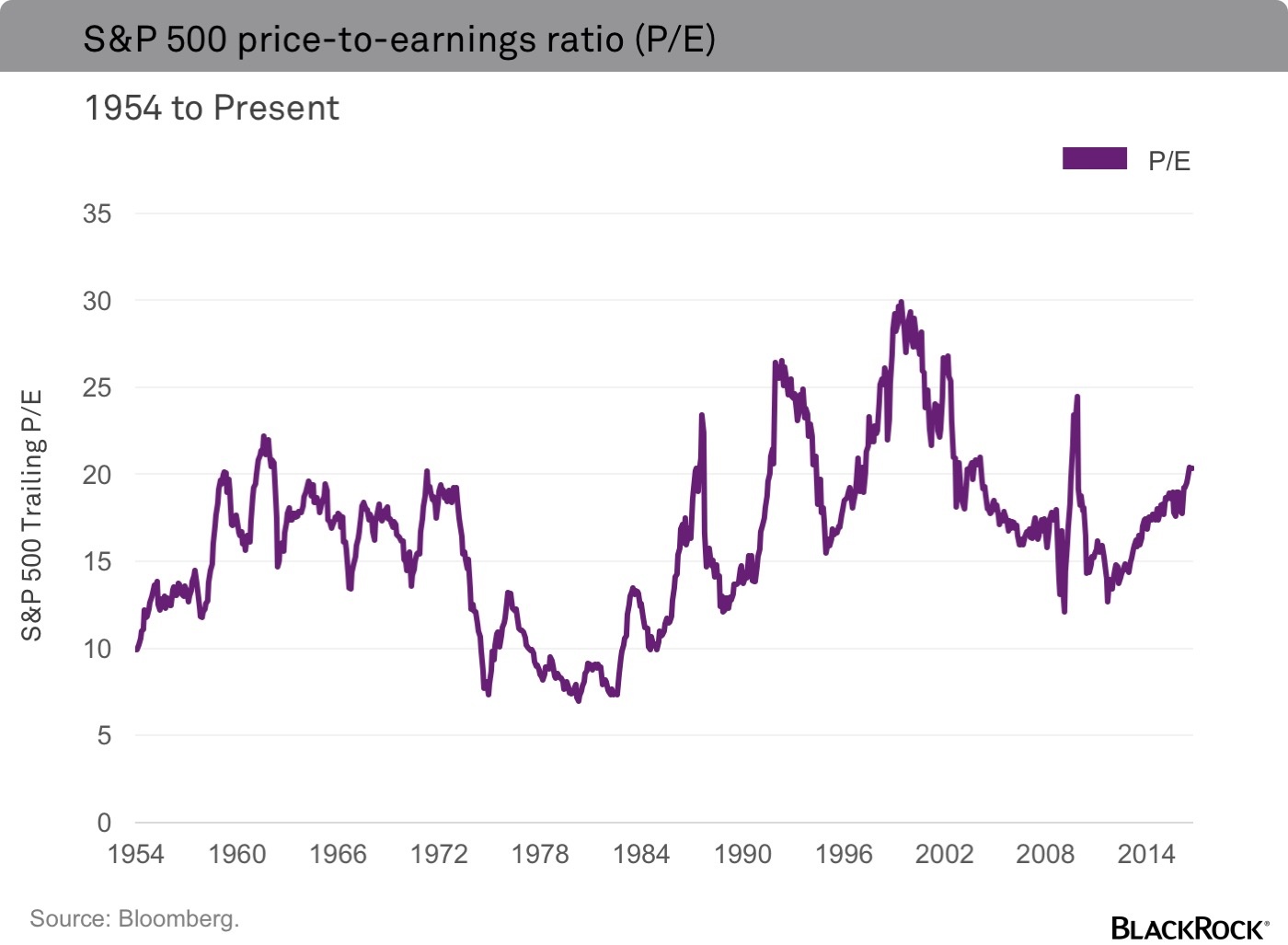

As shown in the chart below, U.S. equities are trading at over 20x trailing price-to-earnings (P/E) and over 26x cyclically adjusted earnings (Shiller P/E). Valuations at these levels have historically been associated with lower forward returns. In contrast, equity markets in Europe, Japan and emerging markets appear somewhere between fairly valued and relatively inexpensive.

For long-term investors, the final point is particularly important. Value is often irrelevant in the short term, but over the long term valuations tend to mean-revert. For example, during the past 60 years, annual changes in the P/E of the S&P 500 had a -0.20 correlation with the change the following year.

Source: Are international markets back?, Russ Koesterich, Blackrock Blog

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

- SPDR EURO STOXX 50 ETF (FEZ)

Disclosure: No Positions