The Railroad industry in North America is an oligopoly with a handful of players dominating the market. From an investment perspective railroads are solid long-term investments with consistent growth and stable and growing dividends. As a cyclical sector, railroads tend to follow the overall state of the economy.

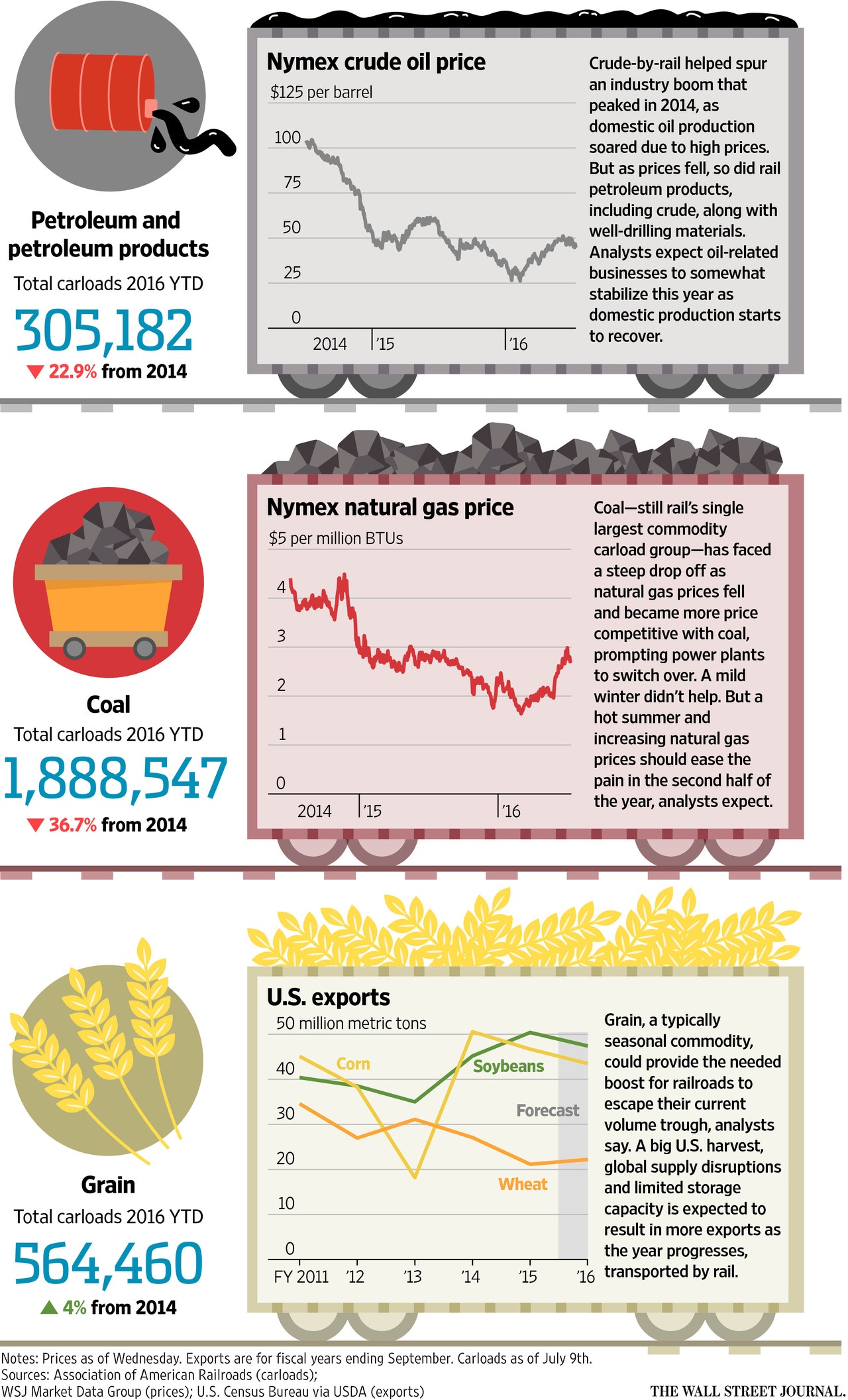

Railroad stocks were flat to down until a few months ago this year. Then they stabilized and recovered strongly when commodities such as crude oil bottomed out. Though they are up substantially year-to-date, they may go even higher according to a recent article in the Journal.

Click to enlarge

Source: Has U.S. Rail Traffic Found Its Rebound?, WSJ, July 14, 2016

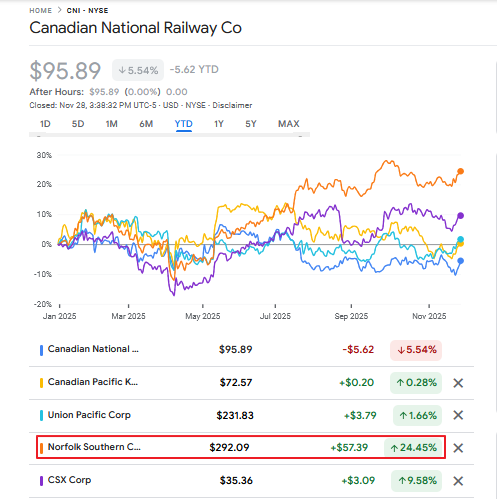

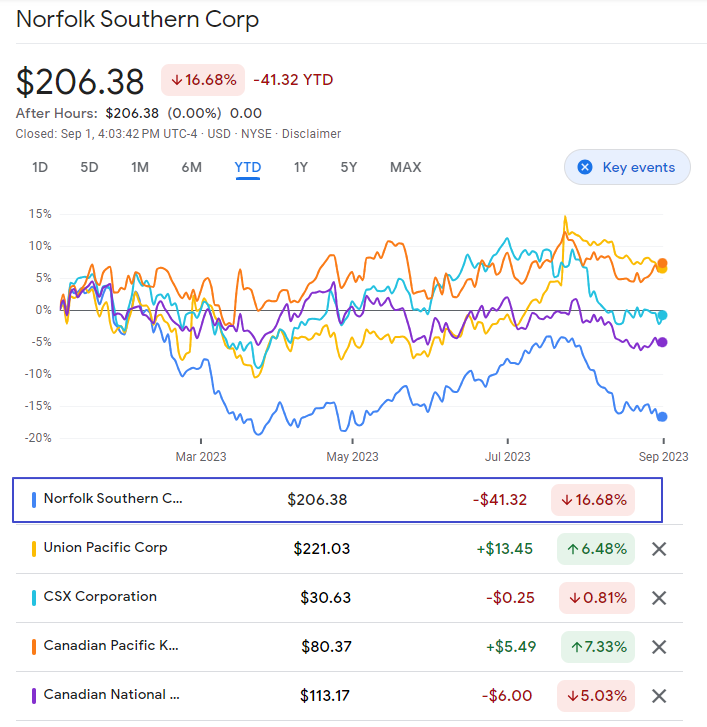

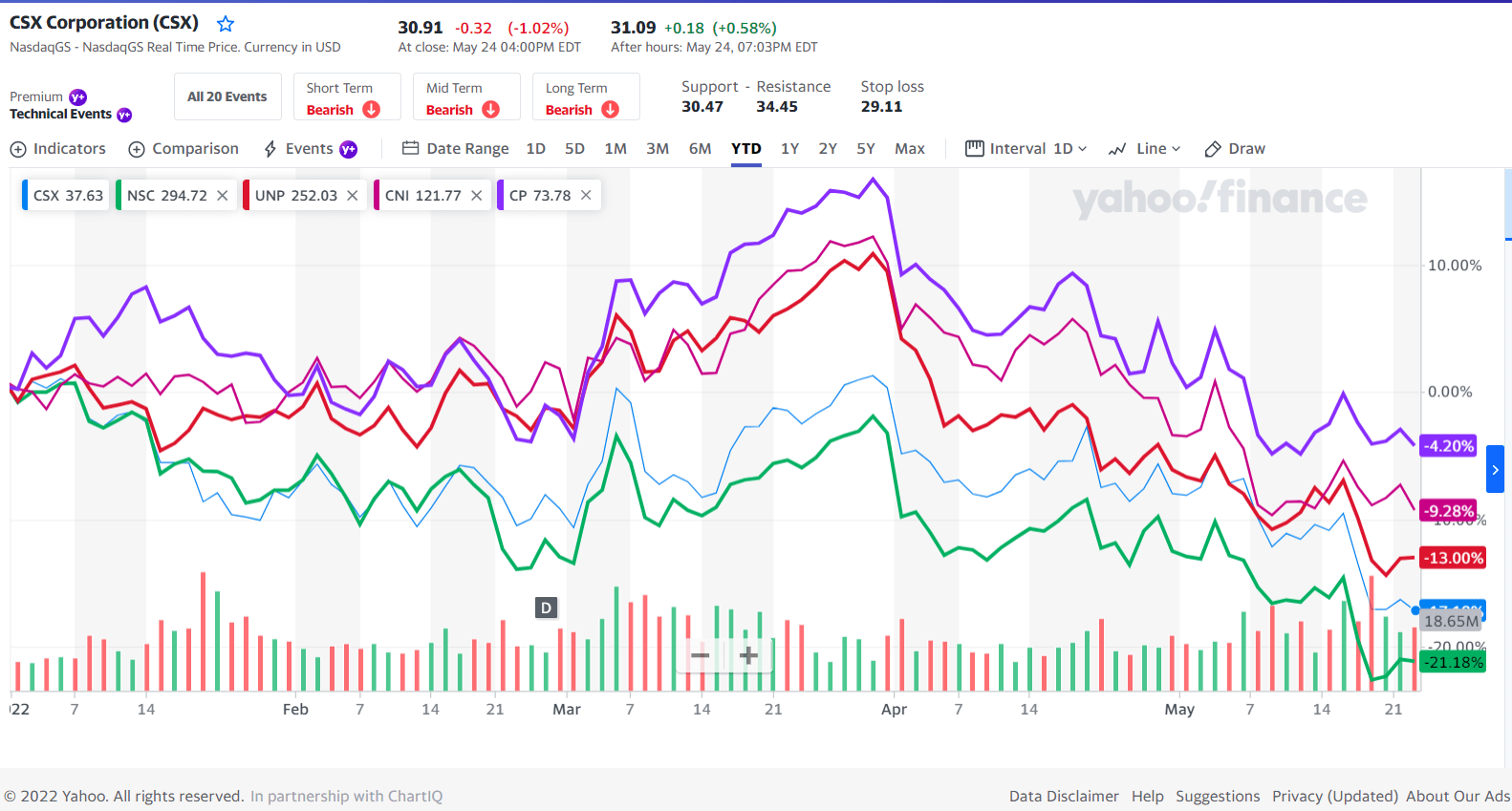

The major North American railroads are listed below with their year-to-date(YTD) price returns:

1.CSX Transportation (CSX)

YTD Return: 9.90%

2. Norfolk Southern Railway (NSC)

YTD Return: 8.16%

3.Kansas City Southern Railway (KSU)

YTD Return: 26.40%

4,Union Pacific Railroad (UNP)

YTD Return: 20.18%

5.Canadian National (CNI)

YTD Return: 11.47%

6.Canadian Pacific (CP)

YTD Return: 10.87%

Source: Yahoo Finance

Disclosure: Long CNI, CSX, NSC and UNP