One of the reasons to invest in foreign stocks is to reduce risk. Simply putting all eggs in one basket is not a good idea. Though U.S. markets may seem stable and have earned better returns recently it does not mean they will continue to do so year after year. By adding exposure to foreign companies an investor can reduce risks of concentration in a single country and also benefit from diversification.

Here is an excerpt from an article by Dan Egan at Betterment:

As such, a well-diversified portfolio helps you manage risk—meaning it reduces the extremes of your ups and downs, keeping you humming along in the center lane of performance.

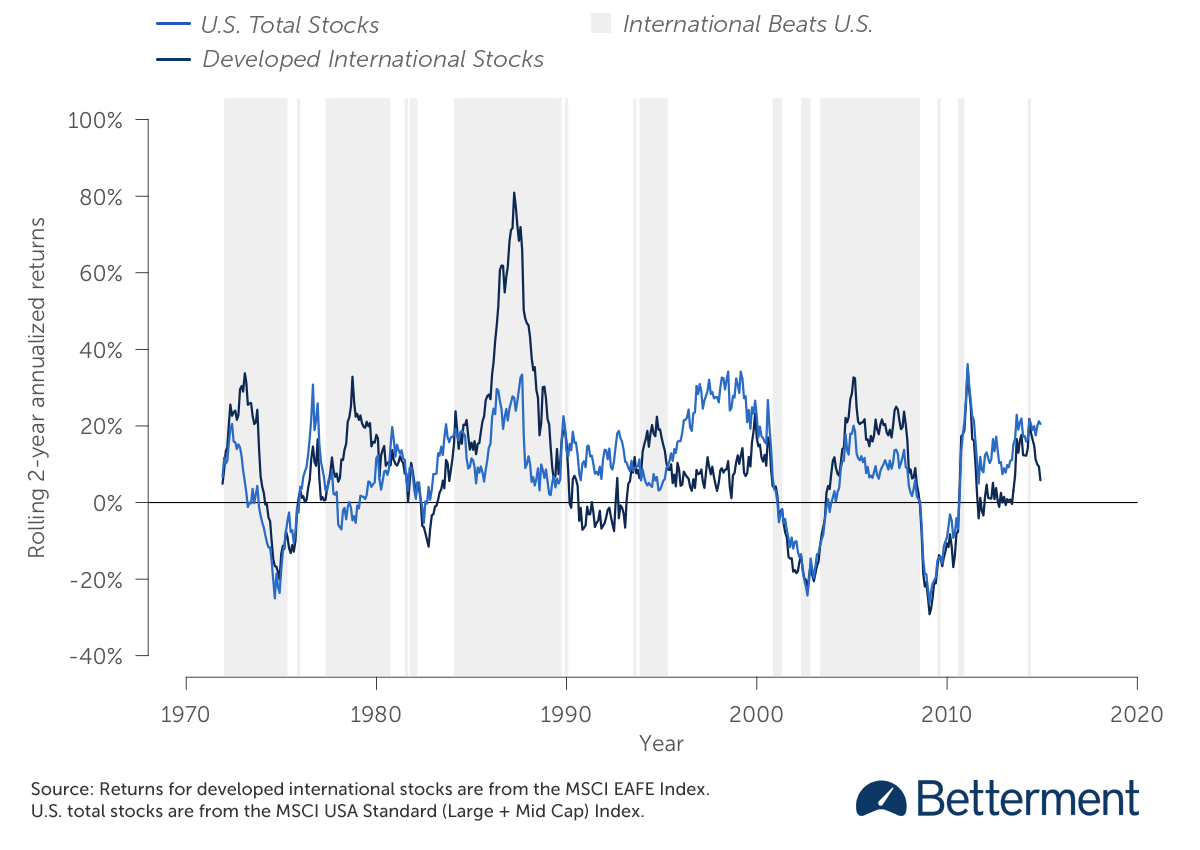

In the chart below, we show rolling two-year returns of the U.S. stock market (light blue) and developed international stock markets (dark blue). The gray shading indicates a period of time where international markets beat domestic markets. As you can see, international wins about 50% of the time. With a diversified portfolio, you’re aiming for the middle of U.S. and international stocks. That doesn’t mean experiencing zero losses—it means getting average gains.

Domestic and International Returns

Source: Why You Should Invest Beyond U.S. Stocks, Betterment

Though some American investors may feel that “America is already great” with thousands of world-class companies and why should I have to care about third-rate companies in some god-forsaken country the reality is much different. So instead of restricting their investments to home country investors are better off exploring and diversifying with international stocks.

But see:

- The real risk behind international investing (Dividend Growth Investor)

If I compare VWO with VOO over the last 10 years, VWO underperformed by a wide margin. I see not reason to invest not more than 15% in foreign stocks.

That is true but it does not mean one need not invest more than 15% in foreign stocks. There are other markets and stocks which have outperformed US markets.So it depends. One thing is foreign stocks offer opportunities for growth that you may miss solely or mostly focused on US stocks.For example, this Chile is up over 17% year-to-date while the S&P is up just over 5%.So a diversified portfolio of foreign emerging and developed stocks can outperform US stocks in the long run.

Thanks for your comment.