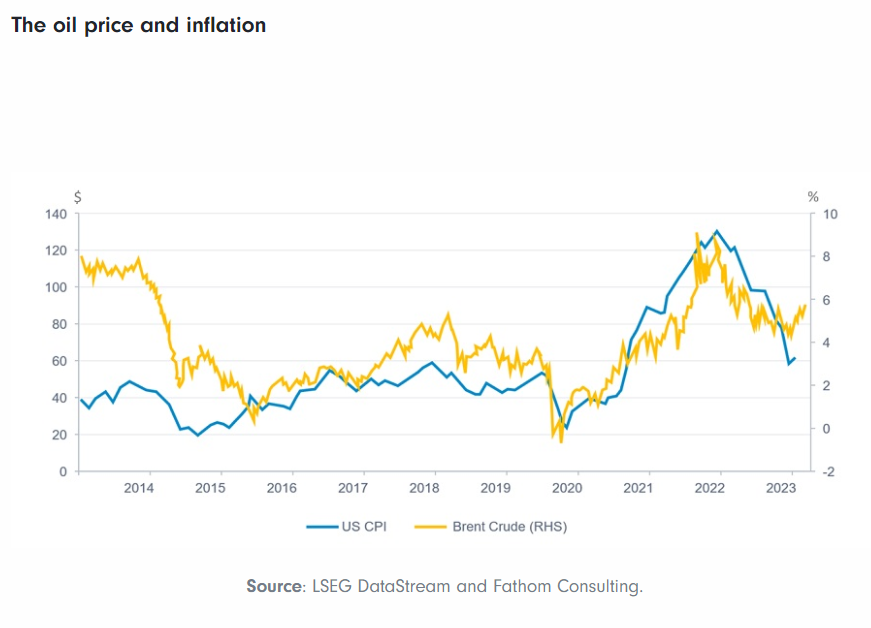

Oil prices have fallen heavily since 2014. Prices reached more than $125 per barrel just a few years ago. On Friday Brent crude futures closed at $38.72/bbl.

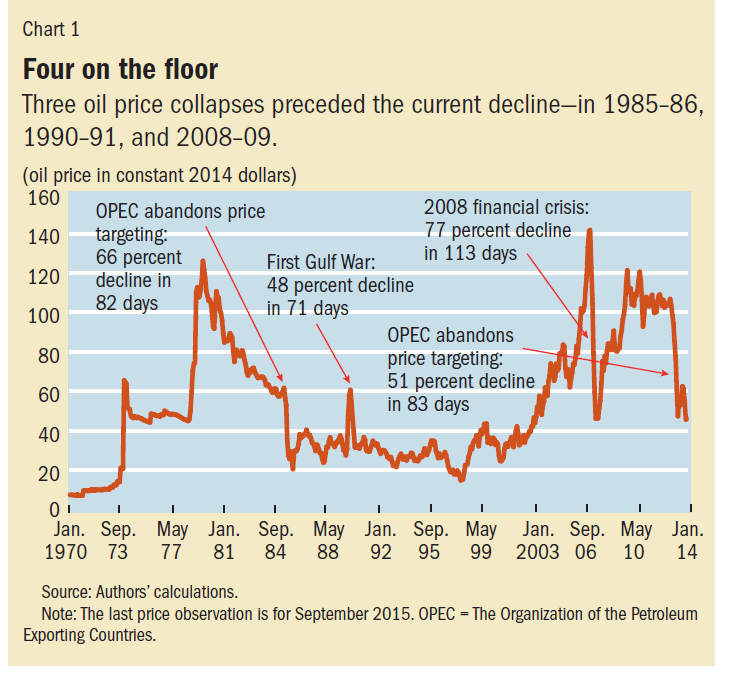

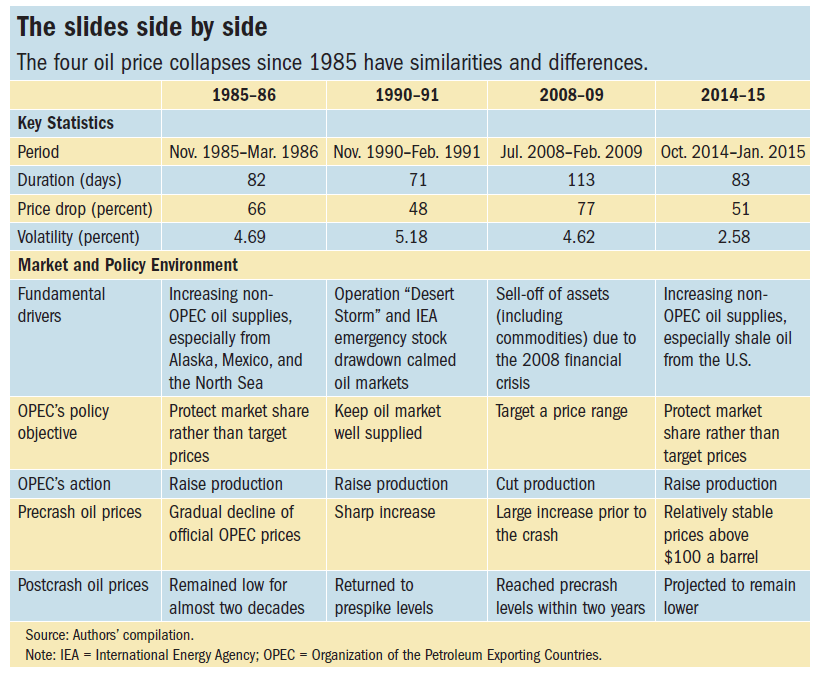

For a few years it seemed oil prices would hold forever at around $100/bbl. Oil producers, refiners and others enjoyed a great earnings period as US consumers were hit with paying over $3.00 per gallon of gasoline and phrases like “pain at the pump” became a standard headline news title by the media. From June 2014, oil prices started to fall dramatically leading to plunge of more than 50%. Nowadays some experts are projecting oil prices to reach as low as $10/bbl or below. According to an article by the IMF, though the collapse in oil prices may seem like an unprecedented event, actually there were three major oil price declines in the past.

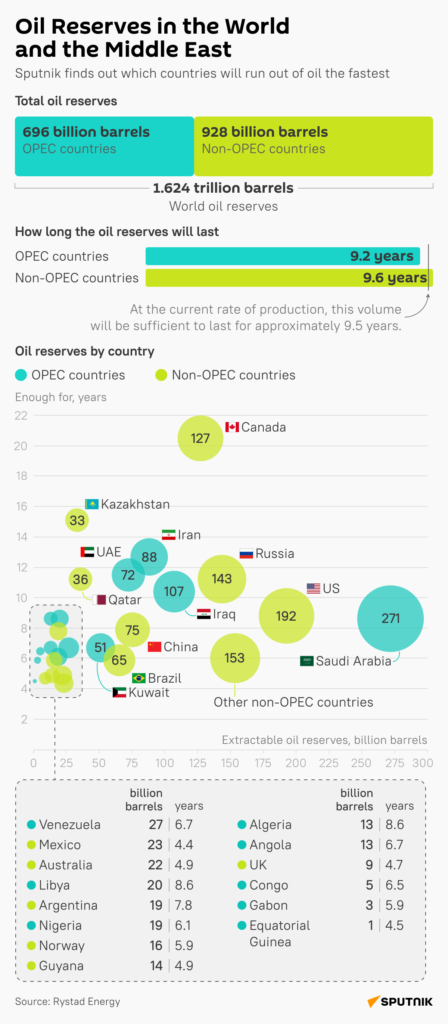

Click to enlarge

The table below shows the similarities and differences of oil price collapses:

Source: Finance & Development Magazine, IMF, December 2015

Here are a few points to remember about oil:

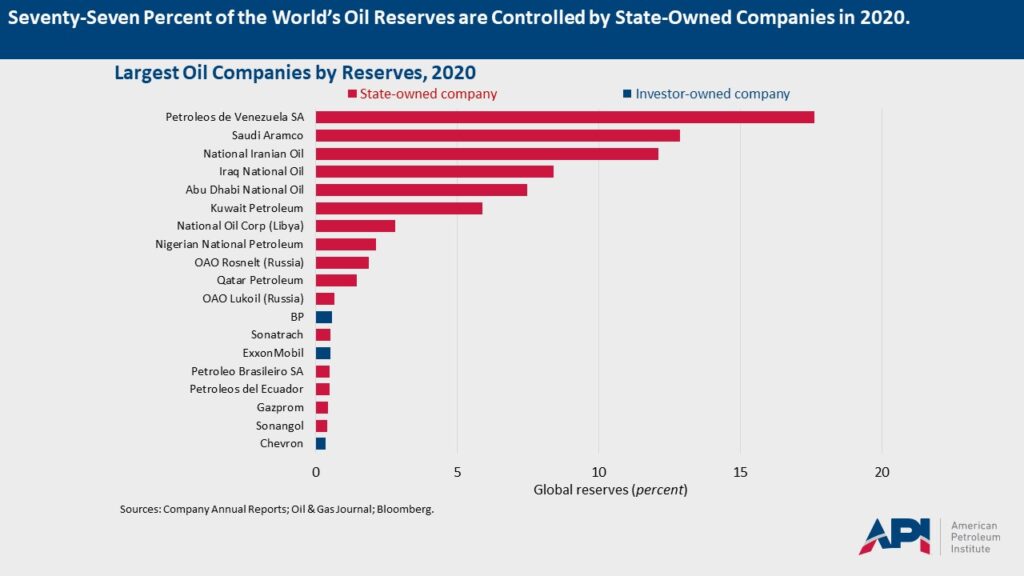

- Oil is one of the most widely traded commodities. Since all commodities are volatile and unpredictable, oil is no different. In fact, oil is more than other commodities due to many factors including speculation, OPEC, shale oil, supply and demand, etc.

- Oil prices can increase or decrease for a multitude of reasons. So equity investors should not change their investment decisions based on oil prices alone. For instance, two guys with firecrackers can punch a hole in some pipeline in Nigeria and cause global prices to go down. Similarly the OPEC cartel can restrict production to raise prices. Nobody in the world knows exactly where oil prices go next.

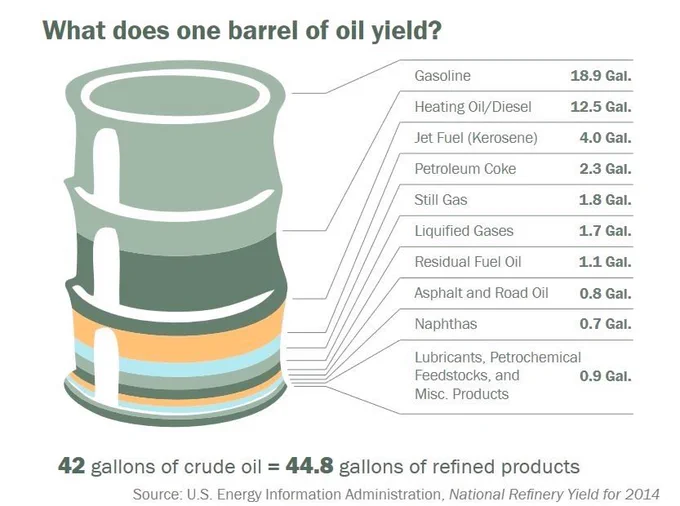

- While low oil prices adversely affect the stocks of companies in the oil industry it does not mean all other industries will also be impacted. There are winners and losers of low oil prices. Hence investors should not panic and instead should focus on picking up cheap stocks from sectors that are bound to benefit from low prices.

Related: Which Sectors are Winners and Which are Losers from Lower Oil Prices ?, TFS

Related ETN:

- iPath S&P GSCI Crude Oil TR ETN (OIL)

Disclosure: No Positions