Some investors may try to find value stocks in countries which have fallen heavily in one year. However this is always not the wise strategy. Simply because the equity market has declined a lot in one year does not mean the market will produce high returns the following year. This is not only true at the country level but also at the individual equity level. For instance, a stock that has plunged by 90% or more does not mean it is a value stock and it also does imply that the stock will bounce back sharply the next year. If this were to happen, all one has to do is find stocks that have declined 90%+ and just invest in them.

According to an article by Michelle Gibley at Charles Schwab, countries that have performed poorly in one year do not necessarily become winners the following year. This is true for both developed and emerging markets.

From the article:

Does it ever make sense to invest in a country’s stock market specifically because it has had a bad year?

With markets getting off to such a rough start so far this year, some investors may be on the hunt for buying opportunities among the global laggards. The idea is that focusing on the poorest-performing stock markets might be a shortcut to finding value. After all, picking up an asset after it tumbles can be a way to take advantage of any future rebounds.

Unfortunately, it’s not that easy. Here’s why.

Poor performers may not bounce

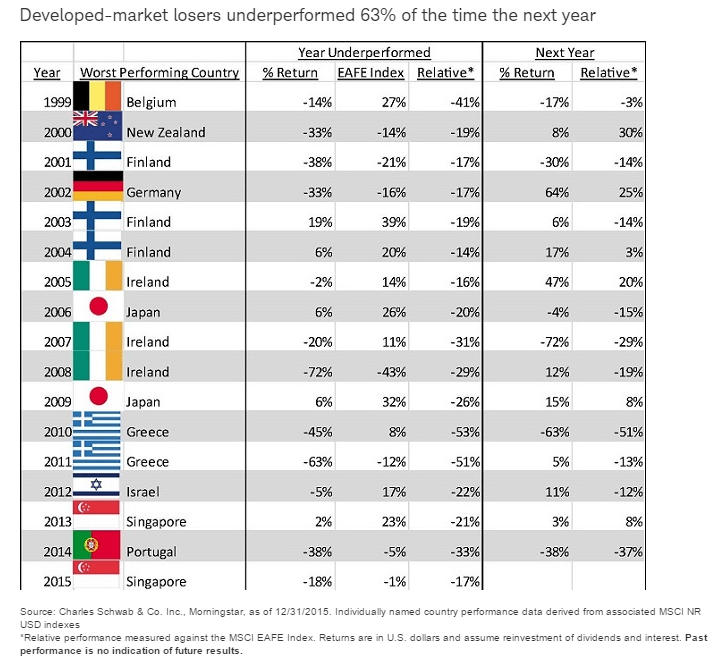

First of all, just because a country’s stock market ranks among the worst performers in a given year doesn’t mean it’s destined for a comeback the year after. In fact, Schwab data covering the past 15 years shows that the worst-performing market in any given year often struggles the next year.

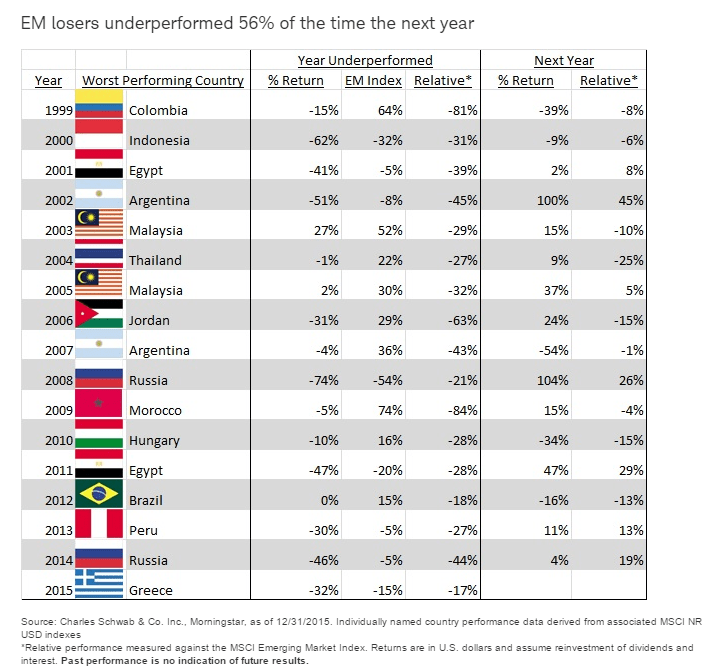

Among developed-country markets, a year at the bottom of the league tables meant continued weakness the year after 63% of the time. Emerging market stock markets fared slightly better, with one bad year leading to another 56% of the time.

Stretching the time horizon out didn’t necessarily improve things. Among developed markets, 64% of losers continued to underperform over the following three years, while 43% of emerging market-losers lagged.

Using Portugal as an example of the developed markets, equity markets there fell by 38% in 2014. The next year it fell again with a loss of another 38%,The same scenario played out with the Greek market in 2010 and 2011.

Click to enlarge

Here is the table for emerging markets:

Source: 2016 International Investing: Why Laggards Don’t Necessarily Produce Winners by Michelle Gibley, Charles Schwab

Greece appears in both the charts since it was downgraded from a developed market to an emerging market by MSCI. Argentina stocks lost 4% in 2007. The next year was even worse with a loss of another 54%.

You should read Irrational Exeburance, Chapter 7 by Robert Shiller. It will present you with an alternative. If 1 year is your time frame then, yes this study may have some relevance, but Shiller shows that in many cases countries and sectors ebb and flow over both a 1 and 5 year time frame.

Also Meb Faber, has a good post to show the returns from buying sectors when they are down 80%. All show positive returns and out-performance over the next 3 years (I think).

Steve

Thanks for your comment and the note about Shiller’s book.Nope.My time frame is not 1 year.In my site you will see most of my articles and views are on long-term only which I consider as five years or more.I agree countries and sectors ebb and flow. In fact, tomorrow’s article on Periodic Table of Emerging Market shows that same logic as well.Every year a different country is the best performer.

I will search for that Faber’s article online.

Good Luck !