Traditional Finance is based on the hypothesis that investors are totally rational and that they make their decisions based on all the available information. Behavioral Finance on the other hand is based on the evidence that real investors are not rational and that they are prone to behavioral biases. In lay man’s terms this simply means real investors are also humans that are usually susceptible to emotions, biases, knee-jerk reactions, manipulations, fear, greed, jealousy, etc.

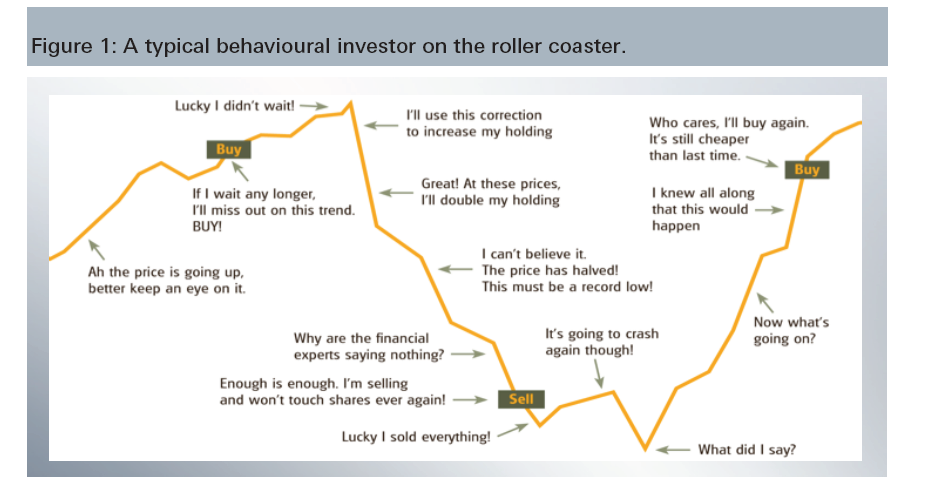

The following chart shows the behavior of a typical investor:

Click to enlarge

Source: Behavioural Finance and Mutual Fund Flows: An International Study, Deutsche Asset & Wealth Management

From the above report:

Figure 1 illustrates the importance of a consistent investment strategy. Had the investor remained invested throughout the whole cycle, he could have gained a higher return. And given that the investor first buys when the prices fall he would even have made an excess return if he had used a countercyclical strategy. But since the downturn was too severe for the investor, he jumped out of the boat when the sea was rough. This shows that an investor who could bear the short-term losses staying focused on his long-term investment goals mostly ends up with a better performance in the long term.

The authors identify two factors that are important in gaining higher returns – patience and loss tolerance. Patience is the most important attribute to have in abundance for success in equity investing. The ability to withstand short-term losses is also very important. However due to behavioral factors investors do not have a tolerance for losses. A classic text book case of this scenario played out during the Global Financial Crisis of 2008-09. Some investors panicked after the market tanked for months on end and when the bear market at the peak in early 2009, they sold out – stating never to set foot in the equity market again. This was a huge mistake to say the least. When the market swiftly roared back in the following months these same investors jumped back in to avoid losing out as stocks continued to rise. These investors lost twice by their actions – first when they sold their holdings at a loss during the trough and then missing out on the gains when stocks shot up from the depths of the dark period.