Canadian stocks are nor performing well this year. As the global commodities market crashed in the past year or so the Canadian economy has suffered. As natural resources such as crude oil account for a significant portion of the economy, declines in the price of oil has had a substantial effect on Canada.

The benchmark S&P/TSX Composite Index is down 10.5% year-to-date. But the top five Canadian banks have fallen even more with losses ranging from 18% to 29% based on price alone for the inter-listed stock trading on the NYSE. Though global investors are bearish on Canadian banks Credit Suisse analysts suggest in a newsletter that investors consider buying the banks instead of selling them short.

From the Selling Canadian Banks Short article:

Investors are worried about low oil prices and an overheated housing market. The energy sector accounts for 9 percent of Canadian GDP, and the price of West Texas Intermediate crude has fallen 41 percent over the past 12 months. Canadian unemployment also rose from 6.6 percent in July to 7.1 percent in September, which has put a damper on the housing market. Still, Credit Suisse says fears about Canadian banks are overdone. For one, a tailwind from abroad may help blunt the impact of the domestic energy headwind. The U.S., which buys 76 percent of Canada’s exports, is in a continuing economic recovery and consumer spending is rising. Canada’s mortgage underwriters also maintained relatively high credit standards as the country’s housing market heated up, and banks look well-positioned to weather a downturn in the credit cycle. A 25-year shift away from credit and toward wealth management and capital markets businesses has also resulted in a dramatic decline in credit losses as a percentage of operating income for the industry. That’s contributing to bank stocks’ outperformance during the downward leg of three of the last four credit cycles. Meanwhile, bank earnings have grown 6 percent year to date, while dividend payouts have increased 8 percent, with an average yield of 4.3 percent. With valuations near a 20-year low, Credit Suisse analysts think it’s time to consider buying the banks, rather than selling them short.

Source: Selling Canadian Banks Short, Credit Suisse, Nov 6, 2015

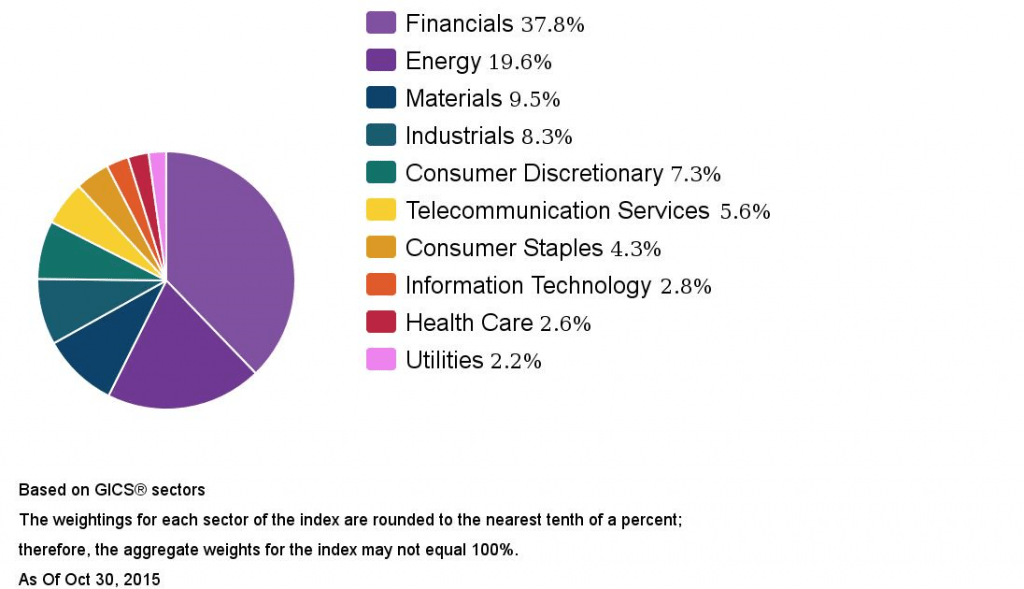

Financials constitute the largest sector by weightage in the TSX Composite Index. The sector accounts for about 38% of the index as shown below:

Click to enlarge

Source; S&P

Energy & Materials together represent about 29% which is high as well but understandable.

Long-term investors can add Canadian bank stocks at current levels. With strong and consistent track records of dividend payouts and decent share price appreciation in the past, the banks have the capacity to weather the current storm. TD Bank for example has a large presence in the US and is able to benefit from the growing US economy.

The table below shows the year-to-date price changes and the current dividend yields of the top five banks:

| S.No. | Bank Name | Ticker | Price end of 2014 | Price as of Nov 13, 2015 | Year-to-date Change | Dividend Yield as of Nov 13, 2015 |

|---|---|---|---|---|---|---|

| 1 | Bank of Montreal | BMO | $70.73 | $55.74 | -27% | 4.47% |

| 2 | Bank of Nova Scotia | BNS | $57.08 | $44.30 | -29% | 4.81% |

| 3 | Canadian Imperial Bank of Commerce | CM | $85.95 | $73.07 | -18% | 4.61% |

| 4 | Royal Bank of Canada | RY | $69.07 | $55.50 | -24% | 4.35% |

| 5 | Toronto-Dominion Bank | TD | $47.78 | $40.05 | -19% | 3.87% |

Data Source: Yahoo Finance and others

Note: Dividend yields noted above are as of Nov 13, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

The banks shown above have declined by double digit percentages year-to-date since the prices are in US dollars and the Canadian dollar has plunged sharply in the recent past against the US dollar. From having a parity with the US dollar in 2011, the loonie now gets only 0.75 USD.

Since Canada does not charge dividend withholding taxes for stocks held in qualified retirement accounts by US investors, Canadian bank stocks are excellent choices for retirement account types like IRA, 401-K , etc.

Disclosure: Long all five banks