The Bank Director magazine published their annual Bank Performance Scorecard for 2015 in July. The winners are selected based on the following criteria:

Five key metrics are used to evaluate bank performance: core return on average equity (ROAE) and core return on average assets (ROAA), to measure profitability; the ratio of tangible common equity (TCE) to tangible assets, to measure capital strength; and credit quality, gauged through the ratio of nonperforming assets to total loans and real estate owned, and the ratio of net charge-offs to average loans. While the Scorecard has a slight bias towards profitability, banks that rank highly tend to do well in all of the metrics.

The following are the top 5 banks with assets from $5 Billion to $50 Billion category (large banks):

1.Capital One Financial Corp (COF)

2.KeyCorp (KEY)

3.U.S. Bancorp (USB)

4.Wells Fargo & Co. (WFC)

5.Comerica Inc. (CMA)

Capital One is mainly a sub-prime credit card issuer.A few years ago it acquired the

ING’s US online bank to expand into banking.

The following are the top 5 banks with assets from $1 Billion to $5 Billion category (mid-size banks):

1.Bank of the Ozarks Inc (OZRK)

2.First Financial Bankshares Inc. (FFIN)

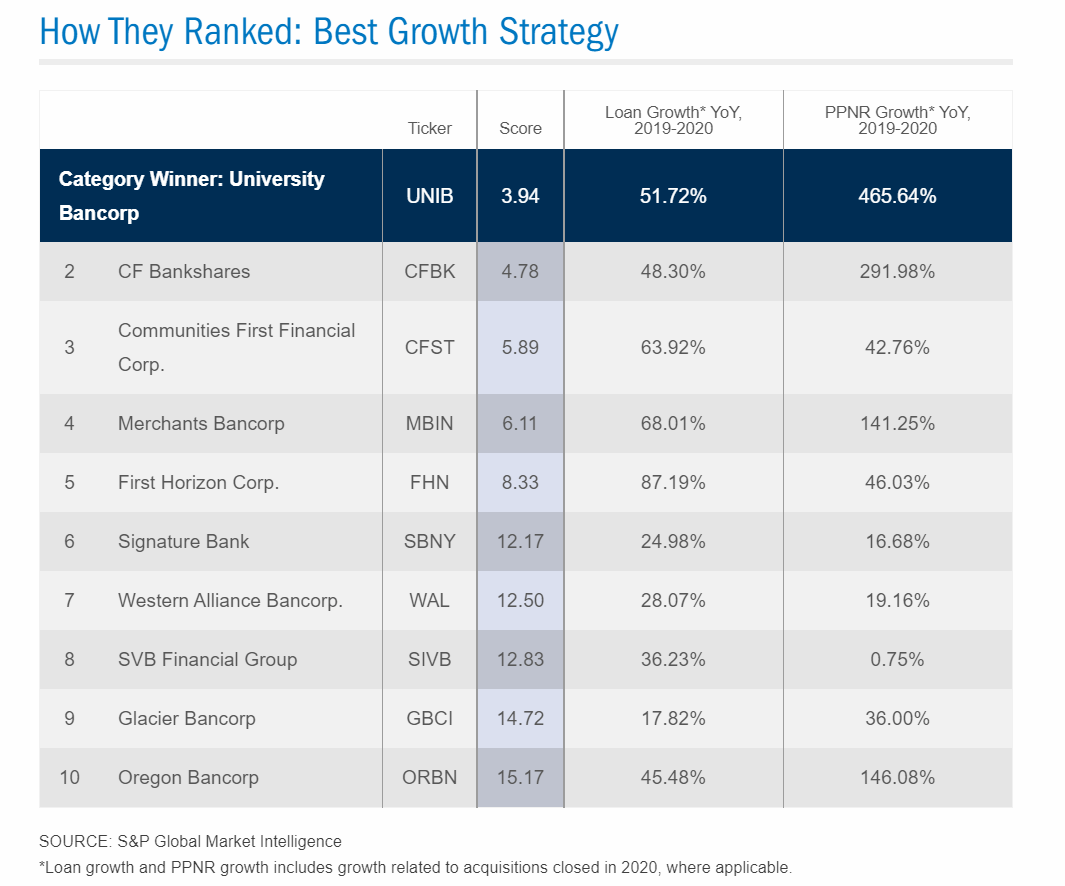

3.Signature Bank (SBNY)

4.BofI Holding Inc.(BOFI)

5.CVB Financial Corp. (CVBF)

Bank of Ozarks is an excellent bank with a consistent track record in in terms of returns.

Recently the bank increased its dividend again.

Click 2015 Bank Performance Scorecard to view the entire list of all the winners. This is an excellent resource for researching and selecting bank stocks for investment.

Source: Bank Director Reveals Top Performers in 2015 Bank Performance Scorecard, Bank Director

Disclosure: Long USB