Germany’s benchmark DAX Index has been swinging wildly in the past few weeks like an emerging market index such as the Bovespa or Sensex. I haven’t seen DAX so volatile in the past. However times have changed. The DAX has become highly volatile among major global developed indices since China’s economy is in a slowdown and many of the DAX constituents generate a substantial portion of their revenue from the communist country.

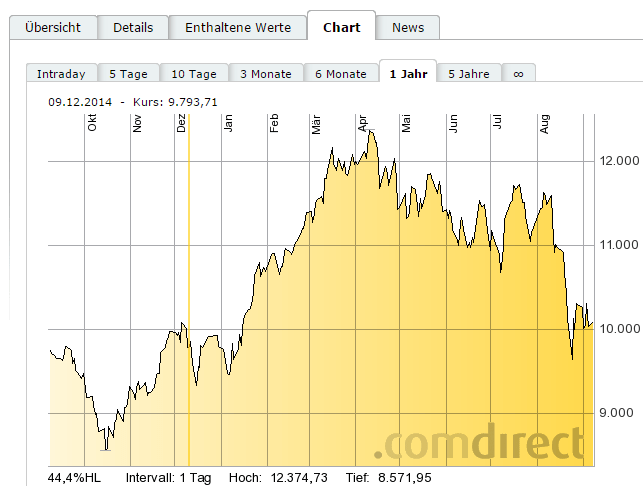

The DAX is up by 2.4% year-to-date. Currently it is at 10,038. In the past few 52-week it reached as high as 12374. From being one of the best performers this year the index has given up most of the gains and is up marginally now.

The DAX 1-year return chart is shown below:

Click to enlarge

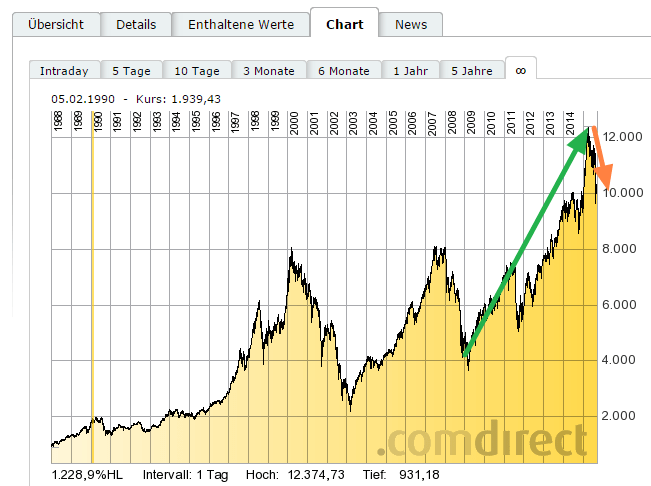

The DAX long-term return chart is shown below:

Source: ComDirect

Though the short-term chart shows high volatility in the long-term DAX has grown nicely.

Here are a few interesting facts about DAX:

- The Base Date for DAX is 30 December 1987 and the base level is 1,000 points.

- The index represents the largest blue-chip German firms.

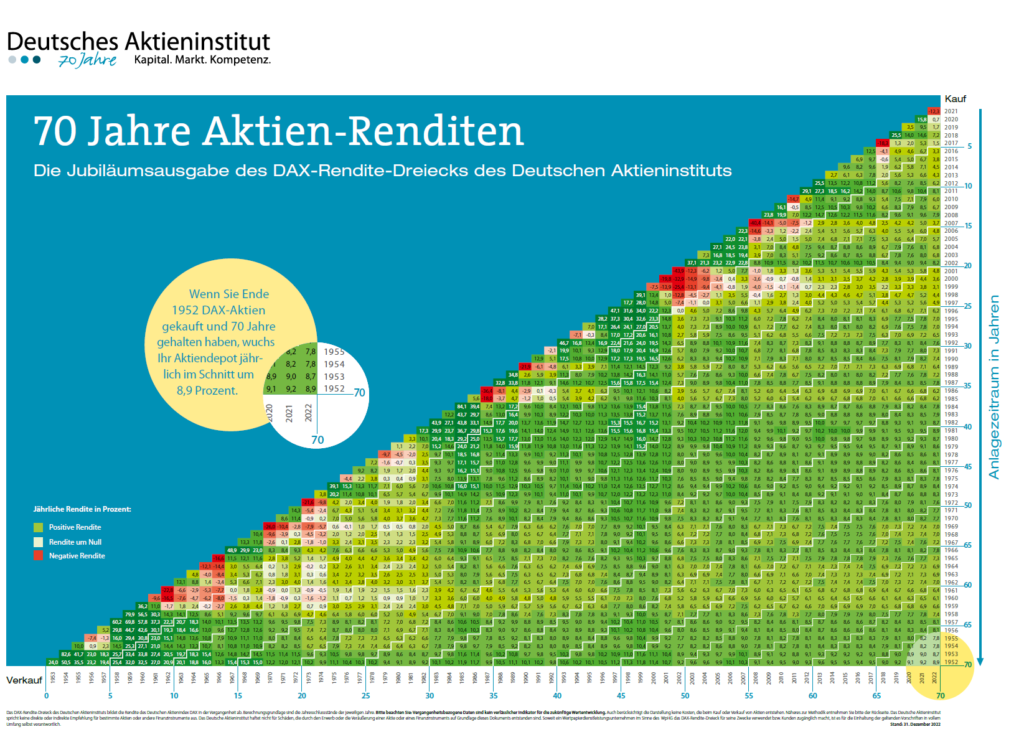

- DAX is weighted by market capitalization, i.e. the weighting of a single stock relates to its share in the overall capitalization of the stocks contained in the index. The return reported is the total-return which means it includes price appreciation and dividends. This is a BIG difference between DAX and other indices such as the S&P 500, FTSE 100, CAC-40, etc. which do not include dividends in their calculations.

- The components of the DAX has changed over the years as a reflection of the development of major German companies in the economy. When it was launched in 1988, the original constituents were: Allianz, BASF, Bayer, Bayerische Hypotheken- und Wechselbank, Bayerische Vereinsbank, BMW, Commerzbank, Continental, Daimler-Benz, Degussa, Deutsche Bank, Deutsche Babcock, Deutsche Lufthansa, Dresdner Bank, Feldmühle Nobel, Henkel, Hoechst, Karstadt, Kaufhof, Linde, MAN, Mannesmann, Nixdorf, RWE, Schering, Siemens, Thyssen, Veba, Viag, Volkswagen.

- Today’s DAX does not include firms like MAN, Mannesmann, Veba, Viag, etc. due to mergers, takeovers, bankruptcies, etc. The current components of the index can be found here.

- Reflecting the composition of the German economy, the top sectors represented in the index are Chemicals, Automobiles & Parts, Industrials and Pharma & Healthcare.

Source: 25 YEARS OF THE DAX® – THE FACTS, Deutsche Boerse

Related ETF:

- iShares MSCI Germany (EWG)

Disclosure: No Positions