Last year I wrote an article on why investing in U.S. multinationals is not the same as investing in foreign companies. From that article:

Michelle Gibley of Charles Schwab discussed the reasons for investing in foreign firms instead of U.S. multinationals in an article back in May. From the article titled “4 Mistakes to Avoid in International Investing“:

- “The stocks of U.S. multinational companies tend to move in tandem with other U.S. stocks, and U.S. multinationals typically still derive a large percentage of their profits from the United States. But this misses the point of investing internationally—to diversify into areas that aren’t so highly correlated with the U.S. market.

- Similarly, multinationals have a greater tendency to hedge currency exposure—and one reason to invest internationally is to increase your currency diversification, not reduce it.

- U.S. multinationals may not do as well as local competitors in their target foreign markets due to cultural and local differences. After all, not everyone prefers U.S. brands, and some U.S. companies have difficulty customizing products for foreign markets.

- The U.S. share of the global stock market is declining, so investing in U.S. multinationals means missing out on different opportunities elsewhere. When you look at global GDP, non-U.S. countries dominate, indicating the market share of these countries has room to grow.

- Owning large multinational companies means excluding small cap companies that are more closely tied to the economic conditions in their local markets. International small cap stocks have even lower correlations to U.S stocks than large cap international stocks.”

Source: 4 Mistakes to Avoid in International Investing, Charles Schwab

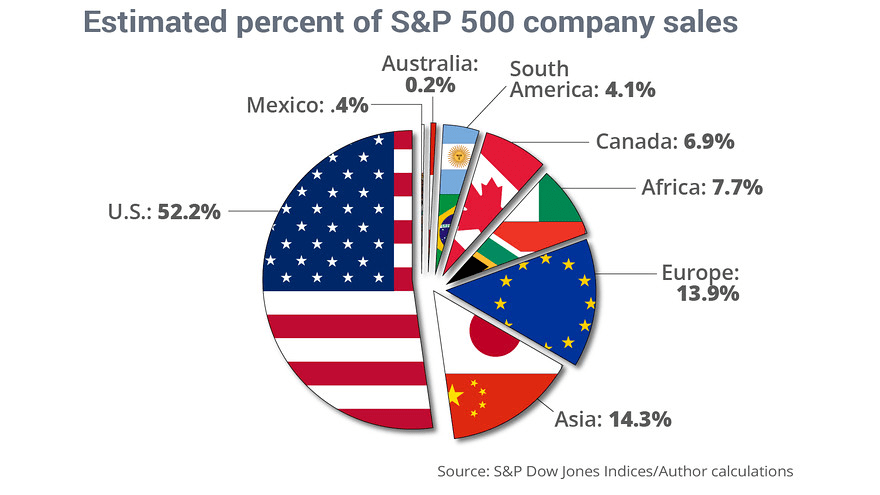

In this post let us take a look at a chart I recently came across at The Big Picture related to this subject. Here is the chart:

Click to enlarge

Source: MarketWatch via Barry

Investors must note that the above chart is not accurate in terms of data and is based on estimates. This is because many US firms including multinationals in the S&P 500 do not report sales by country and may group countries into regions as they wish. For example, instead of reporting sales by US, Canada and Mexico, they may just report it as sales in North America. Similarly they may combine sales in China with the figures for countries such as Taiwan, Hong Kong, etc. and call it ‘The Greater China’ region.