One of the important topics that I have written about many times in the past is Market Timing. Some of those posts can be found here, here, here and here. I came across an interesting article by Fidelity Investments discussing ways to deal with market volatility.

From the article:

Click to enlarge

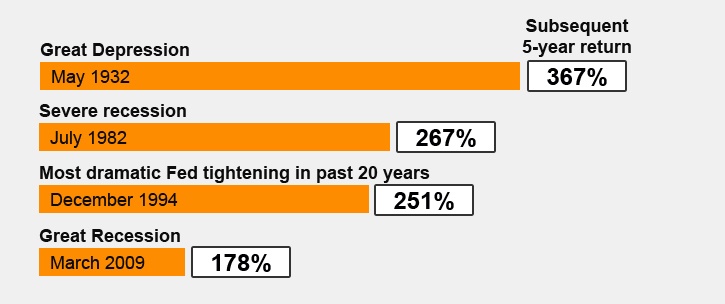

U.S. stock market returns represented by total return of S&P 500® Index. Past performance is no guarantee of future results. It is not possible to invest in an index. First three dates determined by best five-year market return subsequent to the month shown. Sources: Ibbotson, Factset, FMRCo, Asset Allocation Research Team as of March 31, 2015.

In fact, what seemed like some of the worst times to get into the market turned out to be the best times. The best five-year return in the U.S. stock market began in May 1932—in the midst of the Great Depression. The next best five-year period began in July 1982 amid an economy in the midst of one of the worst recessions in the post-war period, featuring double-digit levels of unemployment and interest rates.

Source: Six strategies for volatile markets, Fidelity Investments

As the chart above shows, market timing does not work and panic selling during those times is not a wise strategy. Sometimes doing nothing is the best thing to do. During the recent great recession, the S&P 500 plunged to 666 in March 2009. Today it is trading at over 2,055. In hindsight, March 2009 would have been the best time to pick up stocks on the cheap. However not many people were brave enough to do that. But even investors who did not sell out during that panic, would have done much better had they stayed the course.So the key takeaway is where there is blood on the street, it is a great time to invest or stay put.