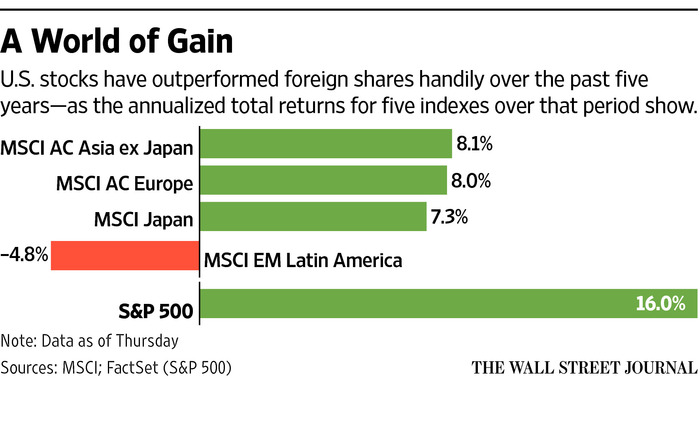

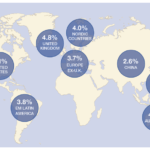

U.S. stocks have handily beat foreign stocks in the past five years as the graphic shows below. So why should one invest in foreign stocks?

Click to enlarge

Source: Four Reasons to Boost Your Foreign-Stock Exposure, Feb 20, 2015, The Wall Street Journal

Some of the reasons to invest in foreign stocks include diversification, potential to earn higher returns, dividend yields, etc. One important reason why going broad makes sense is the market capitalization of U.S. stocks. From the above Journal article:

U.S. stocks now account for more than half of global stock-market capitalization.“Obviously, the U.S. is not half of the global economy,” says William Bernstein, author of the book “The Investor’s Manifesto” and an investment adviser. “That just doesn’t make sense.”

At the end of January, 2015 the market capitalization of all stocks traded on the NYSE and NASDAQ stood at US $19 Trillion and US $6.0 Trillion respectively according to the World Federation of Exchanges. For comparison purposes, in January 2014 the global equity market map was US $ 64.0 Trillion. Since then global market caps have declined since the collapse in crude oil prices have caused oil stocks to crash. So with a total market of $25.0 Trillion U.S. stocks are indeed more than half of the global equity market capitalization. Obviously the U.S. economy does not account half of the global economy. U.S. stocks simply command a premium over foreign stocks and hence the U.S. market is valued highly.As foreign companies compete against U.S. firms fiercely in the global marketplace and economic growth continues in many countries abroad it is wise to take advantage of opportunities presented by overseas firms. Income investors can consider the following five foreign stocks that pay attractive dividends:

1.Company: Vodafone Group PLC (VOD)

Current Dividend Yield: 5.26%

Sector: Wireless Telecom

Country: UK

2.Company: Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 6.38%

Sector: Electric Utilities

Country: Portugal

3.Company: DBS Group Holdings Ltd(DBSDY)

Current Dividend Yield: 4.70%

Sector: Banking

Country: Singapore

4.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 5.36%

Sector:Banking

Country: Australia

5.Company:Telenor ASA (TELNY)

Current Dividend Yield: 5.82%

Sector: Telecom

Country: Norway

Note: Dividend yields noted above are as of Feb 27, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions