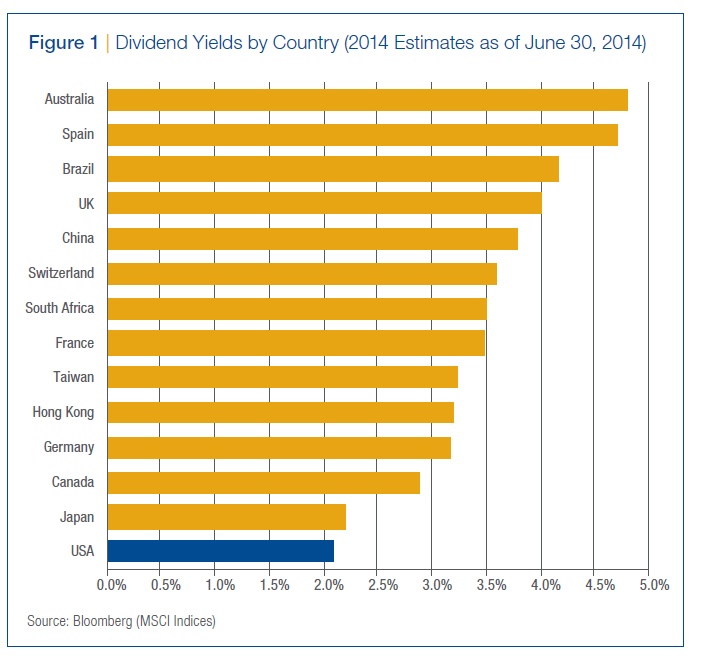

Investors looking for dividend income from equities must consider adding foreign stocks. Going overseas not only provides potentially higher dividends but also other benefits such as diversification, higher capital growth potential, etc. As I have mentioned many times before the dividend yield of the S&P 500 is around 2%. This rate is low compared to many foreign equity markets.

Here is an interesting new perspective on global dividend stocks from a report by Thornburg Investment Management:

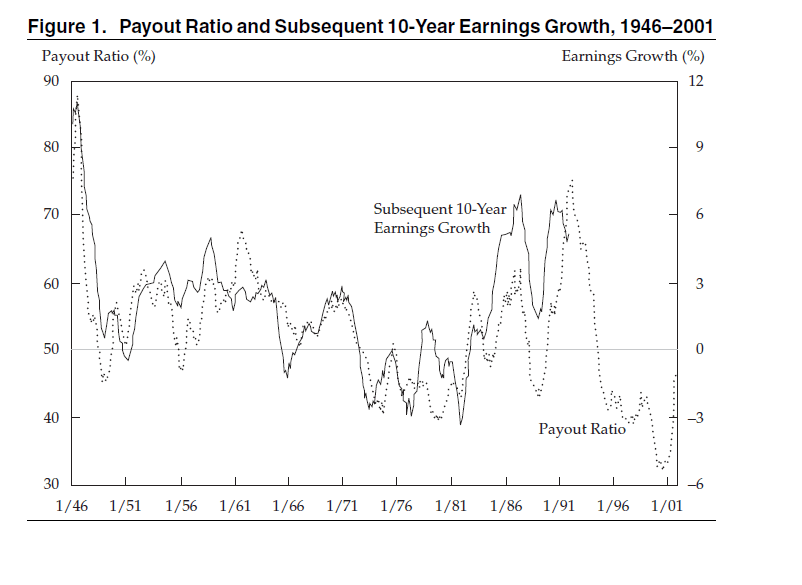

Perspectives on dividends vary between cultures. Among many U.S.-domiciled companies, where executive compensation is tied to growing the share price,dividends are a sign of limited reinvestment opportunities. Arnott and Asness (2003) showed, however, that companies with high dividend payout ratios tend to subsequently have higher earnings growth than companies with lower payout ratios, and that the higher earnings growth may be due to better allocation of capital. This view of dividend payout is more prevalent outside the United States, where payment of high and growing dividends is viewed as a sign of financial strength. A comparison of dividend yields among countries illustrates this cultural difference (Figure 1).

Click to enlarge

Source: Investing in Retirement Using a Global Dividend Income Strategy, Thornburg Investment Management, August 2014

The Arnott and Asness study from 2003 showing that companies with high dividend payout ratios tend to subsequently have higher earnings growth than companies with lower payout ratios is fascinating. The following is the abstract from their research paper:

We investigate whether dividend policy, as observed in the payout ratio of the U.S. equity market portfolio, forecasts future aggregate earnings growth. The historical evidence strongly suggests that expected future earnings growth is fastest when current payout ratios are high and slowest when payout ratios are low. This relationship is not subsumed by other factors, such as simple mean reversion in earnings. Our evidence thus contradicts the views of many who believe that substantial reinvestment of retained earnings will fuel faster future earnings growth. Rather, it is consistent with anecdotal tales about managers signaling their earnings expectations through dividends or engaging, at times, in inefficient empire building. Our findings offer a challenge to market observers who see the low dividend payouts of recent times as a sign of strong future earnings to come.

Click to enlarge

Source: Surprise! Higher Dividends = Higher Earnings Growth, Robert D. Arnott and Clifford S. Asness, 2003, AIMR

Hence it is a wise strategy to diversify one’s portfolio with high-quality dividend-paying stocks from foreign countries.

Ten international dividend opportunities are listed below with their current dividend yields for consideration:

1.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 5.72%

Sector:Banking

Country: Australia

2.Company: Banco Santander SA (SAN)

Current Dividend Yield: 8.92%

Sector: Banking

Country: Spain

3.Company: British American Tobacco PLC(BTI)

Current Dividend Yield: 4.35%

Sector: Tobacco

Country: UK

4.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.37%

Sector: Food Products

Country: Switzerland

5.Company:Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Current Dividend Yield: 2.40%

Sector: Semiconductors & Semiconductor Equipment

Country:Taiwan

6.Company: Deutsche Telekom AG (DTEGY)

Current Dividend Yield: 4.62%

Sector:Telecom

Country:Germany

7.Company: Royal Bank of Canada (RY)

Current Dividend Yield: 3.75%

Sector: Banking

Country: Canada

8.Company: Orange (ORAN)

Current Dividend Yield: 6.62%

Sector: Telecom

Country: France

9.Company: Total SA (TOT)

Current Dividend Yield: 5.33%

Sector:Oil, Gas & Consumable Fuels

Country: France

10.Company: Telstra Corp Ltd (TLSYY)

Current Dividend Yield: 5.65%

Sector: Telecom

Country: Australia

Note: Dividend yields noted above are as of Oct 6, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure:Long RY, SAN