Chinese are big savers compared to Americans. Traditionally households in China save a high portion of their income due to many factors such as culture, lack of a social safety net, lack of availability of credit, need for healthcare expenses, etc. Unlike the U.S., China does not yet have things like medicare, medicaid, social security, etc. This is surprising considering China is a communist country.

On the other hand, Americans generally are big spenders as opposed to savers.Despite being a capitalist country, the state runs a multitude of social programs to ensure that nobody dies due to starvation of lack of ability to pay for healthcare or live in destitution in old age. It must also be noted that such programs were put in place in order to have some social equity and prevent the extreme adverse effects of capitalism that occurred in the 19th century.

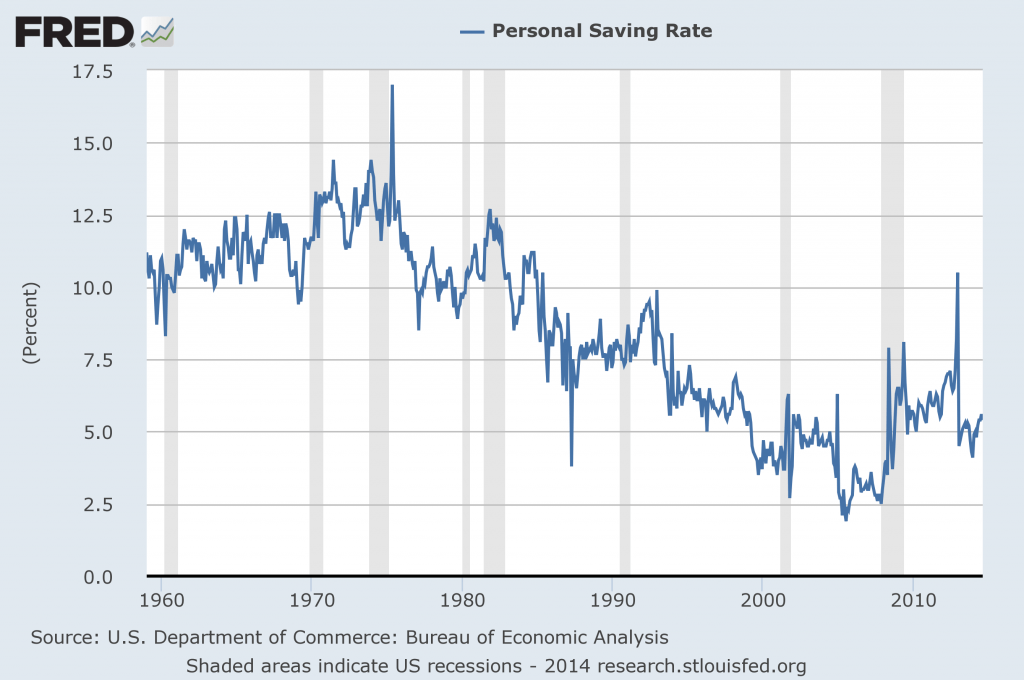

In the U.S., the Personal Saving Rate as as a Percentage of Disposable Income stood at just 5.4%. The rate briefly rose over 10% in 2012 and is now lower as the improving economy encourages people to spend more than save.

Click to enlarge

Source: St.Louis Federal Reserve

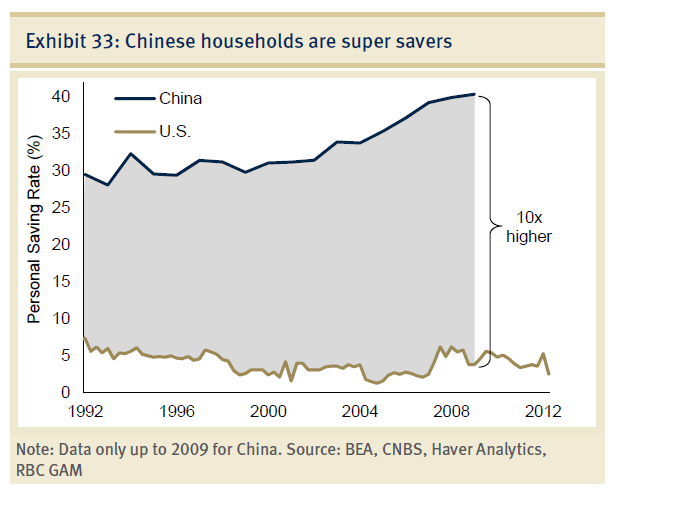

According to a report by RBC Global Asset Management report published last year, Chinese save ten times more of their income than that of Americans.

Source: Economic Compass, Issue 24, August 2013,RBC Global Asset Management

The high savings rate in China is one reason why the Chinese government’s policies to transform China’s manufacturing-based economy to a consumption-based economy has been unsuccessful until now. A huge cultural change has to occur in order for Chinese to embrace mass consumerism like in the U.S.