The Royal Bank of Scotland Group (RBS) started trading on the NYSE in late 2007. Since then the stock has been as disaster for investors. The global financial crisis crushed RBS. But while other global banks have recovered since then RBS stock continues to be dead money.

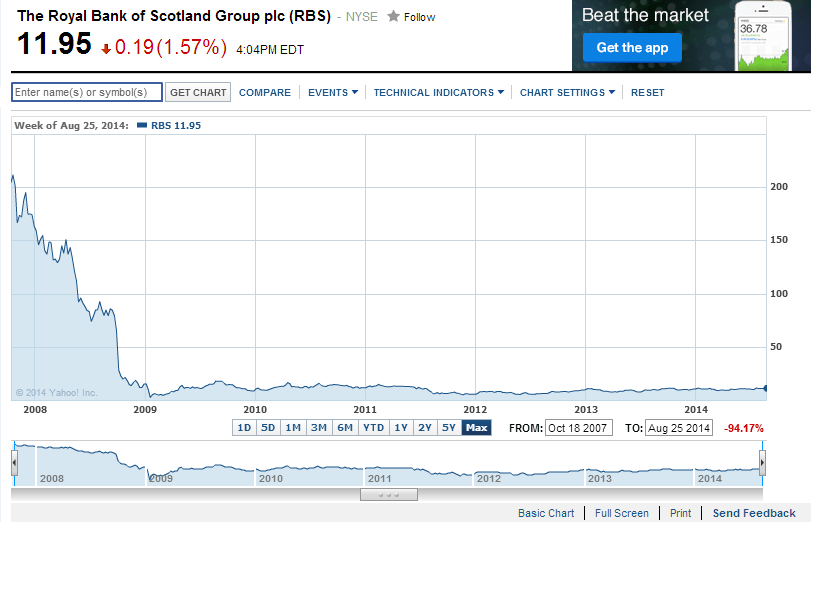

The long-term chart below shows the disaster that is Royal Bank of Scotland:

Click to enlarge

Source: Yahoo Finance

RBS is down over 97% for the period shown. The last time the bank paid any dividend was in May 2008.

In November, 2008 the bank implemented a 1 for 20 reverse split. Even after that split the stock price has plunged and continues to struggle. The stock price has practically gone nowhere in the past few years.

Investors waiting for a turnaround can consider taking the losses and move on to other alternatives.

Disclosure: No positions