Most emerging markets performed poorly last year relative to developed markets. The question on many investors’ mind now is if emerging markets would continue the dismal performance this year also.

I found the following information on emerging markets in a research report by Barclays.

Click to enlarge

Source: Compass, December 2013/January 2014, Barclays

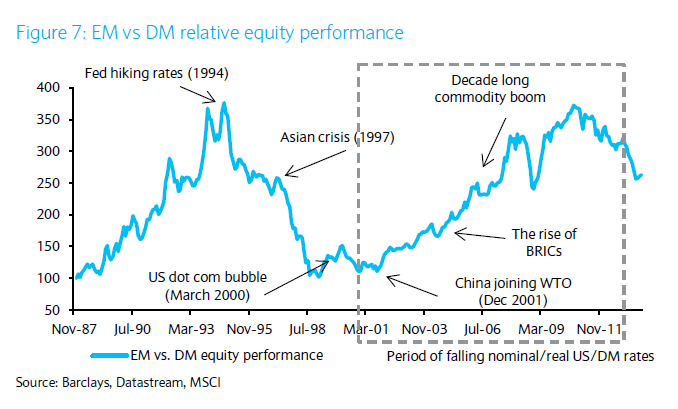

The period from 2002 to 2010 was the heyday for emerging markets due to the boom in commodity markets. The economies of resource-rich nations like Brazil, Canada, Chile, Australia, etc. boomed as the demand for all types of commodities such as copper, iron, coal, timber soared. China was one of the main factors behind this demand since the country was investing heavily in infrastructure development.

The Chinese economy has slowed and the country is rebalancing its economy. Similarly other emerging countries are also facing their own domestic challenges. Hence the fall in demand for commodities particularly from China should affect commodity exporters such as those in Latin America.

The tightening of the US monetary policy in 1997 started a sharp and prolonged fall in emerging markets leading to the Asian financial crisis. However that scenario is unlikely to repeat now since the external debt positions and fiscal balances of emerging markets are much better now than in 1997.

Among the emerging market asset classes, Barclays prefers equities as they are bound to benefit from global growth. They are also attractive from a valuation perspective. Countries that export to the developed world such as Korea, Taiwan, Mexico and Poland are good candidates though Mexico and Poland are not cheap.

Related ETFs:

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard Emerging Markets ETF (VWO)

- SPDR S&P 500 ETF (SPY)

- SPDR STOXX Europe 50 ETF (FEU)

- SPDR DJ Euro STOXX 50 ETF (FEZ)

Disclosure: No Positions