I wrote an article titled Can the U.S. Become the Mecca of Manufacturing Again? back in May 2012. In the article noted why Caterpillar (CAT) shut down its plant in London, Ontario and moved it to Muncie, Indiana and that places like Greenville/Spartanburg corridor in South Carolina are emerging as the Mecca of manufacturing in the U.S quoting a Journal piece on the manufacturing industry.

Greg Meier, a strategist at Allianz Global Investors published an excellent research report on this topic late last year. His main conclusion is “the concept of a manufacturing ‘renaissance’ is yet to be proven”. Before we get to his report, let me quote some recent media articles on the state of manufacturing industry in the U.S.

From U.S. Manufacturing Looks Set to Grow Bolder in The Wall Street Journal , Jan 4, 2014:

Some major investments are being made, particularly in the South. Airbus last April began building a passenger- jet factory in Mobile, Ala. In Louisiana, petrochemical plants are mushrooming. Keer Group, a Chinese textile firm, is spending $218 million to build a yarn-spinning factory near Charlotte, N.C.

Even so, the U.S. still relies heavily on products made overseas. The deficit on manufacturing trade totaled $568 billion in the first 10 months of 2013, narrowed only slightly from $574 billion a year earlier, Mr. Meckstroth calculates. U.S. manufacturers also face big challenges, including skill shortages, deteriorating highways and bridges, and higher taxes than most major foreign rivals.

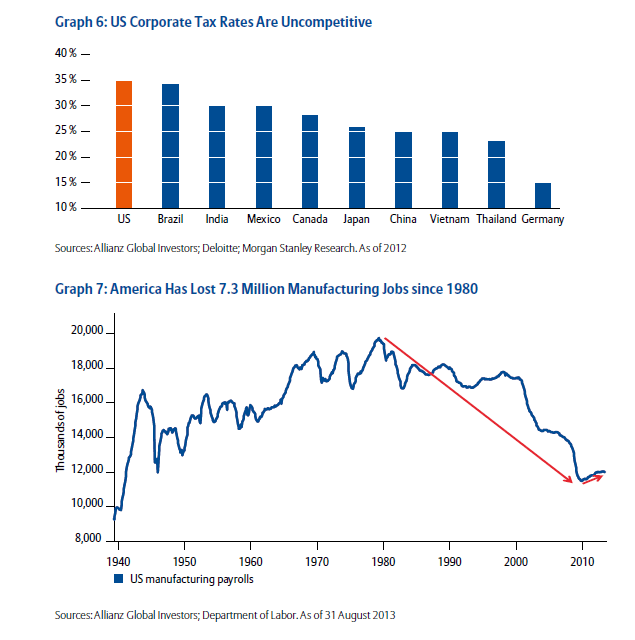

Employment in U.S. manufacturing has grown about 5%, to 12 million jobs, since bottoming out in early 2010. But it is still 13% below the prerecession level of late 2007.

U.S. manufacturers have several trends running in their favor: Wages are flat, while those in China are soaring. U.S. energy costs have fallen. And many U.S. companies want to stop relying so heavily on foreign plants, where quality and delivery times are hard to control.

(Mr. Daniel Meckstroth is the chief economist at the Manufacturers Alliance for Productivity and Innovation, a research organization in Arlington, Va).

Here is Gary Shilling writing in a Bloomberg article on Nov, 2013:

Even with the recent strength in the U.S. manufacturing sector, labor-intensive industries won’t return to the U.S. as long as the huge labor compensation gaps persist with Asian and other developing countries. Sure, there will be niches created when quick delivery, changes in fashion and other developments require production to be close by.

The majority of what could be rapid growth in U.S. manufacturing will probably come from capital-intensive, robotics-intensive production that doesn’t require many people. Those employed in this area will need considerable skills. Furthermore, these are the industries that show rapid productivity growth as new technologies are introduced. But when productivity growth is robust, output will rise substantially without much increase in employment.

Source: U.S. Manufacturing Only Has Jobs for the Skilled Few, Bloomberg

From a September, 2013 article in The Washington Post’s Wonkblog:

The United States lost 6 million manufacturing jobs between 2000 and 2009. At least, that’s the official count from the Bureau of Labor Statistics. But could the official count be missing something?

In a new paper, two economists point out that nowadays there are lots of companies in the United States that aren’t counted as manufacturing by the government but are still heavily involved in the manufacturing of goods.

The prevalence of these “factory-less goods producers” — Apple, Inc. is a prime example — suggests that the country might have more manufacturing capabilities than official statistics suggest.

Some interesting facts from the industry’s trade association website:

In 2012, manufacturers contributed $1.87 trillion to the economy, up from $1.73 trillion in 2011. This was 11.9 percent of GDP. For every $1.00 spent in manufacturing, another $1.48 is added to the economy, the highest multiplier effect of any economic sector. 1

Manufacturing supports an estimated 17.2 million jobs in the United States—about one in six private-sector jobs. Nearly 12 million Americans (or 9 percent of the workforce) are employed directly in manufacturing.2

In 2011, the average manufacturing worker in the United States earned $77,060 annually, including pay and benefits. The average worker in all industries earned $60,168.3

Manufacturers in the United States are the most productive in the world, far surpassing the worker productivity of any other major manufacturing economy, leading to higher wages and living standards.4

Manufacturers in the United States perform two-thirds of all private-sector R&D in the nation, driving more innovation than any other sector.5

Taken alone, manufacturing in the United States would be the 10th largest economy in the world.6

1 Bureau of Economic Analysis, Industry Economic Accounts (2011).

2 Bureau of Labor Statistics (2012), with estimate of total employment supported by manufacturing calculated by NAM using data from the Bureau of Economic Analysis (2011).

3 Bureau of Economic Analysis (2011).

4 NAM calculations based on data from the United Nations, Bureau of Labor Statistics, and the International Labour Organization.

5 National Science Foundation (2008).

6 Bureau of Economic Analysis, Industry Economic Accounts (2011) and International Monetary Fund (2011).

Source: National Association of Manufacturers

The summary of five main points discussed by Greg Meier of Allianz Global Investors in his report are listed below:

Factor 1: The US macroeconomic backdrop

The U.S. economy is in recovery mode and the housing market is growing again. Hence U.S. consumers are planning to upgrade their cars and appliances, buy homes,etc.Producing products locally helps companies reduce the risk of supply disruption and save time and cost.

Factor 2: Relative labor costs

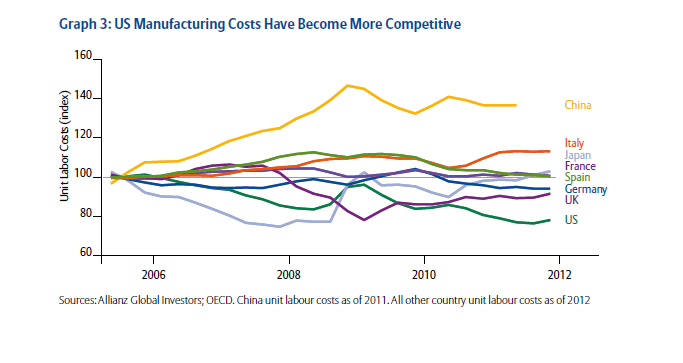

Labor costs are cheaper in the U.S. American manufacturing unit costs fell 20% from 2005 to 2012 according to the OECD. This compares to a 36% rise in Chinese labor costs from 2005 to 2011 as shown in the chart below:

Click to enlarge

Factor 3: The shale energy revolution

The explosive growth of the shale oil industry has led to cheaper oil and natural gas prices in the U.S. helping energy-intensive industries such as paper and chemicals.

Factor 4: The value of the dollar

Since 2002 the US dollar has fallen about a third in value against six commonly-traded currencies of the world.This has dual benefit for U.S. manufacturers since it makes U.S. imports of foreign goods expensive and US goods cheaper to foreign buyers.

Factor 5: Tax and monetary policy

The biggest challenge to US manufacturing renaissance is the tax and monetary policy. The 35% statutory US corporate tax rate is uncompetitive relative to other developed economies.

Click to enlarge

The Federal Reserve will eventually reduce its stimulus program. This may strengthen the US dollar and is a risk to rate sensitive industries.

Here is Greg’s conclusion:

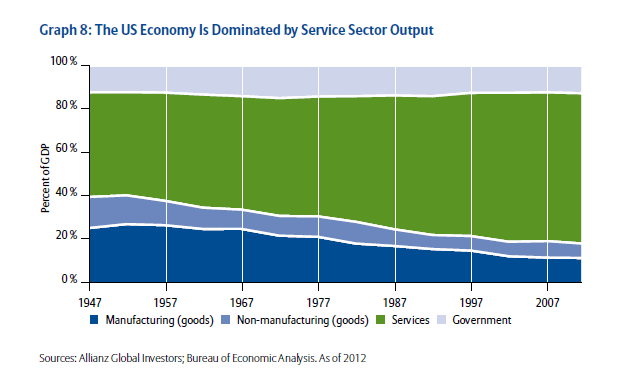

US manufacturers are supported by comparatively robust domestic demand and relatively cheap labour and energy costs. However, tax policy changes – the largest swing factor that could boost US manufacturing – look unlikely. Even then, a return to the glory days when manufacturing accounted for more than 25 % of US GDP and more than 30% of nonfarm payrolls would be difficult to achieve (see Graph 8). While the US offshoring trend of the last 50 years has likely peaked, the concept of a manufacturing ‘renaissance’ is yet to be proven.

Source:

US Manufacturing: Prospects, Threats and Misperceptions – Is the US going through a manufacturing ‘renaissance’?, Allianz Global Investors

Related:

Spotted Again in America: Textile Jobs (WSJ)

BASF Steps Up Investment in U.S (WSJ)