Some investors tend to invest in equities primarily for price appreciation. They ignore dividends or consider dividends to be of low to no significance. However the strategy of ignoring dividends and concentrating purely on share price growth may not work all the time. This is especially true during times of economic uncertainty or recessions.

Dividends matter during both bull and bear markets. During bull markets dividends an extra kick to the total return while during bear markets they offer a cushion effect to a portfolio and provide at least some returns as opposed to no returns at all.

Dividends are a significant part of the total returns especially for high-quality stocks held for the long-term such as 5 years or more. The following chart shows the contribution of price appreciation and dividends to the total return of the S&P 500 since 1930 by decade:

Source: High Dividend Investing – East Side Story, Nikko Asset Management, Singapore

Dividends contributed more to total returns than capital appreciation during the following four decades: 1930-1939, 1940-1949, 1970-1979 and 2000-2009. These four decades were periods of low or uncertain economic growth in the U.S. The 1930s and 40s saw The Great Depression and World War II. The Oil Crisis of the 1970s adversely affected economic growth and more recently the crash of the dot-com bubble in the last decade killed stock prices and the negative effects lingered for many years that followed.

Even when we consider the bull markets of the 50s, 80s and 90s dividends were a significant portion of the total returns of the S&P 500. For example, in the period 1950-1959 dividends accounted for about 28% of total returns. During the 1990s when the dot-com stocks were all the rage, dividends contributed 15% of the total return of 18%.

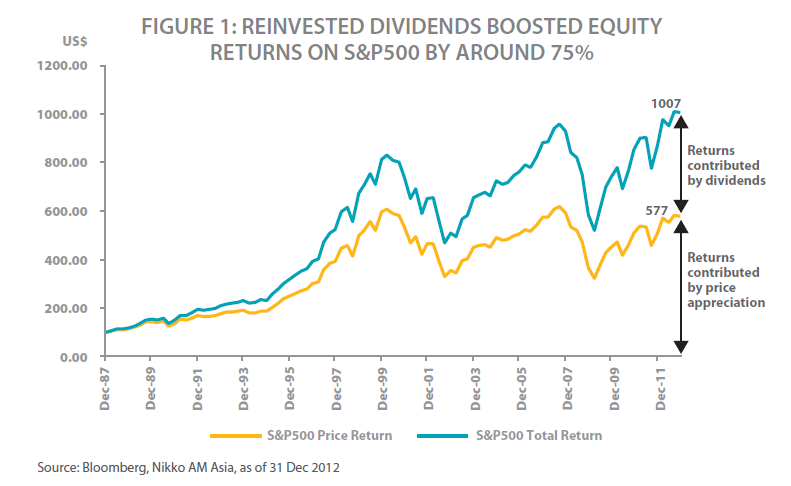

Reinvestment of dividends can boost total returns significantly over the long-term due to the effect of dividend growth and compounding. The chart below shows the growth of $100 invested in an S&P 500 index tracker fund from Dec 31, 1987 to Dec 31, 2012 by price appreciation and reinvestment of dividends:

Based on purely price appreciation the $100 investment would have grown to $577 by the end of 2012. However it would grown to $1,007 had the dividends received over the years were reinvested. Hence the reinvested dividends boosted an investor’s return by 75%. This shows the importance of dividends and dividend reinvestment when evaluating the total return of an equity investment.

A few of the high-quality S&P 500 stocks that investors can consider holding for both share price growth and dividends are Johnson & Johnson (JNJ), Colgate-Palmolive Co(CL), General Mills Inc (GIS), Northrop Grumman Corp (NOC) and FedEx Corp (FDX).

Related ETF:

- SPDR S&P Dividend ETF (SDY)

Disclosure: Long GIS