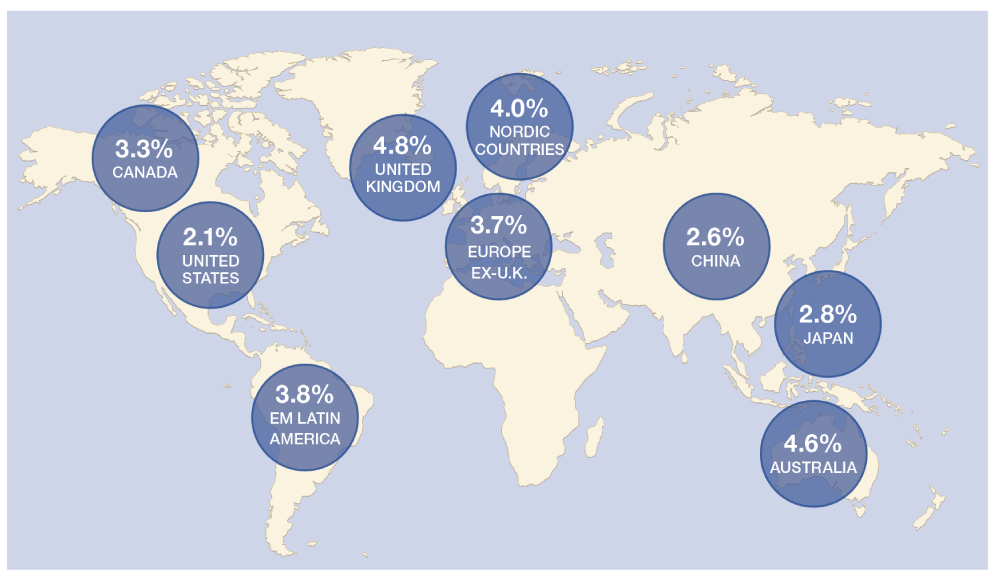

Many developed equities generally have higher dividend yields than U.S. stocks. For example, the dividend yield on the S&P 500 has remained around a low 2.0% for many years now. However it is possible to earn much higher yields by investing in companies in other developed markets such as Germany, Australia, Singapore, etc.

In countries such as Singapore or Australia, the dividend culture is deeply-rooted. Companies there return a good chunk of their profits as dividends to shareholders. This is vastly different from the U.S. where most companies retain a major portion of their profits for expanding operations, increasing R&D expenditures, share buybacks, acquisitions, etc. Many decades ago U.S. investors bought stocks in order to earn a steady income in the firm of dividends. However that expectation changed in the past few decades when investors focused more on capital appreciation than income. As a result, companies are more than happy to hold on to earnings and spend them as they wish. Though corporate profits has soared in the years since the financial crisis and only limited growth opportunities exist, most firms continue to have low payout ratios. Some firms have artificially boosted their earnings and stock prices by implementing share buyback programs. Since short-term mentality drives how U.S. public companies operate on a daily basis and management’s compensation is mostly tied to rising stock prices, accounting gimmicks such as share buybacks are unlikely to go away anytime soon.

From an article on global dividend stocks in Financial Advisor magazine:

When advisors and investors seek dividend yields, many think U.S. only. U.S. companies are expected to pay $300 billion in dividends in 2013, according to S&P Dow Jones Indices. But foreign companies yield more, on average, and overseas dividend growth is expected again for this year. Dividend yields received from U.S. companies currently average only 2.1 percent, compared to nearly double that — 4 percent to 4.5 percent — from foreign companies, according to Thomson Reuters MSCI.

About 66 percent of the world’s dividends come from outside the U.S., according to Thomson Reuters MSCI, and advisors can easily diversify client portfolios with a dollop of foreign dividend-paying stocks.

Within the global market for dividends, the practices and policies surrounding dividend payments varies. The UK, Europe and Asia-Pacific maintain strong dividend cultures and companies tend to distribute high percentages of earnings in the form of cash dividends. Meanwhile, the U.S. and Japan have less emphasis on returning profits to shareholders via dividend payments.

Source: Going Global For Dividends, Bruce W.Fraser, Financial Advisor

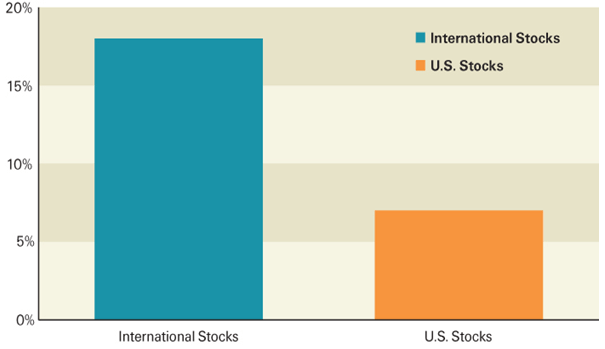

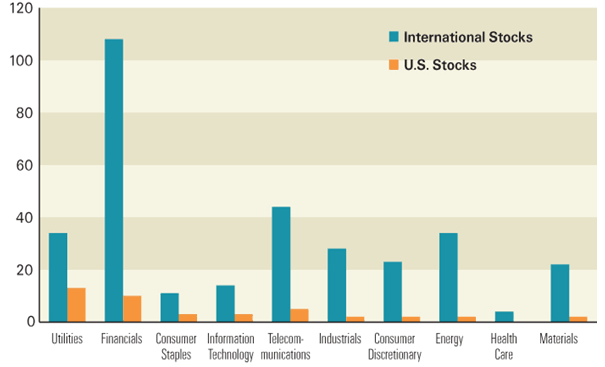

The following two charts show how foreign companies pay higher dividends and have more total return opportunities :

Click to enlarge

Percentage of MSCI ACWI stocks with dividend yield of 4% or more and market capitalization of $1.5 billion or more

Data Source: MSCI All Country World Index. Data as of 03/31/13

International Markets Offer More Total Return OpportunitiesNumber of stocks by sector with dividend yield of 4% or more and market capitalization of $1.5 billion or more.

Source: Market View: Attractive Dividends? Earnings Growth? A Way to Get Both, Lord Abbett

It should be noted that though factors such as withholding taxes, currency exchange rates, etc. can affect overall returns from investments in foreign stocks, one can still come out ahead since the base dividend yield rates are higher.

Investors looking to add international dividend stocks can consider some of the options listed below:

1.Company:Singapore Telecommunications Ltd (SGAPY)

Current Dividend Yield: 4.35%

Sector: Telecom

Country: Singapore

2.Company: Eni SpA (E)

Current Dividend Yield: 4.91%

Sector:Oil, Gas & Consumable Fuels

Country: Italy

3.Company: Telstra Corp Ltd (TLSYY)

Current Dividend Yield: 6.43%

Sector:Telecom

Country: Australia

4.Company: Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 4.68%

Sector:Electric Utilities

Country: Portugal

5.Company:Reed Elsevier NV (ENL)

Current Dividend Yield: 3.03%

Sector: Media

Country: The Netherlands

6.Company:Syngenta AG (SYT)

Current Dividend Yield: 2.13%

Sector: Chemicals

Country: Switzerland

7.Company:Diageo PLC (DEO)

Current Dividend Yield: 2.32%

Sector: Beverages

Country: UK

8.Company: Total SA (TOT)

Current Dividend Yield: 5.16%

Sector:Oil, Gas & Consumable Fuels

Country: France

9.Company: Swedbank AB (SWDBY)

Current Dividend Yield: 6.50%

Sector: Banking

Country: Sweden

10.Company: National Grid PLC (NGG)

Current Dividend Yield: 5.39%

Sector: Multi-Utilities

Country: UK

Note: Dividend yields noted are as of June 11, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long SWDBY