Investing in the equity markets of Middle East and North Africa (MENA) involves high political risks since most of the countries are not democratic(with the exception of Israel) and are run by monarchies, dictators, etc. As a result, economic growth is stagnant and social ills such as corruption, high unemployment, lack of transparency, nepotism, etc.others are the norm and not the exception. So investing in these markets involves higher risks than other frontier markets. Though many countries in the region have abundant natural resources such as oil and natural gas, equity markets are not mature and public participation in the markets are very low relative to developed countries.

From December, 2010 thru the end of 2012 the MENA region was rocked by the Arab Spring revolution. In country after country regimes fell amid widespread opposition from the general public against the status quo. For example, in Egypt the Western-backed longtime dictator Hosni Mubarak’s regime collapsed and was replaced by Egypt’s President Mohamed Morsi who himself is under fire from the public for his heavy-handed actions against protesters.

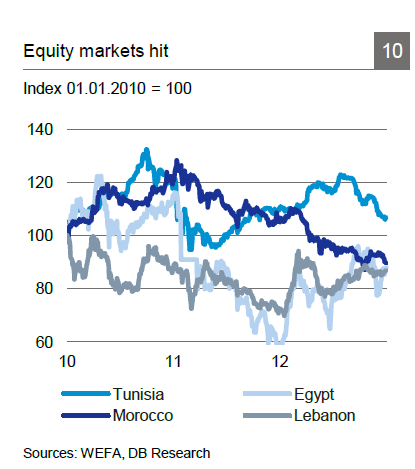

During the Arab Spring, Egypt, Lebanon, Tunisia and Morocco – the four biggest markets based on market capitalization in the region fell heavily. Egypt suffered the heaviest losses due to many months of uncertainty and violence as Mubarak tried in van to crush the revolution. The Egyptian stock market was closed for eight weeks in early 2011 and the index by about 50%. The other markets in the region recovered from their lows but they remain very volatile. The following chart shows the performance of the performance of the four markets mentioned above:

Click to enlarge

Source: Two years of Arab Spring: Where are we now? What’s next?, Deutsche Bank Research

However CASE3o, the benchmark index of the Cairo Stock Exchange, was the world’s third-best performing index in 2012 when it rose 50.8%. The dramatic plunge and the incredible rise of the Egyptian market underlines the risks and volatility involved in the MENA markets.

Most of the structural problems in the countries that experience the Arab Spring have not been resolved though regimes have been replaced. Hence further protests and anemic economic growth are likely to continue for years. From an investment standpoint, it is a wise idea to stay away from the equity markets of the region or invest only a very small portion of one’s portfolio via an ETF.

Related ETFs:

Market Vectors Gulf States (MES)

PowerShares MENA Frontier Countries ETF (PMNA)

Disclosure: No Positions