I recently came across an article on frontier markets in which Franklin Templeton’s Carlos von Hardenberg, the deputy manager of the $1.2bn Templeton Frontier Markets fund stated that for sky-high returns investors should consider frontier markets. According to him, investors focusing on just the emerging markets for growth are missing the opportunities in frontier markets. However this trend seems to be changing with investors now more interested in frontier markets. These seems to be true based on a piece in Barron’s magazine today. More that below.

First let me summarize some of the key points mentioned by Carlos von Hardenberg:

- Based on GDP growth, of the last world’s 10 fastest-growing countries in the world in the last decade just one of them is an emerging market. The rest are frontier markets.

- Emerging markets are trading at a big premium compared to frontier markets. Frontier markets are trading at just 7.-5 times earnings relative to emerging markets’ 13-times earnings.

- Frontier markets such as Nigeria are interesting. As an example, Guinness is selling more beer in Nigeria than in Ireland.

Source: How to tap into the world’s fastest-growing regions, Trustnet

From the Barron’s article Braving the Frontier Markets by Ben Levisohn:

Frontier markets are surging this year. Investors, however, should think twice before plunging headlong into stocks from countries as far-flung as Argentina, Bangladesh, Botswana, Slovakia, and Sri Lanka.

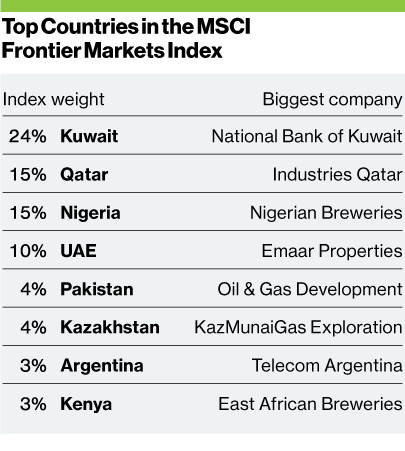

The appeal is obvious: The MSCI Frontier Markets Total Return Index has risen 8% since the start of the year, besting the MSCI Emerging Markets Total Return Index’s 0.4% return by 7.6 percentage points.

But frontier markets today are essentially what emerging markets were more than a decade ago—in both positive and negative respects. There’s the outsized growth, sure, but that comes with higher-than-average risks. Most frontier-market stocks trade infrequently, are expensive to enter and exit, and come with idiosyncratic factors that can cause markets to plunge or freeze up completely. It’s not a bet for the faint of heart—or an easy market to play. “It makes sense to have some exposure,” says David Romhilt, head of manager research for the Americas at Barclays in New York. “But there are real risks in the space.”

FRONTIER MARKETS HAVE A lot to recommend them. HSBC strategist John Lomax points to their high expected-growth rates and hefty dividends, which average about 5%, compared with just a 2.7% yield in emerging markets. Even better, frontier markets generally outperform emerging markets as investors feel comfortable heading for the more remote reaches of the world’s stock markets—which would be right about now.

So should investors simply dive into frontier market stocks with now?

The answer to the above question is an absolute no. Frontier markets are in general not for the faint-hearted. For example, the MSCI Frontier Markets Index fell over 67% during the global financial crisis. The benchmark indices of many individual countries fell even more. The 5-year and 10-year return of this index are -13.07% and 6.08% respectively.

Frontier stocks are especially not worth the effort for retail investors. Investing directly in individual frontier market stocks is an extremely ill-risky proposition due to some of the reasons mentioned in the Barron’s article above. However this does not mean individual investors should stay clear of those markets. In order to profit from the growth in those markets one can assign a small portion of their portfolio’s assets to these markets. The actual percentage of allocation that one can allocate depends on a variety of factors such as portfolio size, goal, age, investment horizon of an investor. Some investors should simply avoid frontier markets at all costs. An example of such investor would be an average senior citizen depending on dividend income from a moderate-size portfolio.

If an investor is able to take the risk, the best way to gain exposure to frontier markets is via ETF. Some of the ETFs to access these markets are listed below:

Guggenheim Frontier Markets ETF (FRN)

iShares MSCI Frontier 100 Index (FM)

Market Vectors Africa Index ETF (AFK)

Market Vectors Gulf States (MES)

PowerShares MENA Frontier Countries ETF (PMNA)

Stock picking has become less attractive in the recent years after investors have been hit with one crisis after another. The dot-com implosion, the global financial crisis, the European soverign debt crisis, the Greek crisis, the Enron, Wamu, CountryWide frauds and uncovered frauds at money other companies have made stock picking a futile and losing exercise for retail investors. However stock picking can still pay off big if an investor is able to select stocks with thorough research. The stock picking strategy works extremely well in frontier markets according to an article in the latest issue of Bloomberg BusinessWeek.

From “Frontier Markets: Where Picking Stocks Is Paying Off“:

Fund managers who focus on the world’s least-developed markets are trouncing their benchmark index—something most investors routinely fail to do. Mark Mobius’s Templeton Frontier Markets Fund and 12 similar funds investing in countries from Vietnam to Nigeria and Romania earned an average 24 percent last year, topping the 8.4 percent gain in the MSCI Frontier Markets Index. Their edge comes from uncovering undervalued stocks in markets where there aren’t crowds of well-informed investors. “The companies are overlooked and under-owned,” says Carlos von Hardenberg, an Istanbul-based money manager at Franklin Templeton Investments who helped the firm’s $1.3 billion Frontier Markets Fund (TFMAX) post a 24 percent gain last year.

The lack of information about frontier market companies creates opportunities for managers who do on-the-ground research. “Sometimes companies wonder why I’m there—they’ve never had a foreign investor visit before,” says Stephen Mack, who manages the Frontaura Global Frontier Fund, which returned about 18 percent in 2012. “You’ve just got to do the legwork.”

Disclosure: No Positions