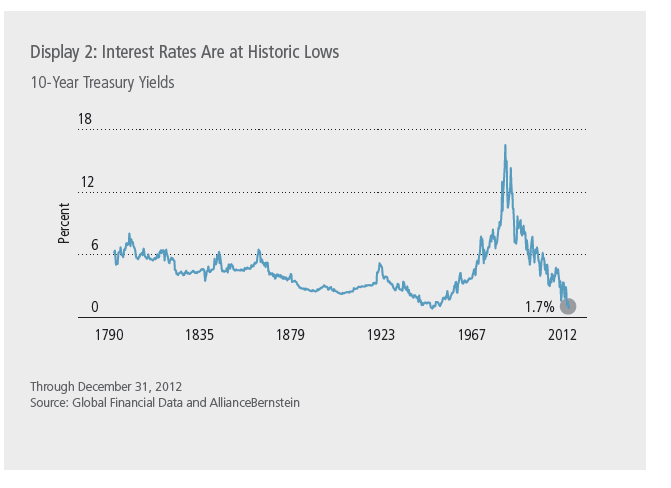

Investors rushed into bonds in 2012 pushing the yield on the 10-year US Treasury bonds to under 2%, their lowest level since George Washington was president.

Click to enlarge

Source: Desperately Seeking Safety, Seth J. Masters, Alliance Bernstein

From the research report by Seth:

These extraordinarily low yields primarily reflect the Federal Reserve’s concerted efforts in recent years to stimulate the economy by buying Treasuries and mortgage bonds.

De-risking by individual and institutional investors alike has also pushed down bond yields. Bonds are now richly priced relative to expected economic growth and inflation.

It is interesting to see how the yield has varied over such a long period.The 10-year US Treasury yield stood at 1.95% as of Feb 8, 2013.The ultra-low yields hurt income investors who seek the safety of these bullet-proof investments. Rates below 2% also does not help offset the soaring real inflation that consumers are dealing with year after year. One silver lining to the low rates is that investors may finally dump bonds and invest in equities to earn decent returns. That should give a further boost to the rising stock prices this year.

Related ETFs:

iShares Lehman 7-10 Year Treasury Bond Fund (IEF)

iShares Lehman 10-20 Year Treasury Bond Fund (TLH)

SPDR Lehman Long Term Treasury ETF (TLO)

SPDR Lehman Intermediate Term Treasury ETF (ITE)

iShares Lehman TIPS Bond Fund (TIP)

Vanguard Long-Term Government Bond Index Fund (VGLT)

Disclosure: No Positions

For a Guide to U.S. Government Bond ETFs click here.