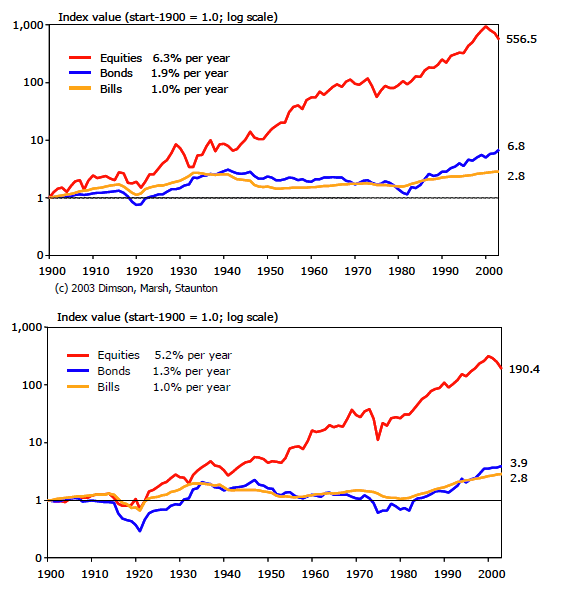

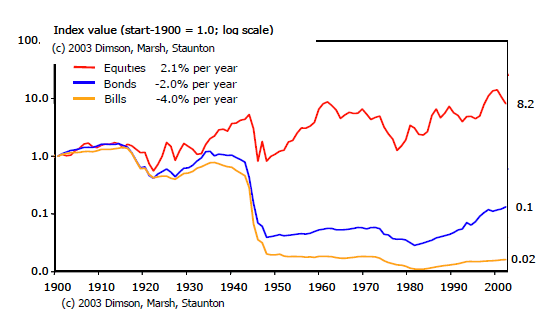

Equities beat other asset classes such as bonds and short-term deposits over the long-term.Stocks not only yield higher returns than those asset classes but also yield higher returns on an inflation-adjusted basis.

The following graphs for three developed markets over the course of a century proves this point:

Real Equity Returns in US (top), UK (middle) and Italy (bottom), 1900 – 2002

Click to enlarge

Source: Triumph of the Optimists, by Elroy Dimson, Ph.D. Professor, London Business School, October 2003, ArrowStreet Capital, L.P.

Related ETFs:

SPDR S&P 500 ETF (SPY)

iShares MSCI United Kingdom Index (EWU)

iShares MSCI Italy Index (EWI)

Disclosure: No Positions