A well diversified portfolio should hold many types of asset classes such as stocks, bonds, real estate, gold, bank deposits, etc. Bonds are particularly important to a portfolio that is heavy in stocks. This is because bonds can help smoothen the portfolio performance when stocks become extremely volatile or perform poorly in year.

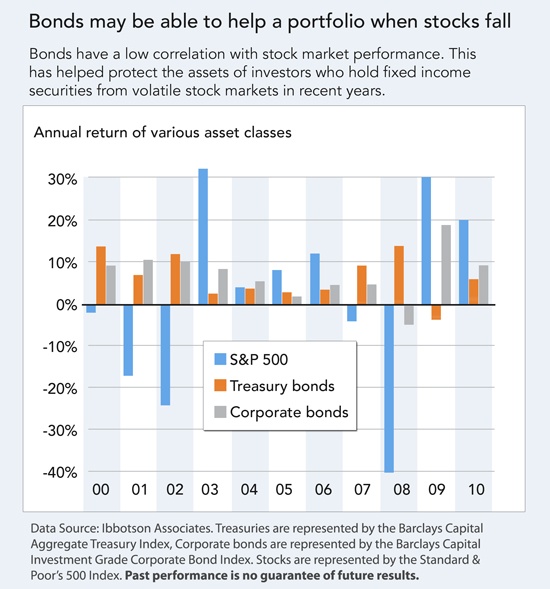

The chart below shows the performance of the S&P 500 and Treasury and Corporate bonds from 2000 thru 2010:

Source: Seeking shelter? Consider bonds, Fidelity Investments

The low correlation between stocks and bonds is evident in the above chart.

The importance of holding bonds are highlighted by the following facts. In 2008, while the S&P 500 fell 37% treasury bonds gained about 14% as investors sought shelter in the government bonds. Similarly in the past five years before 2011, the S&P 500 had a positive return of less than 1% whereas the average taxable bond fund yielded a 4% return during the same period.

Related ETFs:

SPDR S&P 500 Fund (SPY)

iShares Lehman Aggregate Fund (AGG)

iShares Barclays 10-20 Year Treasury Bond Fund (TLH)

Disclosure: No Positions