Bonds should be an integral part of a well diversified portfolio.While stocks in general stocks offer higher growth than bonds, investors should not ignore the value of holding bonds as an asset class.

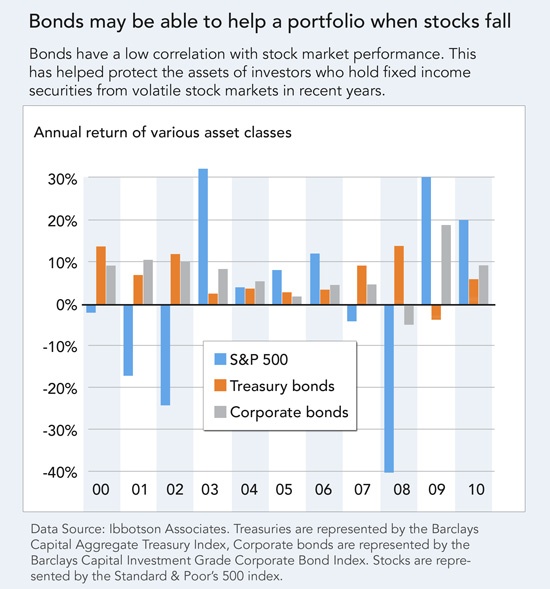

For the period from 2000 to 2010, the S&P 500 was basically flat leading many to call it as the “lost decade” for U.S. stocks. However a research report Fidelity Investments notes that during the same period “Treasury bonds gained 6.25% annually and corporate bonds gained 6.96% annually, respectively.1 And if the economy continues to limp along, bonds could continue to outperform stocks.”

Note:

1. Returns represent the average annual return of indexes from December 31, 1999 to December 31, 2010, as measured by the Barclays Capital Aggregate Treasury Index and the Barclays Capital Aggregate Investment Grade Corporate Bond Index, respectively.

Bonds offer the following benefits to a portfolio:

- Lower volatility

- Diversification

- Fax efficiency

The following chart shows the performance of stocks and bonds from 2000 to 2010:

Click to enlarge

Source: Bonds for growth investors, Fidelity Investments

Hence investors should allocate some portion of their assets to fixed income. The exact percentage of allocation depends on the individual. For example, young investors may want to allocate only a smaller pecentage to bonds compared to older investors who should have the majority of their assets in bonds and other less risky investments. Regardless of age and other factors, investors should hold bonds at all times. Holding bonds in a portfolio is especially important in the current scenario where equity markets have become extremely volatile.

Related ETFs:

SPDR S&P 500 ETF (SPY)

iShares Barclays Treasury Inflation Protected Securities Fund (TIP)

iShares iBoxx $ Investment Grade Corporate Bond Fund (LQD)

iShares Barclays US Aggregate Bond Fund(AGG)

Vanguard Total Bond Market ETF (BND)

PIMCO Enhanced Short Maturity Strategy Fund (MINT)

Disclosure: No Positions