Recently I came across an article titled “Buy, hold, regret” in the Buttonwood blog of The Economist. The main gist of the article was that the buy-and-hold theory does not work in all countries. From the article:

IT IS a truth universally acknowledged that equities outperform over the long term, so that the best strategy is to buy and hold. But as Deutsche Bank’s long-term asset study (the subject of yesterday’s post) makes clear, this has not been true for all markets. Over the last 50 years, the real returns from equities have been lower than those from bonds in Germany, Japan and Italy. In the Italian case, the gap is almost three percentage points, and that is despite the recent bond sell-off (actually, as Deutsche points out, a 5-6% yield on Italian debt is quite low by historical standards.)

The buy and hold mantra was developed in the US where real equity returns have generally been positive over long periods. But the US was history’s winner in the 20th century; enjoying 100 years of political stability while its European rivals destroyed themselves in two world wars and Russia followed the dead end path of communism. The US equity market, in other words, displays distinct survivorship bias. In turn, that bias leads to greater confidence and thus higher valuations; eventually the valuations become so high (as in 2000) that they doom future returns to be disappointing.

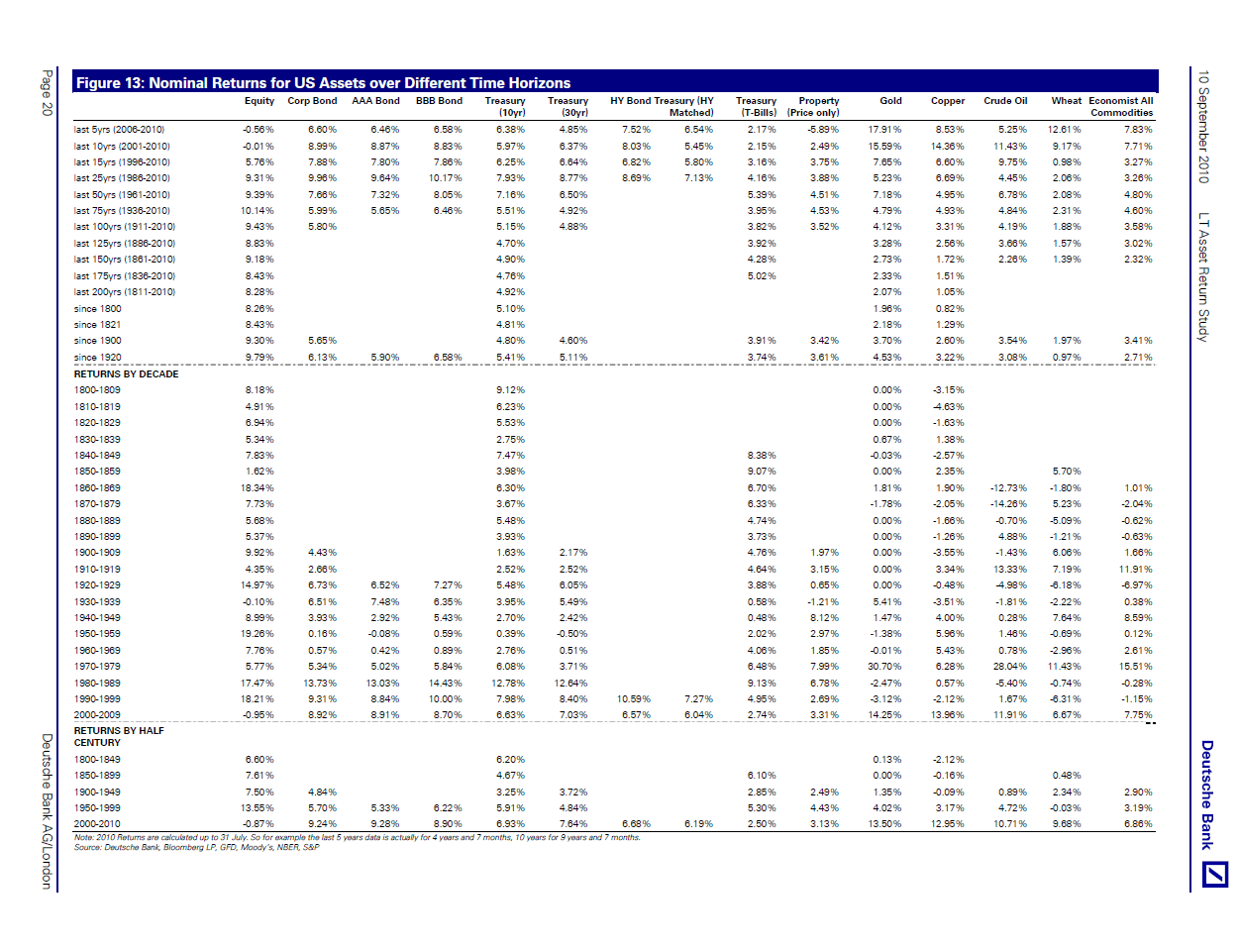

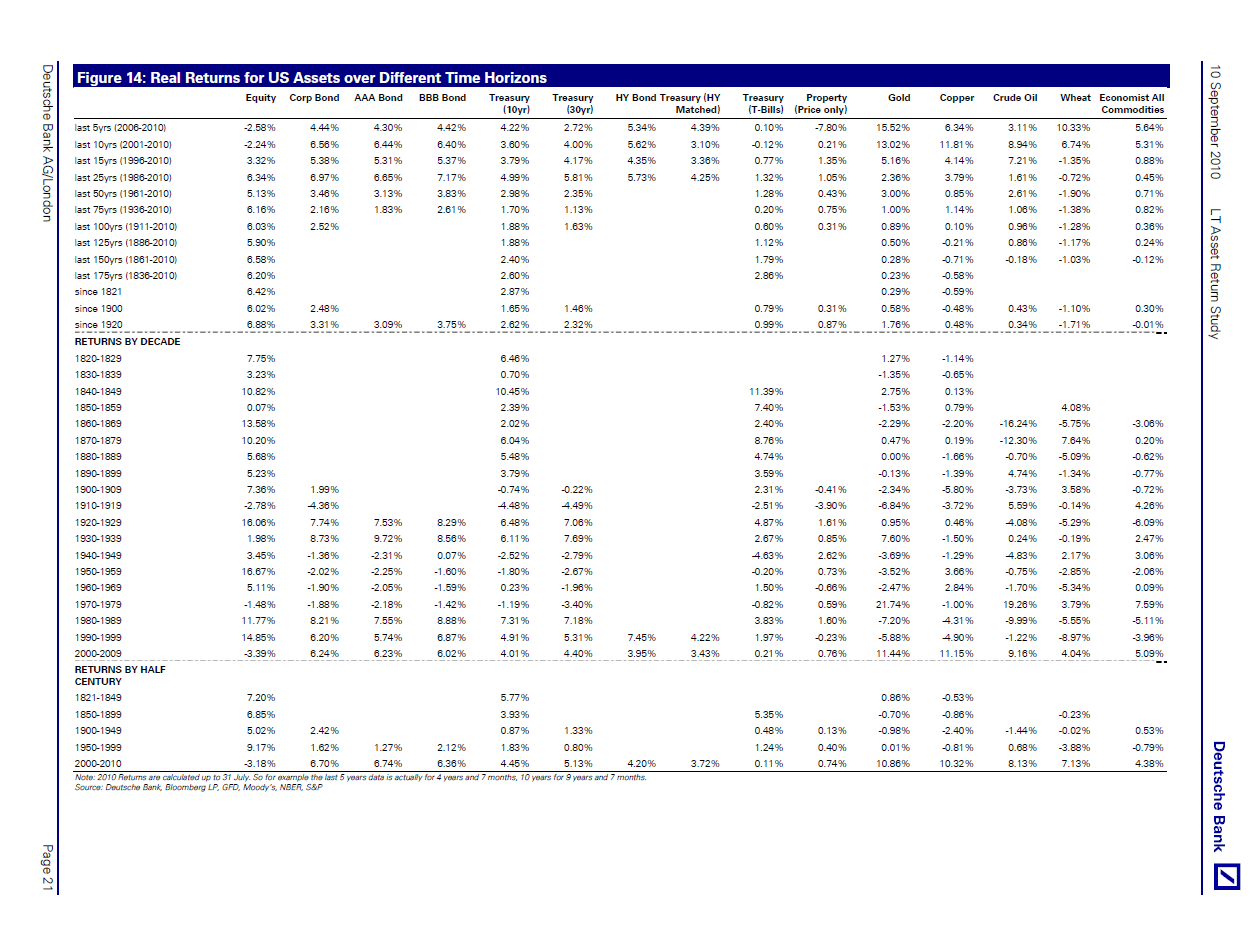

The following charts show the nominal and real returns for various U.S. asset class over different periods:

Click to enlarge

Source: Long-Term Asset Return Study, Deutsche Bank

Some key takeaways from the Deutsche Bank study:

- Holding cash over long periods of time have been a cause of wealth erosion.

- Over the past 200 years, stocks outperform Corporate Bonds, which outperform Government bonds, which outperform Cash, which outperform Commodities.

- While Commodities have been great performers in the recent 5 and 10 year periods, they actually struggled to beat inflation in the long-run. In the past 150 years, the Commodity Index delivered negative real returns. Commodities with such awful performance included oil and gold.

The risk of using long-term U.S. equity returns as benchmark has also been documented in the Credit Suisse Global Investment Returns Yearbook 2011 as well. From the research report:

US financial markets are also the best documented in the world and, until recently, most of the long-run evidence cited on historical asset returns drew almost exclusively on the US experience. Since 1900, US equities and US bonds have given real returns of 6.3% and 1.8%, respectively.

There is an obvious danger of placing too much reliance on the excellent long run past performance of US stocks. The New York Stock Exchange traces its origins back to 1792. At that time, the Dutch and UK stock markets were already nearly 200 and 100 years old,respectively. Thus, in just a little over 200 years, the USA has gone from zero to a 41% share of the world’s equity markets.

Extrapolating from such a successful market can lead to “success” bias. Investors can gain a misleading view of equity returns elsewhere, or of future equity returns for the USA itself.”

In summary, investors should not consider the U.S. equity markets as a benchmark for evaluating long-term investment strategies. This is especially true when considering investments in foreign markets. In addition, the buy-and-hold strategy does not work with most emerging markets as equities in these countries tend to be highly volatile and tend to soar and plunge based on many factors including flow of foreign capital.