The Weekend Investor section of The Wall Street Journal had an interesting article on dividend stocks.

From the article:

Mutual funds specializing in dividend stocks have seen inflows of $12.6 billion so far this year, four times as much as in all of 2010—even as stock funds as a whole have posted outflows of nearly $25 billion, according to fund tracker Lipper.

But dividend stocks aren’t a panacea—and buying them willy-nilly can lead to disappointment down the road. Dividend stocks are notorious laggards during big rallies, which often start when investors are most averse to risk. And the market is full of “dividend traps”—troubled companies that pay hefty dividends merely to keep investors from bailing out, a risky gambit that usually isn’t sustainable.

Click to enlarge

Source: The Wall Street Journal

Source: The Wall Street Journal

The best way to view dividends, say money managers, isn’t as an end in themselves but rather as a means to other goals such as reducing volatility or boosting (but not turbocharging) income. Used smartly, dividend stocks can even generate returns that match the overall market—with beefier income streams. But investors shouldn’t live on the div alone.

“A focus on dividend-yield strategies is an important part of an investor’s tool kit,” says Rob Arnott, chairman of money manager Research Affiliates in Newport Beach, Calif., which helps oversee $80 billion. “But they’re a little bit overrated today.”

The key to dividend investing, say strategists, is to be selective. That means avoiding the juiciest dividends and concentrating instead on companies that are boosting their payouts—and have the growth potential to keep those payments coming.

“You should never be taking shortcuts,” says Ben Inker, director of asset allocation at money manager GMO LLC in Boston. “Just because a stock pays a dividend doesn’t mean you don’t have to worry about the rest of the company.”

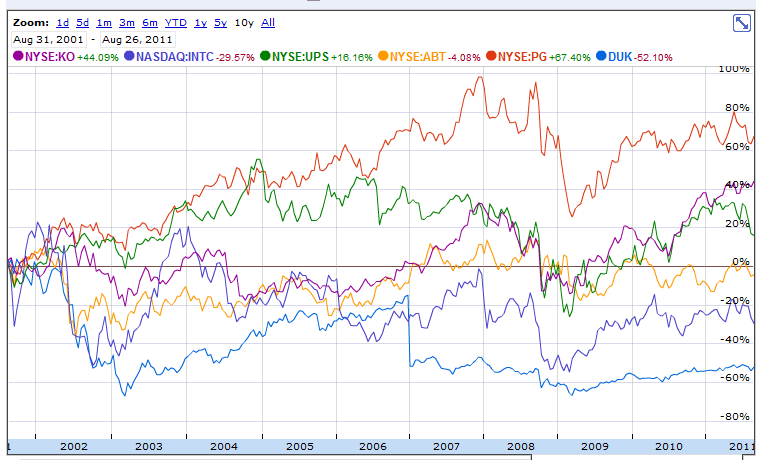

All the stocks mentioned in the above graphic have decent yields. But how did they perform in the past 10-years in terms of price appreciation?.

Click to enlarge

Of the six stocks, only Coca Cola(KO), UPS (UPS) and P&G (PG) had their stock prices rise by 44%, 16% and 67% respectively while Intel (INTC), Abbot Labs(ABT) and Duke Energy (DUK) actually lost 29%, 4% and 52% respectively. The returns of KO, UPS and PG have been average but not excellent.

Intel is a technology company and hence its stock will never be a dividend stock. Intel rode the technology wave of the 80s and 90s and its high growth period is long gone. Until a few years ago Intel did not pay a dividend. So despite its 4.3% yield now, its best to avoid Intel. Since January 13th 1978, Intel grew by over 16,000% easily beating the other five companies noted above. That type of performance is unlikely to repeat in the future.

Though the share price of Abbot Laboratories(ABT) has been pretty much flat in the past decade, it is still a good long-term investment. The company has increased dividends consistently over the past 25 years and with the health-care reform and millions of baby boomers retiring from workforce, demand for drugs and other healthcare services are projected to increase.

Duke Energy (DUK) is one of the worst run utilities in the U.S. The 5.4% dividend yield is not great considering that the stock price has plunged 52% in the past decade. Investors expect utilities to have decent dividend yields AND steady price appreciation. From Jan 13th, 1978 (as far back as Google Finance goes) thru Aug 26, 2011 Duke’s stock price has grown by a miserable 285%. In 2005, Duke bought Cincinnati-based Cinergy for $9.1 B in an all-stock deal. This year Duke announced to merge with Progress Energy. As part of this deal, Duke has set a revere stock split in the ratio of 1:3. All these acquisitions have not helped Duke earn respect from the market.

In summary, some of the dividend stocks can be traps and its best to stay clear off them. Like the Duke Energy example noted above, some stocks may pay good dividends but their stock prices may crash erasing any gains earned with dividends.

Disclosure: No Positions