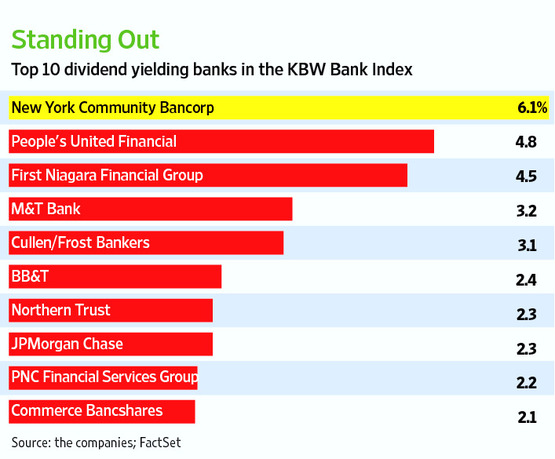

Dividend is a powerful variable that confirms the profitability of a company. Unlike many other financial factors that can be used to evaluate a firm, dividend is a simple and quick way to determine a firm’s financial strength. However just dividend payment themselves do not give the full financial picture. This is especially true with banks. In recent months many banks have raised dividends on the back of rising earnings and lower loan losses. At current price levels, many bank stocks pay above-average dividend yields. But before jumping into these stocks investors may want to analyze if these yields are sustainable. The Wall Street Journal recently had an article about bank dividends and discussed in detail using New York Community Bancorp (NYB) as an example. From the article:

A hefty dividend can be a source of strength, especially in these yield-deprived times. It can also become an Achilles heel.

That is the risk for investors in New York Community Bancorp. At 6.2%, it has the highest dividend yield of any significant U.S. bank.

Yet New York Community’s first-quarter payout of 25 cents a share is equal to nearly 90% of net income. In 2010, the bank’s dividend payout was 80% of net profit. That is high, and well above the 30% threshold the Federal Reserve favored when assessing capital-return plans for some big banks.

So far, it hasn’t been a problem. When asked on the bank’s recent earnings call if the 30% level might be applied to other banks, Chief Executive Joseph Ficalora said, “It’s been indicated, at least, in all conversations we’ve had in Washington that that would not be the case.”

Still, investors will have to be watchful for any changes in regulatory views. This also puts the company under additional pressure—any falloff in earnings that propels the payout ratio to over 100% could lead to heightened scrutiny. That has happened before—from 2005 to 2010, New York Community paid $1.98 billion in dividends, $160 million more than it earned over that period. But that was during a different regulatory time.

The immediate question for investors is whether the dividend is sustainable since it underpins the stock. Although down about 11% this year, the shares trade at about 2.3 times tangible book value, a roughly 70% premium to peers.

The SPDR KBW Bank ETF (KBE) tracks the performance of KBW Bank Index.The fund has 26 holdings and a dividend yield of 0.60%.