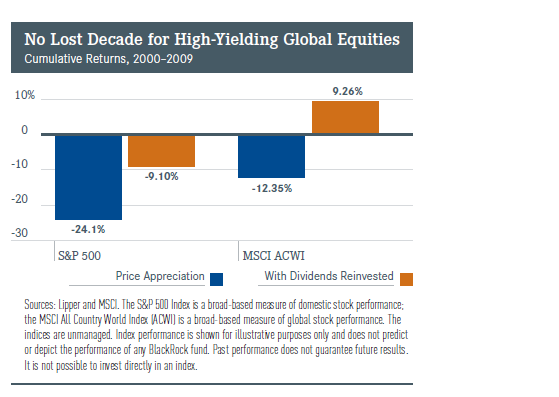

In a December 2009 post I wrote that the S&P 500 Index lost 23% from Dec 31, 1999 thru Dec 14, 2009 referring to an article in Bloomberg BusinessWeek. During this time the indices of many other countries performed relatively better than the S&P 500. In that same article I quoted a piece in The Wall Street Journal which said:

The U.S. stock market is wrapping up what is likely to be its worst decade ever.

In nearly 200 years of recorded stock-market history, no calendar decade has seen such a dismal performance as the 2000s.

Investors would have been better off investing in pretty much anything else, from bonds to gold or even just stuffing money under a mattress. Since the end of 1999, stocks traded on the New York Stock Exchange have lost an average of 0.5% a year thanks to the twin bear markets this decade.

The period has provided a lesson for ordinary Americans who used stocks as their primary way of saving for retirement.

Many investors were lured to the stock market by the bull market that began in the early 1980s and gained force through the 1990s. But coming out of the 1990s—when a 17.6% average annual gain made it the second-best decade in history behind the 1950s—stocks simply had gotten too expensive. Companies also pared dividends, cutting into investor returns. And in a time of financial panic like 2008, stocks were a terrible place to invest.

With two weeks to go in 2009, the declines since the end of 1999 make the last 10 years the worst calendar decade for stocks going back to the 1820s, when reliable stock market records begin, according to data compiled by Yale University finance professor William Goetzmann.

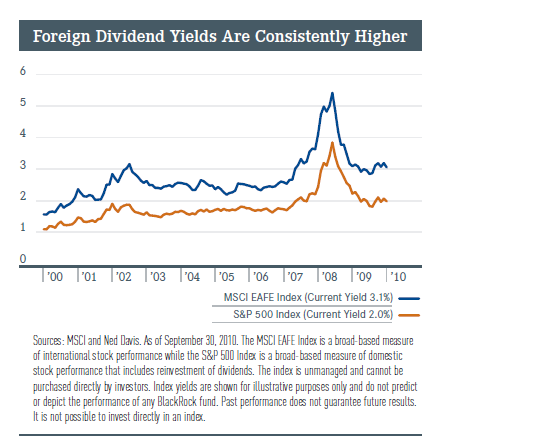

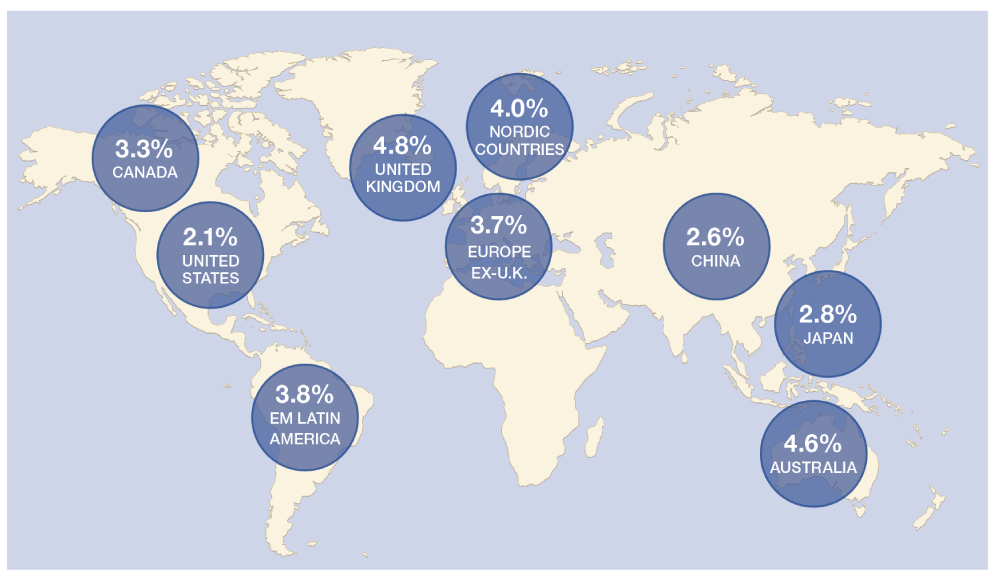

While U.S. stocks performed poorly in the last decade, foreign dividend-paying stocks performed especially well. More specifically global high-dividend paying and high-dividend growth stocks consistently outperformed the broad market.

So should investors hold dividend-paying foreign stocks ?

The answer is an absolute “yes”. Here are three reasons to hold these stocks:

- Since 1970 more than 80% of European returns have come from a combination of yield and real dividend growth.

- According to a research report by Société Générale, over the past 30 years, well over 90% of UK, Germany and France returns have come from dividends and dividend growth.

- Even in high-growth regions such as Asia excluding Japan, that figure stands at about 60% over the past 30 years.

Source: Why Dividend Make A Difference, Black Rock, Dec 2010

18 high-dividend paying foreign stocks from the STOXX Global 1800 Index are listed below with their current dividend yields:

1.Company: Astrazeneca (AZN)

Current Dividend Yield: 7.14%

Sector: Drugs

Country: UK

2.Company:Australia & New Zealand Banking (ANZBY)

Current Dividend Yield: 5.93%

Sector: Banking

Country: Australia

3.Company: Bank of Montreal (BMO)

Current Dividend Yield: 4.70%

Sector: Banking

Country: Canada

4.Company: Banco Santander (SAN)

Current Dividend Yield: 12.02%

Sector: Banking

Country: Spain

5.Company: Belgacom (BGAOY)

Current Dividend Yield: 13.64%

Sector: Telecom

Country: Belgium

6.Company:Canadian Imperial Bank of Commerce (CM)

Current Dividend Yield: 4.19%

Sector: Banking

Country: Canada

7.Company:CRH plc (CRH)

Current Dividend Yield: 5.47%

Sector:Â Construction & Materials

Country: Ireland

8.Company:DBS Group Holdings Ltd. (DBSDY)

Current Dividend Yield: 3.82%

Sector: Banking

Country: Singapore

9.Company: Deutsche Telekom (DTEGY)

Current Dividend Yield: 7.00%

Sector: Telecom

Country: Germany

10.Company: E.ON (EONGY)

Current Dividend Yield: 7.44%

Sector:Utilities

Country: Germany

11.Company: Enel (E)

Current Dividend Yield: 7.48%

Sector:Utilities

Country: Italy

12.Company: France Telecom (FTE)

Current Dividend Yield:

Sector: Telecom

Country: France

13.Company: GlaxoSmithKline (GSK)

Current Dividend Yield:

Sector: Drugs

Country: UK

14.Company:Keppel Corp. Ltd. (KPELY)

Current Dividend Yield: 4.13%

Sector: Oil & Gas

Country: Singapore

15.Company:National Australia Bank Ltd. (NABZY)

Current Dividend Yield: 5.42%

Sector: Banking

Country: Autralia

16.Company:United Overseas Bank Ltd. (UOVEY)

Current Dividend Yield: 4.03%

Sector: Banking

Country: Singapore

17.Company:Statoil (STO)

Current Dividend Yield: 4.29%

Sector: Oil & Gas

Country: Norway

18.Company: United Utilities Group (UUGRY)

Current Dividend Yield: 3.20%

Sector:Utilities

Country: UK

Note: Dividend yields noted are as of May 13, 2011

Disclosure: Long STD,CM,BMO,EONGY