The European debt crisis is again taking the center stage in recent weeks as countries such as Greece and Portugal are struggling with mountains of debt and may need further bailouts. As we all know there is good and bad debt. Just like individuals, the type of debt a country holds and the ability to repay them is very important when considering the possibility of defaults.

From an article titled “How Much Debt Is Too Much?” by Marcel Thieliant of Credit Suisse Private Banking:

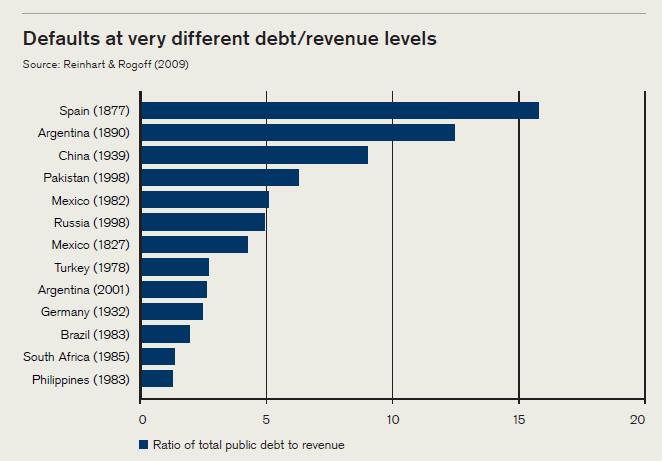

Is there a clear limit for government debt, beyond which things can go wrong? The short answer is “no”. This is illustrated, for example, by data from Reinhart & Rogodd, which shows that past defaults occurred at wide range of government debt-to-revenue ratios (see below). So what are the factors that determine which debt is sustainable? First of all, looking only at gross debt is misleading.If a government has a large amount of assets, it can in principle use these to repay debt. For example, while Japan has by far the highest government debt to GDP in the world, its ratio of net debt to GDP is much lower, though still slightly higher than that of Greece.

Second, looking at the public sector is not sufficient. If a country has large private savings, these can in principle be used to finance the public debt, especially if investors have a strong home bias. In Greece and Portugal and to a lesser extent in Spain, domestic savings are low, so public debt was financed by more “fickle” foreign investors; all three countries are net foreign debts. For large debtors, default risk is much lower if the debt is denominated in their own currency, especially if it is a global reserve currency.This suggests that US sovereign risk is limited, despite high public and national debt.Finally the ability to collect taxes also affects the ability to service sovereign debt.This, in turn, depends on the wealth and income of the country, the efficiency of the government and tax authorities, and the willingness of citizens to pay taxes rather than evade them.

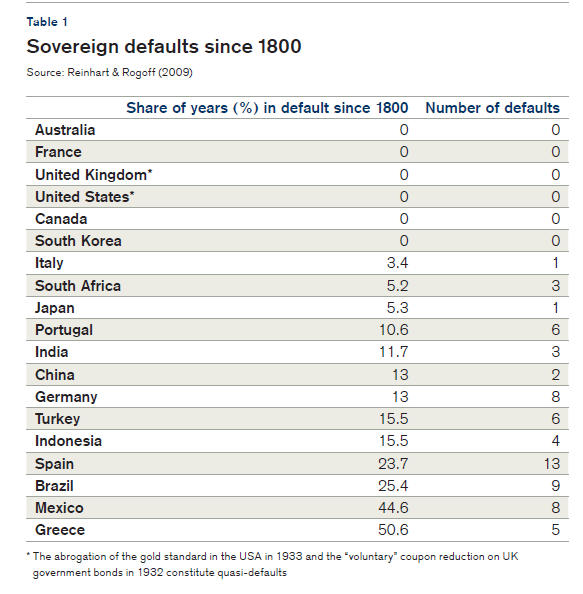

Sovereign debt defaults since 1800 are shown in the chart below:

Source: Country Indebtedness, An Update, Credit Suisse

The current U.S. debt ceiling remains at $14.20 Trillion. U.S. Treasury Timothy Geithner has urged Congress to lift the ceiling since the limit will be reached on Monday, May 16th. From a news report:

WASHINGTON — Three days before the US public debt hits its legal limit, US Treasury Secretary Timothy Geithner urged lawmakers to lift the ceiling to ensure confidence remains in the world’s largest economy.

“On Monday, May 16 — just three days from today — the United States will reach the debt limit set by Congress,” Geithner said.

“I want to again encourage Congress to move as quickly as possible, so that all Americans will remain confident that the United States will meet all of its obligations — not just our interest payments but also our commitments to our seniors,” he said.

Republicans in Congress have refused to raise the national debt ceiling, which now stands at $14.29 trillion, unless they can get the White House and its Democratic supporters to agree to sweeping long-term spending cuts.

The administration of President Barack Obama has said they could agree cuts but they are also demanding some tax hikes to increase revenues.

The limit will be hit next Monday, after this week’s Treasury Department debt auctions are settled.

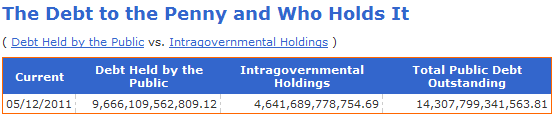

The current U.S. total debt and holders of that debt are shown below:

Source: U.S. Department of the Treasury

As shown above, more than half of the total public debt is held by the U.S. public. This entire debt is highly unlikely to demanded to be repaid in full at once by Americans anytime soon.

The fact that Americans are the major holders of U.S. debt and not China as widely believed was discussed by fellow blogger and fund manager Barry Ritholtz in an article back in January. From the article titled “Is China Really Funding the US Debt?”:

I keep hearing people erroneously claim that China is funding US deficit spending. It seems that every eejit with a fundamental misunderstanding of mathematics (and access to Xtranormal‘s animated talking bears) has been pushing this concept.

It turns out to be only partially true — and by partially, I mean 7.5% true. But that means the statement is 92.5% false.

The biggest holders of US debt are American individuals, institutions, and Social Security. We own more than 2 out of every 3 dollars of US debt — about over 67%. Hence, we depend far less on the kindness of strangers than you might imagine if your listen to the intertubes.

Those viral animated bears may be clever, but they sure suck at math.

Total United States’ public debt was ~$13.562 trillion at the end of the fiscal year (30 September 2010). As of last week, January 4, 2011, the United States’ total public debt outstanding has surpassed 14 trillion dollars.

Foreign investors held $4.4 Trillion of U.S. Treasury securities at the end of Feb 2011.Out of this, China held the largest stake at about $1.4 Trillion. Unlike public debt shown above, foreigners holding U.S. debt may demand that the U.S. repay their debts in full anytime. However this scenario also is highly unlikely to occur due to many factors such as the U.S. dollar being the hard currency, the ability of the U.S. to comfortably repay the creditors by raising taxes, ability to repay using national wealth, etc as mentioned by Marcel Thieliant in his article. Hence last month’s news that S&P downgraded its outlook on the U.S. credit rating to “negative” and threatened to cut the AAA credit rating does not matter. In summary, the U.S. is unlikely to default on it debt.