Emerging markets have not performed well in recent months compared to many developed markets. Investors are concerned about investing in emerging markets due to inflation, political risks and other factors. However according to a report by Josephine Shea of Hartford Investment Management the best days of emerging markets(EM) are in fact ahead of us. He offers the following reasons on why investing in emerging markets is a must:

- The future growth of U.S. multinationals is in emerging markets and not in the domestic market.

- Global GDP is expected to grow 4.4% this year with roughly two-thirds driven by EM.

- According to the IMF, the growth rate for China and U.S. are estimated to be 4.4% and 11.7% per year for 2011-2015.

- Emerging and developing economies already produce 36.5% of global GDP.In ten years that could be 50% and by 2030, as high as 60%.

- Foreign Direct Investment (FDI) flows into emerging markets have rebounded since the financial crisis according to a United Nations Conference on Trade and Development (UNCTAD).

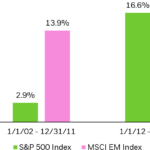

- In just five years, the market capitalization of the Hang Seng Index grew 48%, the Bombay 200 Index 55%, the Shanghai Composite Index 123%, the Brazil Bovespa Index 77% and lastly Russia’s RTS Index 38%, while the market capitalization of the S&P 500 Index has gone up only 2.5%.

- Large EM corporates have stronger credit rating than their U.S. peers.

Source: Emerging Markets No Longer a Choice; A Must – Hartford Investment Management

Some of the large-cap emerging market giants are Petrochina Co Ltd of China (PTR), Vale SA (VALE) of Brazil, HDFC Bank Ltd (HDB) of India and Gazprom OAO (OGZPY) of Russia. While investing in EM companies directly is one way to profit from their growth another option is to simply invest in U.S. and European multinationals who have a strong presence in developing countries. Examples of such western multinationals include Nestle (NSRGY), Caterpillar Inc(CAT), Unilever (UN, UL), Coca Cola (KO), etc. A list of the top 25 U.S. and European multinationals with high exposure to emerging markets can be found here and here.

Disclosure: No positions