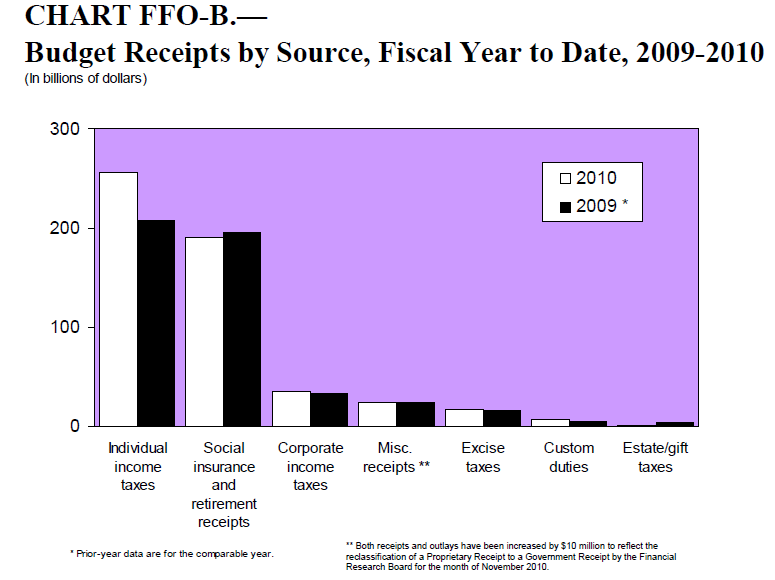

The chart below answers the question in the title of this post:

Source: Treasury Bulletin March 2011. U.S. Department of the Treasury

From the report:

Individual income tax receipts, net of refunds, were $256.0 billion for the first quarter of fiscal year 2011. This is an increase of $48.3 billion over the comparable prior year quarter.

Net corporate income tax receipts were $35.9 billion for the first quarter of fiscal year 2011. This is an increase of $2.0 billion compared to the prior year first quarter.

Over the past few decades corporations have paid lower and lower taxes each year while individual income taxes have accounted for a larger portion of the Federal receipts.