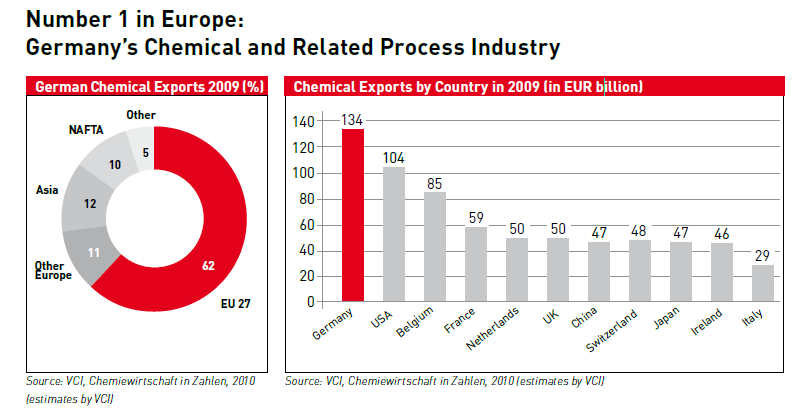

The German chemical industry is the fourth largest in the world and number one in Europe. Traditionally Germany has maintained leadership position in this industry beating other countries due to innovative policies encouraging investment, highly specialized educational programs fostering the advancement of chemical science, world-class infrastructure, sustainable development with public and private sector partnership, substantial development, high investment in R&D, etc. As chemicals are an ingredient in most of the products we consume, this sector offers attractive opportunities for long-term investment. German companies are especially well-positioned to profit from growth in the developed world and in the emerging countries.

The following are some of the reasons to invest in German chemical stocks:

- Germany is Europe’s preferred location for chemical investment.

- Germany is the world’s largest exporter of chemicals.

Click to enlarge

- German chemical firms set the benchmarks for advancement of various state-of-the-art technologies in other sectors.

- Located in heart of Europe, chemical firms supply their products to other industries in Europe with easy access to a market of more than 450 million customers.

- The country is home to 40 large-scale chemical parks that offer excellent infrastructure including their own power plant.

- Global chemical firms such as Dow Chemical, Ineos and Sabic have a significant presence in Germany.

Source: Germany Trade and Invest

The four German chemical companies available for US-investors as sponsored ADRs on the the OTC market are listed below:

1. BASF AG (BASFY)

Current Share Price: $84.48

Current Dividend Yield: 2.63%

Total Revenue: $89.3B

2. Bayer (BAYRY)

Current Share Price: $79.10

Current Dividend Yield: 2.33%

3. K+SÂ AG(KPLUY)

Current Share Price: $39.26

Current Dividend Yield: 0.32%

4. Linde AG (LNEGY)

Current Share Price: $15.76

Current Dividend Yield: 1.46%

Note: Stock prices and dividend yields noted are as of market close Mar 4, 2011

Disclosure: No Positions