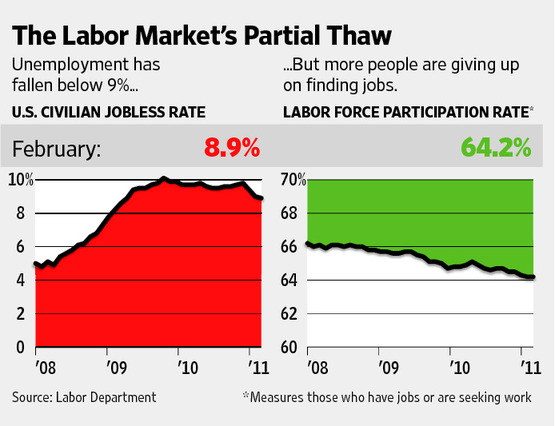

U.S. employers created 192,000 jobs in February pushing the unemployment rate to below 9% according to the Department of Labor. While this is a positive news, investors may want to dig a little deeper before making any conclusions on the state of the U.S. economy.

Source: The Wall Street Journal

An editorial in the Journal praises the supposed economic recovery commenting the following:

With 192,000 new jobs created in February, the U.S. economic engine clearly has shifted into forward recovery. The unemployment rate for the first time in 20 months nudged below 9%, settling at 8.9%.

In the private economy, the source of real wealth, hiring expanded by 222,000. Government employment receded. Gains in jobs were particularly welcome in manufacturing and construction (each up 33,000), transportation (22,000) and business services (47,000). The construction hiring hints that perhaps the worst of the housing depression is over.

The pace of job growth from a recession that vaporized some eight million jobs has been the most anemic of all post-World War II recoveries. Keynesians will have a hard time explaining why the jobs recovery started long after the bulk of the stimulus dollars were spent.

We still have 13.7 million officially unemployed Americans, with 2.7 million more who stopped looking for jobs. Nearly half (43.9%) of those without jobs have been out of work at least six months. The main reason the unemployment rate has fallen the last several months is that the number of working-age Americans not in the labor force dropped by two million over the past year. The U.S. economy needs to maintain a pace of 190,000 net new jobs for at least the next 12 months merely to get the jobless rate back to a still awful 8%. At least the jobs recovery is finally headed in the right direction.

But is this type of job recovery good enough to sustain a strong economic recovery?. The answer is absolutely no in my opinion.

The majority of the jobs that are being created are not high-paying permanent jobs but temporary and low-paying jobs. This has implications for the consumption-based U.S. economy as most of these workers will not able to stimulate consumer spending like they did before the recession. A recent article in Bloomberg BusinessWeek discussed this aspect of the current recovery. From the article titled “A U.S. Recovery Built on Low-Paying Jobs“:

Before she lost her job last November as a full-time health department caseworker in Aurora, Ill., Amy Valle was making $23 an hour. Now she’s paid $10 an hour as a part-time assistant coordinator in an after-school program. “From here on out, it will be a struggle,” says Valle, 32, whose husband lost his $50,000 government job and still is out of work after a year. “I don’t feel like there’s any place we can go to get what we were getting paid.”

While the unemployment rate dropped to 9 percent in January, from a two-decade peak of 10.1 percent in October 2009, many of the jobs people are now taking don’t match the pay, the hours, or the benefits of the 8.75 million positions that vanished in the recession, according to Paul Ashworth, chief U.S. economist at Capital Economics in Toronto.

This may restrain wage and salary growth, limiting gains in consumer spending, which accounts for 70 percent of the U.S. economy. The good jobs that would trigger a solid boost in spending just don’t seem to be there. “In the last recovery we were adding management jobs at this point, and this time it’s disappointing,” says Ashworth, who published a report on Jan. 27 about pre- and post-slump employment based on U.S. Labor Dept. data. “The very best jobs, we’re still losing those.”

Projections from the Bureau of Labor Statistics reinforce his pessimism. While the number of openings for food preparation and serving workers will grow by 394,000 in the decade ending in 2018, the average wage is only $16,430 including tips, based on 2008 data. Meanwhile, the number of posts for financial examiners, who work at financial-services firms to ensure regulatory compliance, will expand by just 11,100. The average pay for examiners is $70,930.

Like the article notes above, the growth of low-paying service sector jobs such as food preparers and servers are not going help much to this economy. Jobs that pay excellent pay and benefits such as those in the IT and manufacturing industries are not being created in this recovery.Most of the jobs in these sectors that were off-shored or eliminated due to technological advancements are not coming back anytime soon.So from an investment standpoint, it is better to avoid U.S. consumer sector stocks as consumer spending is not going to pick up steam with the current recovery.